As part of my monitoring process, I review the list of dividend increases every single week. This process helps me to identify patterns, and find out more about companies that regularly raise dividends. That's helpful information if you want to review existing holdings and identify companies for review early in their journey.

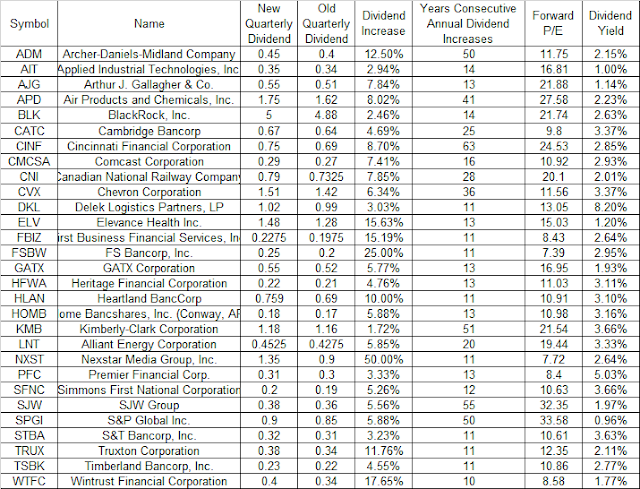

Last week was very busy for dividend increases. There were 64 companies that increased dividends last week. I reviewed the list, and narrowed it down to the companies that managed to increase dividends for at least a decade.

You can view the full list of 29 companies that met the criteria below:

This is a list of companies for further review. Most seem attractive as businesses, but that doesn’t mean that they should be invested in at any price, regardless of valuation.

The next step is to check each business, in order to determine if it is worth further review. I would look at ten year trends in earnings per share, dividends per share, payout ratios, shares outstanding. I would try to understand what the business does, and make an assessment if the good times would continue, so that I can expect higher earnings, dividends and intrinsic values over time. I would look at the valuation relative to earnings and dividend growth, in order to determine if the business is fairly valued, if it looks promising too.

Companies listed in this post include: ADM, AIT, AJG, APD, BLK, CATC, CINF, CMCSA, CNI, CVX, DKL, ELV, FBIZ, FSBW, GATX, HFWA, HLAN, HOMB, KMB, LNT, NXST, PFC, SFNC, SJW, SPGI, STBA, TRUX, TSBK, WTFC,

Relevant Articles: