Wednesday, June 28, 2023

How to find companies for my dividend portfolio

Thursday, June 22, 2023

Diageo (DEO) Dividend Stock Analysis

Diageo plc (DEO) produces, distills, brews, bottles, packages, and distributes spirits, beer, wine, and ready to drink beverages. This international dividend company has increased dividends for 25 years in a row. The company’s peer group includes Brown-Forman (BF.B), Suntory, and Constellation Brands (STZ).

The company’s latest dividend increase was announced in January 2023 when the Board of Directors approved an 5% increase in the interim dividend to 30.83 pence /share. The final dividend had been increased by 5% to 46.82 pence/share in October 2022.

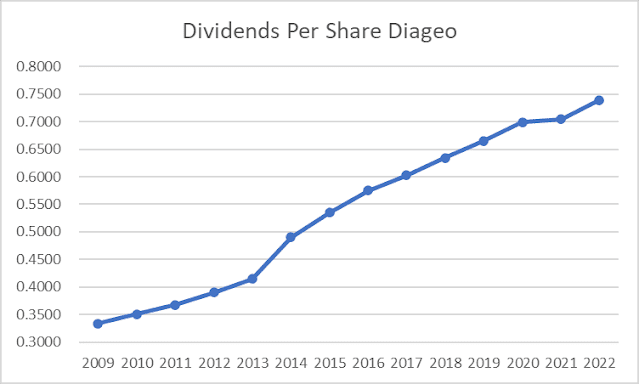

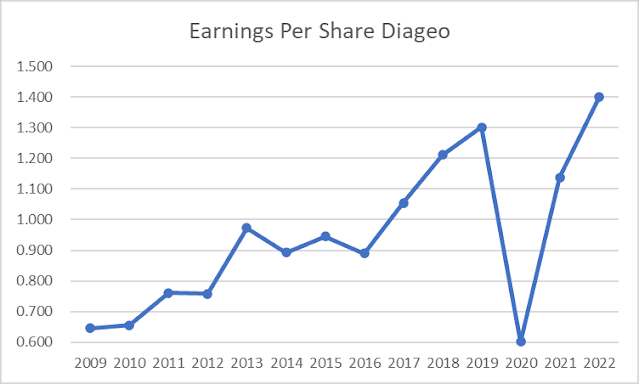

The annual dividend payment has increased by 6.30% per year since 2009, which is in line with the growth in EPS.

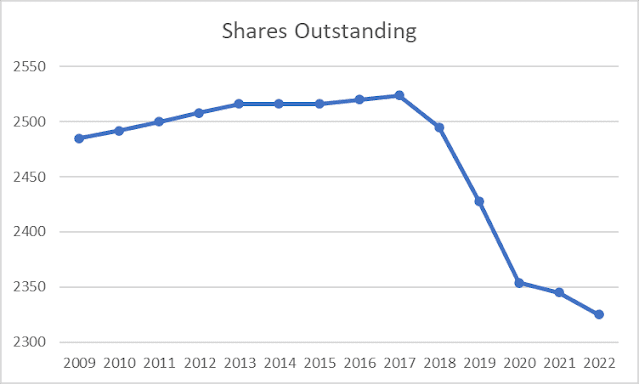

Between 2009 and 2022, the number of shares decreased from 2.485 billion to 2.325 billion.

Sunday, June 18, 2023

Four Companies Increasing Dividends to Shareholders Last Week

I review the list of dividend increases each week, as part of my monitoring process. I follow this process in order to monitor existing investments and to potentially identify companies for further research. I focus on quality companies with consistent cashflows, which can be purchased at attractive valuations, which I can then buy and hold forever. These are the types of long-term investments that can deliver rising dividends for decades, while also delivering dependable returns in the process.

This exercise also shows the data points I use in my quick evaluation of a company. This helps me determine if I want to proceed in analyzing a company for potential investment or not. Typically, a promising fundamental development, such as increasing earnings, a sustainable payout ratio and a track record of consistent dividend increases would place a company on my list for further research. I review the growth in earnings and dividends over the past decade, in order to evaluate the likelihood of them continuing their steady march upwards. I also look at valuation together with fundamental performance.

If a company is attractively valued, that's definitely great and increases the chances of it becoming a part of my portfolio, if my analysis doesn't raise any red flags. Even if the company seems overvalued today, I would still review it, in order to be ready to act if it ever becomes cheaper.

Over the past week, there were four companies that have managed to increase dividends for at least a decade, AND also increased dividends last week. The companies include:

National Fuel Gas Company (NFG) operates as a diversified energy company. It operates through four segments: Exploration and Production, Pipeline and Storage, Gathering, and Utility.

The company increased quarterly dividends by 4.20% to $0.495/share. This dividend king has increased annual dividends for 53 straight years.

Over the past decade, the company has managed to grow dividends at an annualized rate of 2.60%.

The company managed to grow earnings from $3.11/share in 2013 to $6.19/share in 2022. The company is expected to earn $5.18/share in 2023.

The stock is selling for 10 times forward earnings and yields 3.81%.

Realty Income (O) is a real estate investment trust with over 12,400 real estate properties owned under long-term net lease agreements with commercial clients.

The company increased monthly dividends by 0.20% to $0.2555/share. This is a 3.23% increase over the dividend paid during the same time last year. This dividend aristocrat has increased dividends multiple times per year since going public in 1994.

Over the past decade, the company has managed to grow dividends at an annualized rate of 5.30%.

Between 2013 and 2022, the company managed to grow FFO/share from $2.41/share to $4.04/share. Realty Income is expected to generate $4.13/share in FFO in 2023.

The stock is selling for 14.85 times forward FFO and yields 5%.

Target Corporation (TGT) operates as a general merchandise retailer in the United States.

The company increased quarterly dividends by a paltry 1.90% to $1.10/share. This is the 52nd consecutive year in which Target has increased its annual dividend.

Over the past decade, the company has managed to grow dividends at an annualized rate of 11.60%.

This dividend king has managed to grow earnings from $3.10/share in 2014 to $6.02/share in 2023. However, earnings are down from the pandemic high of $14.23/share in 2023. The company is expected to earn $8.27/share in 2024.

The stock is selling for 16.19 times forward earnings and yields 3.28%.

W. R. Berkley Corporation (WRB) is an insurance holding company which operates as a commercial lines writer in the United States and internationally. It operates in two segments, Insurance and Reinsurance & Monoline Excess.

The company increased quarterly dividends by 10% to $0.11/share. This is the 22nd year of consecutive annual dividend increase for this dividend achiever.

Over the past decade, the company has managed to grow dividends at an annualized rate of 9.90%.

The company increased earnings from $1.64/share in 2013 to $4.99/share in 2022. The company is expected to earn $4.68/share.

The stock is selling for 12.66 times forward earnings and yields 0.78%.

Relevant Articles:

- Five Dividend Growth Companies Increasing Distributions to Shareholders

- Eight Companies Rewarding Shareholders With a Raise

Monday, June 12, 2023

Five Dividend Growth Companies Increasing Distributions to Shareholders

Wednesday, June 7, 2023

The importance of investing for retirement as early as possible

At the beginning of the 21st century most young people are told that social security won’t be there for them when they retire from the work force. Thus, in order to be able to completely retire from the workforce, a person has to invest as early as possible in order to take full advantage of the power of compounding.

Let’s follow the story of Erica and John. They both grew up on the same street in the same city. Their mothers gave birth to them at almost the same time. Erica and John went to the same high-school, after which their paths separated. They lost contact with each other for the next 40 years, at which point they found each other on Facebook, and met to reminiscence their childhood and talk about grandkids.

They quickly started talking about their retirement and the amount of money they had each had at the time of their retirement. John, who always saved the extra money he earned from jobs at college and his first job after college, started investing $2000/year in dividend stocks starting at the age of 18 and kept saving and investing the same amount until he was 28. At that point he had so many expenses in order to pay for the needs of his growing family that he couldn’t save anymore. Despite the fact that John couldn’t contribute any more to fund his retirement, he was very good at picking solid dividend growth stocks, and was able to generate annual returns of 10% for the next four decades.

Erica on the other hand had decided that she didn’t want to work in college since she wanted to concentrate on her studies while also enjoying the whole college experience. She then decided to go ahead and get a masters degree after which she was able to get a very good job with one of the largest companies in the USA. She did accumulate a large amount of student debt in the process, which she diligently paid off in a record time after she got her first job. After learning about the importance of saving for your own retirement, she started investing $2000/year in dividend stocks, and was able to also generate 10% in annual returns.

We then fast forward to the age of 65. At age of 65, John's net worth is 1,192,257.81. Erica's networth is $728,086.87 at the age of 65.

Despite the fact that John had invested only $20,000 in total, versus $76,000 that Erica had invested, he was able to achieve a higher amount of wealth because he had taken a full advantage of the power of compounding by investing his hard earned money as early as his freshman year in college. Even though Erica contributed money for over 37 years her nest egg was $400,000 lower than John’s, because she had ten years less to utilize the power of compounding. You could also access the spreadsheet from here.

The most important point from this exercise is: start investing for your retirement as early as possible! Ask your kids to invest their first paychecks from high school jobs. And most importantly, let the money compound uninterruptedly for as long as possible. And if you want to take full advantage of compounding, Turbo Charge Your Portfolio With Reinvested Dividends.

Relevant Articles:

- Determining Withdrawal Rates Using Historical Data

- Why do I like Dividend Aristocrats?

Saturday, June 3, 2023

Health Savings Account (HSA) for Dividend Investors

Benefits

An HSA offers a triple tax advantage in most states. The contributions are before tax, which means that the account holder does not pay Federal, State and FICA taxes. If you were in the 24% marginal tax bracket, had a 5% state income tax rate, and you didn’t pay 7.65% for FICA, you will end up saving 36.65% merely by contributing to an HSA account. On $3,850, this comes out to $1,411.02 in tax savings right off the bat. The money can be used for qualified medical expenses at any age, without having to pay any taxes on such withdrawals. However, support documentation should be retained in case of an audit. Withdrawals not for qualified medical expenses are subject to a 20% penalty and income tax. After age of 65, withdrawals are not subject to a 20% penalty. While they continue to be tax-free for medical expenses, they are taxed at your ordinary income rate for any other type of distribution from the account.

I was attracted to HSA’s because of the large up-front tax deduction. When I contribute money to a tax-deferred vehicle, I have more money under my control, since I reduce the largest expense in my household budget ( taxes). I have done a similar thing by maxing out 401 (k) and Sep IRA contributions since early 2013.

Drawbacks

One of the major drawbacks to HSA accounts is the large monthly fees with many providers. When I reviewed different providers in 2014 - 2015, it looked like a minimum account balance that is anywhere between $3,000 - $5,000 has to be maintained in cash, in order to avoid a monthly charge in the range of $2 - $5/month.

The one positive thing however is that a person is not stuck with an HSA provider, if their employer offers a high-fee HSA provider. One can simply rollover the funds from their original HSA administrator, to the HSA administrator of their choice. This is one thing I did a few years ago. I moved my HSA money to LivelyMe, which is a no-cost HSA alternative.

The other drawback is the low limits on how much one can potentially defer. If limits for individuals are increased to at least match those on IRA or Roth IRA accounts, this would be a good start.

Best Providers

I looked at different providers, and looked at their costs to have an account, and availability of investment options. In my research, I give extra points for companies that are not going to charge me $4- $5/month on a $3,000 - $6,000 balance that takes 1 – 2 years to build up, or at least will not charge me monthly fees after my total balances exceed a reasonable amount of dollars. I am talking about eliminating as much in monthly or annual fees are possible, since some administrators tend to charge you an HSA Bank fee if you have less than $3,000 - $5,000 in a bank, in addition to charging you a monthly brokerage fee. I also wanted to find the broker that would allow me as much flexibility as possible in choosing investments that do not cost me a lot.

The thing to consider of course is that fees can change if minimum balances are changed as well. Plus, there might be fees assessed if you transfer money from one custodian to the next.

I have contributed to a Health Savings Account since 2015, and have enjoyed the process of accumulating funds there and investing them. One thing to note is that all of my employers that have offered an HSA have also matched a certain portion of contributions. This is similar to a 401 (k) match, but only for HSA's. In a way, it is another account to use to accumulate a nest egg in a tax efficient way.

I calculated that if I choose to invest $1,000 in an HSA that generates a net annual total return of 7%/year, I would end up with $5,807 in 26 years. This return assumes that no taxes are taken and also assumes fees paid are subtracted from returns ( meaning the gross return is slightly higher). However, if I were to earn those $1,000 from my day job but decided not to put them in an HSA, I would be left with $623.50. This is because I would be paying 24% Federal Tax, 5% State Tax, 1% City Tax and 7.65% FICA. If I managed to earn an after-tax annual total return of 9%/year for 26 years in a row, my account balance will be $5860. The break-even point will be 26 years. Of course I am not comparing apples to apples here, because an after-tax return of 9% in a taxable account usually requires a return above 10% even at today’s low rates on dividends and capital gains.

Conclusion

To summarize, I believe that HSA accounts provide several benefits to investors who want to build retirement savings, and have exhausted common vehicles such as 401 (k) or IRA's.

Relevant Articles:

- Why I Considered Tax-Advantaged Accounts for My Dividend Investments

- Roth IRA’s for Dividend Investors

- Six Dividend Paying Stocks I Purchased for my IRA

- Twenty Dividend Stocks I Recently Purchased for my 401 (k) Rollover

- Nine Quality Dividend Stocks Purchased for the Roth IRA

Thursday, June 1, 2023

Carlisle Companies (CSL) Dividend Stock Analysis

Carlisle Companies Incorporated (CSL) operates as a diversified manufacturer of engineered products in the United States, Europe, Asia, Canada, Mexico, the Middle East, Africa, and internationally.

The company is a dividend champion, which has increased dividends to shareholders for 46 years in a row. Over the past decade the company has managed to grow dividends at an annualized rate of 13%/year.

The last dividend increase was in August 2022, when the Board of Directors approved a 38.90% hike in the quarterly distributions to 75 cents/share.

Chris Koch, Chair, President and Chief Executive Officer, said “As part of our legacy of being superior capital allocators, we are very pleased to announce a dividend increase for the 46th consecutive year. This 39% increase is our largest in the past 25 years, and reflects our strong, sustainable financial position, and confidence in continued growth of Carlisle’s earnings power. Our commitment to returning capital to shareholders is made possible by the support of Carlisle’s dedicated employees, who embrace our culture of continuous improvement and maintain a steadfast commitment to creating value for all stakeholders.”

The company has managed to boost earnings from $3.57/share in 2012 to $17.58/share in 2022. The company is expected to earn $18.05/share in 2023. We have to take forward guidance with a grain of salt, given the state of affairs in the world economy today.

Their Vision 2025 strategy is an interesting program. In Vision 2025, the company targets doubling annual revenues to $8 billion, expanding operating margins to 20%, and generating 15% ROIC. This would be achieved through 5% organic growth, and reducing costs by 1% - 2% of sales, by using efficiencies. The company is also working to make acquisitions and review existing divisions for further optimization. Carlisle expected to invest in M&A through 2025. The company is working to develop its employees as well, and spend money on capital expenditures, share buybacks and dividends to reward long-term shareholders. Carlisle Companies is trying to reach $15/share by 2025. They expect revenues of 8 billion by 2025.

I like these slides on the Vision 2025 strategy:

Also check out the Vision 2025 Website

The company operates in these major segments:

Construction materials accounted for 80% of 2021 revenues. Manufactures EPDM, TPO, and PVC roofing systems, as well as energy-efficient rigid foam insulations panels, spray polyurethane foam, and metal roofing products. Key end markets served include US and EU Non-residential and Building Envelope.

The risk factor is that a slowdown in construction amidst rising interest rates could slow down growth, leading to a decrease in profits. The impact of a slowing construction may not be seen for a few quarters to an year.

Interconnect Technologies accounted for 14% of revenues. Designs and manufactures high-performance wire, cable, connectors, contacts, and cable assemblies for transfer of power and data. Key markets served include Commercial Aerospace, Medical Technologies and General Industrial.

Fluid Technologies accounted 5% of revenues. Manufactures industrial finishing equipment for spraying, pumping, mixing, and curing of protective coatings for industrial applications. Key markets served include Transportation, General Industrial and Automotive.

The company has been active on the share repurchase front over the past 7 years. Prior to that, shares increased, due to acquisitions.

The company’s dividend is well covered from earnings. It has managed a conservative payout ratio that has largely remained below 30%.

Right now, the company looks fairly priced at 12 times forward earnings and yields 1.40%.

Popular Posts

-

I review the list of dividend increases each week, as part of my monitoring process . I follow this process in order to monitor existing in...

-

I review the list of dividend increases every week, as part of my monitoring process. I typically focus my attention to companies that have...

-

I am a big fan of frugality. I believe that frugality is all about the most efficient use of scarce resources. This could mean thinking outs...

-

I review the list of dividend increases every week, as part of my monitoring process. It's one of my processes to monitor existing holdi...

-

Do you ever wonder how your net worth compares to others in your age group? Do you ever wonder if you are ahead or behind? Do you also ever ...

-

The best decision I ever made was to invest in my own financial education. Everything I have done is easily achieved by anyone else with a ...

-

Several of the large banking institutions in the US passed the Stress Tests imposed by the Federal Reserve. As a result, they announced thei...

-

I am a big fan of Dividend Growth Investing. I like the mental model of Dividend Growth Investing, where a rising stream of annual dividend ...

-

Warren Buffett is the best investor in the world. I've dedicated a ton of time studying him and writing about him on this humble site . ...

-

In my investing, look for businesses I can understand that have some sort of a competitive advantage that translates into consistent earn...