Moody's has included a list of companies that have increase annual dividends for at least the past ten consecutive years since 1979. They call these companies dividend achievers. Each year, Mergent compiles a list of Dividend Achievers from more than 10,000 companies in the US.

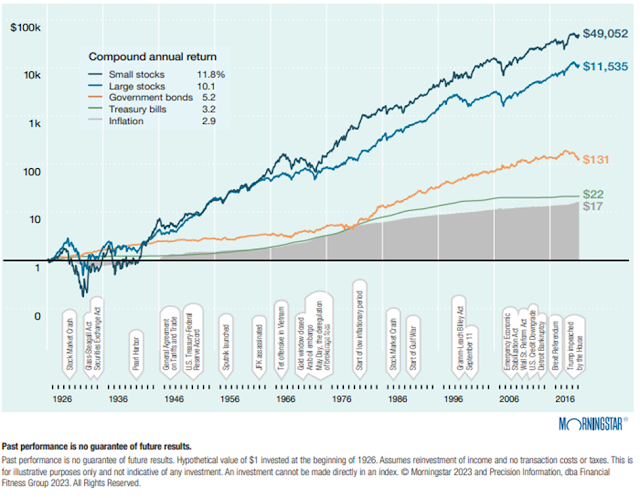

The Dividend Achievers list is based on the concept that certain equity investments can provide a rising cash stream of income over the long run, while offering the additional benefit of potential price appreciation. Annual total return for some stocks may compare favorably with other investment alternatives. Dividends can also serve as signals from companies management teams about the future. When directors increase dividends, they're signaling that they believe that future earnings will be able to maintain the higher dividend payment. This shows their confidence in the near term business prospects and timing of cashflows for the business they are managing.

Peter Lynch has discussed his fascination with the Handbook of Dividend Achievers. These are the words of Peter Lynch from "Beating the Street" below:

“The dividend is such an important factor in the success of many stocks that you could hardly go wrong by making an entire portfolio of companies that have raised their dividends for 10 to 20 years in a row. Moody’s Handbook of Dividend Achievers – one of my favorite bedside thrillers – lists such companies. Here’s a simple way to succeed on Wall Street: buy stocks from the Moody’s list and stick with them as long as they stay on the list.”

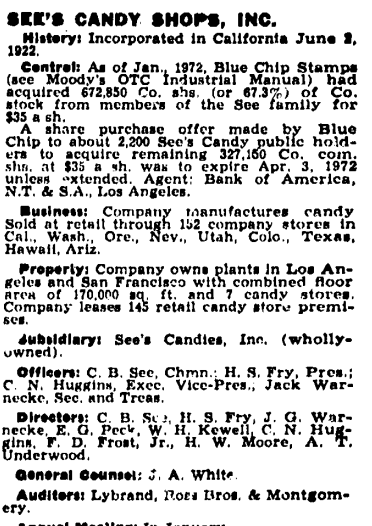

Back in the 1990s and 2010s, the list of dividend achievers was printed and sold as handbooks. I obtained several of those old Handbooks of Dividend Achievers on Amazon. I went through several of those, and reviewed the statistics included there.

I love going through old stock manuals. It's helpful to see how conditions looked like for the investors during that time period. I bought old copies of Moody's Handbook of Dividend Achievers from the 1990s and 2000s a while back.

For example, there were 313 Dividend Achievers in the US in 1992.

These were companies that had managed to increase annual dividends for 10 years in a row.

This list shows 1) company name, 2) annualized dividend growth rate over the past decade 3) Number of Consecutive Annual Dividend Increases

Going through the list, and learning what happened to these companies 30 years later can be an invaluable experience. It can definitely change the way you look at things. The fun part of investing is asking questions, trying to connect the dots and hopefully trying to learn something in the process. It is a journey, not a destination.

It fascinating to see what types of businesses grew dividends for at least a decade, and then continued growing them. It’s also fascinating to observe how many of the businesses ended up off the dividend achievers list due to acquisitions or doing spin-offs. There were companies that eventually dropped out of the dividend achievers list due to freezing dividends or cutting dividends. Even declines in a business that was previously a quality one took a long time, and wasn’t a sudden shift at all.

Personally, I believe in diversification and holding as many quality companies that I can find at the right valuation. I also believe in a coffee can type approach to investing, where I invest money in the companies, and then do not touch them for as long as the dividend is not cut or the company is not acquired.

The handbook included the companies with highest Return on Equity. The return on equity is a measure of the profitability of a business in relation to the equity. Because shareholder's equity can be calculated by taking all assets and subtracting all liabilities, ROE can also be thought of as a return on assets minus liabilities.

These are the Dividend Achievers from 1992 with the highest Return on Equity (ROE) .

It is fascinating to observe how many companies with a high (ROE) on this list are still around 30 years later. High returns on equity are a sign of a competitive advantage.

The companies on that list are still around. However, many of them have also been acquired. I think high ROE could be a sign of a competitive advantage.

You may like the list of 2011 Dividend Achievers with the highest ROE below:

I went ahead and identified the 2023 Dividend Achievers List. I then obtained Return on Equity for each company, and have listed the top 40 dividend achievers by ROE.

I wanted to share a list of the 40 Dividend Achievers with the highest Return on Equity. I used a few databased to obtain that information, instead of manually searching for it for several hundred companies.

You can view that list below:

Of course, this would be just one step in the process. Screening is only a step.

Some may argue that ROE may be misleading, as higher debt/leverage may juice up returns to the point of them being elevated. So the company may often be low but leverage can make that number look big because shareholders equity would shrink with debt accumulation.

If you look at Return on Assets (ROA) instead, and focus on the 40 dividend achievers with the highest ROA, you get to the following table:

The next steps would be to evaluate each company, including earnings per share growth, dividend per share growth, payout ratios and valuation. It also means understanding the business and determining if it has competitive advantages.

Another step further could be looking at Return on Invested Capital. Unfortunately, this has not been published in the old manuals. Thus, ROE could be a decent proxy but not perfect, due to the effects of leverage.

Relevant Articles:

- Dividend Achievers Offer Income Growth and Capital Appreciation Potential

- Peter Lynch on Dividend Growth Investing

- Peter Lynch Articles For Worth Magazine