There were several companies over the past week which announced their intent to raise dividends to shareholders. It is always great to see companies that are able to extend their long streaks of annual dividend increases. I find dividend increases to be a good indicator of how company executives feel about the near-term business environment. It also shows their confidence in the company’s growth prospects.

I review these press releases as part of my monitoring process. For the purposes of this article, I narrowed the list of dividend increases down to a more manageable level.

I focused on companies that can afford to grow dividends for at least a decade. I figured that a company which has managed to boost dividends during a recession and an expansion, or even longer, is better suited for further research by a long-term dividend growth investor like me.

In my previews, I look at the most recent dividend increase, and compare it to the ten year average. While there are some year-over-year fluctuations in dividend growth, it is helpful to see if dividend growth is decelerating.

In addition, it is helpful to review trends in earnings and dividends, alongside dividend payout ratios. This is another indicator of dividend safety.

Last, but not least, I also try to review the valuation behind every company. I prefer to buy future dividend income at attractive valuations; overpaying for future dividend income is not a good business decision.

The companies that raised dividends last week include:

Hormel Foods Corporation (HRL) produces and markets various meat and food products in the United States and internationally. The company operates through five segments: Grocery Products, Refrigerated Foods, Jennie-O Turkey Store, Specialty Foods, and International & Other. The company raised its dividend for the 53rd year in a row. The dividend king raised distributions by 12% to 21 cents/share. Over the past decade, it has managed to boost distributions by 16.30%/year. Between 2008 and 2018, the company has managed to grow earnings from $0.52 to $1.86/share.

Currently, the stock is overvalued at 24.60 times earnings and yields 1.80%. Hormel may be worth a second look on dips below $37/share.

Becton, Dickinson and Company (BDX) develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products worldwide. It operates in two segments, BD Medical and BD Life Sciences. The company raised its quarterly dividend by 2.70% to 77 cents/share. This marked the 47th consecutive annual dividend increase for this dividend champion. Over the past decade, it has been able to grow dividends at an annual rate of 11.60%/year. Unfortunately, this is the second year in a row that Becton Dickinson has rewarded shareholders with a very small dividend increase.

Earnings have increased from $4.46/share in 2008 to an estimated $12.12/share in 2019.

Currently, the stock is fully valued at 20 times forward earnings and yields 1.30%. Given the slowdown in dividends per share, and the high valuation, I view the stock as a hold for the time being.

The York Water Company (YORW) impounds, purifies, and distributes drinking water. It also owns and operates three wastewater collection systems and two wastewater treatment systems.

The company raised its quarterly dividend by 4% to 17.33/share. This marked the 22nd consecutive annual dividend increase for this dividend achiever. Over the past decade, it has been able to grow its dividend at a rate of 3.10%/year.

Between 2007 and 2017, earnings rose from $0.57/share to $1.01/share. The company is expected to earn $1/share in 2018.

The stock is overvalued at 32.50 times forward earnings and yields 2.10%. I may be interested in this business if it ever drops below $20/share. I may wait for a while.

South Jersey Industries, Inc. (SJI) provides energy-related products and services. The company engages in the purchase, transmission, and sale of natural gas. South Jersey Industries raised its quarterly dividend by 2.70% to 28.75 cents/share. This marked the 20th consecutive annual dividend increase for this dividend achiever. Over the past decade, the company has managed to reward shareholders with an 8.40% annual dividend increase on average. The rate of dividend growth has been slowing over the past five years or so to roughly 5%/year. This is to be expected, given the fact that earnings per share only went from $1 in 2007 to an estimated $1.44/share for 2018.

The stock is overvalued at 21.80 times forward earnings. While the yield is pretty decent at 3.60% today, the forward dividend payout ratio is rather steep at 80%.

Hingham Institution for Savings (HIFS) provides various financial products and services to individuals and small businesses in the United States.

The company raised its quarterly dividend by 2.80% to 37 cents/share. This is the third dividend increase this year. The company routinely pays a special dividend in the fourth quarter. In addition to the regular quarterly dividend, the Bank's Board of Directors announced that it will pay a special dividend of $0.50 per share.

Hingham Institution for Savings is a dividend achiever with a 20 year record of annual dividend increases.

Over the past decade, this bank has managed to grow its distributions at an annual rate of 5%/year. At the same time, the company has managed to boost earnings per share by 18.70%/year during the same time period.

The stock sells for 17.90 times earnings and yields 0.70%. While I would not buy the stock today, I will hold on to it for the time being. This investment is a great case study for me, because it ended up disappointing on the dividend growth part. However, it did spectacularly well in terms of earnings per share growth and total returns.

Relevant Articles:

- Record Week Leaves Investors Thankful For Dividend Increases

- How to avoid dividend cuts

- My screening criteria for dividend growth stocks

- Use these tools within your control to get rich

Tuesday, November 27, 2018

Monday, November 26, 2018

Ten Dividend Stocks for November

Readers of my Dividend Growth Investor newsletter just received a list of ten dividend growth stocks I plan to purchase on today. This is a real money portfolio which I started in July, in an effort to educate investors on the process of building a portfolio to reach long-term objectives. I invest $1,000 in the ten companies I profile every single month, and let interested readers observe in real time how I build a dividend machine from scratch.

The report includes a detailed analysis of each company, using the methods I use to evaluate dividends for safety, valuation and whether dividend growth is on a solid footing. I used the same methods for building my dividend growth portfolio over the past decade.

The goal of the newsletter is to go beyond just identifying ten companies for investment every month. The real goal is to educate investors how real wealth can be built in the stock market. The process of building an income portfolio is very simple, but not easy. An investor simply needs to save money and put them to work in attractively valued stocks regularly. The next step involves reinvesting dividends either selectively or through a DRIP. The last step is the most exciting one – to patiently hold on to your collection of businesses for the long-term. To build a dividend machine, one has to arm themselves with a lot of patience and a long-term focus. This means avoiding the expensive habit of timing the market because it “looks high” or because “it is crashing”. Having the patience to hold on to your investments through thick or thin is a habit that is within the control of the investor.

I try to select companies that I believe will be around in a decade or so, and will be more profitable and pay higher dividend payments along the way. I also evaluate dividends for safety. I focus on valuation today as well as long-term fundamentals. Without growth in fundamentals, and the ability of the business to grow them over time, the companies I invest in will be unable to achieve future dividend growth. As a long-term investor, I buy companies to hold for years if not decades. This is not a newsletter where I will buy securities with the intent of selling them a few months later.

The price for the monthly subscription is just $6/month to new subscribers who sign up for the service. The price for the annual subscription is only $65/year for new subscribers. If you subscribe at the low introductory rate today, the price will never increase for you.

I offer a 7 day free trial for new readers. If you want to give my newsletter a try, you may do so by signing up below:

Once you sign up, I will add you to my premium mailing list, and you will receive all exclusive content related to the portfolio.

Each month, I will be allocating $1,000 to my dividend portfolio by buying stakes in ten attractively valued companies. The newsletter will include information on the companies I am purchasing, along with a brief analysis of each company.

The ultimate goal of the portfolio is to generate $1,000 in monthly dividend income.

I plan to track this portfolio in real time over the next few years, and track our progress towards our goal.

Thank you for reading Dividend Growth Investor.

The report includes a detailed analysis of each company, using the methods I use to evaluate dividends for safety, valuation and whether dividend growth is on a solid footing. I used the same methods for building my dividend growth portfolio over the past decade.

The goal of the newsletter is to go beyond just identifying ten companies for investment every month. The real goal is to educate investors how real wealth can be built in the stock market. The process of building an income portfolio is very simple, but not easy. An investor simply needs to save money and put them to work in attractively valued stocks regularly. The next step involves reinvesting dividends either selectively or through a DRIP. The last step is the most exciting one – to patiently hold on to your collection of businesses for the long-term. To build a dividend machine, one has to arm themselves with a lot of patience and a long-term focus. This means avoiding the expensive habit of timing the market because it “looks high” or because “it is crashing”. Having the patience to hold on to your investments through thick or thin is a habit that is within the control of the investor.

I try to select companies that I believe will be around in a decade or so, and will be more profitable and pay higher dividend payments along the way. I also evaluate dividends for safety. I focus on valuation today as well as long-term fundamentals. Without growth in fundamentals, and the ability of the business to grow them over time, the companies I invest in will be unable to achieve future dividend growth. As a long-term investor, I buy companies to hold for years if not decades. This is not a newsletter where I will buy securities with the intent of selling them a few months later.

The price for the monthly subscription is just $6/month to new subscribers who sign up for the service. The price for the annual subscription is only $65/year for new subscribers. If you subscribe at the low introductory rate today, the price will never increase for you.

I offer a 7 day free trial for new readers. If you want to give my newsletter a try, you may do so by signing up below:

Once you sign up, I will add you to my premium mailing list, and you will receive all exclusive content related to the portfolio.

Each month, I will be allocating $1,000 to my dividend portfolio by buying stakes in ten attractively valued companies. The newsletter will include information on the companies I am purchasing, along with a brief analysis of each company.

The ultimate goal of the portfolio is to generate $1,000 in monthly dividend income.

I plan to track this portfolio in real time over the next few years, and track our progress towards our goal.

Thank you for reading Dividend Growth Investor.

Wednesday, November 21, 2018

Dividend Growth Investor Black Friday and Cyber Monday Sale

Dear Readers,

I have a special deal for you on through this Black Friday and Cyber Monday. I would like to offer a subscription to my premium newsletter for a low price of $65/year. You can sign up for a 7 day free trial below:

Instead of waking up early after your Thanksgiving feast, and waiting in line in the cold, you can simply sign up online and gain a wealth of knowledge at your finger tips.

As part of this limited time promotion, you will receive the following:

- Ten Dividend Stock Ideas I am investing in for the month

- A list of dividend portfolio holdings

- Valuable Education to help you towards your journey to financial independence

The goal of this dividend newsletter is to provide a real-world and real-time educational tool, to help achieve dividend investing goals. I provide a listing of ten companies that I will purchase with my own money, and show you how I build and manage a portfolio from scratch. The newsletter includes detailed analysis of each company, and includes bonus materials on dividend growth investing.

In my investing, I believe in the following principles:

- Buy and hold investing

- Dividend Growth Investing

- Dividend Safety

- Value Investing

- Diversification

- Equal weighting

- Keeping investment costs low

I put all of these concepts together in building and managing the portfolio in the Dividend Growth Investor newsletter.

I believe that this newsletter will provide educational insights to investors in the accumulation phase, as well as those who are at or near retirement. The concepts discussed in the newsletter are the same ones I have used for over a decade to build my dividend growth stock portfolio.

If you subscribe today at the low introductory price of $65/year, your price will never increase. I believe that this newsletter is a bargain at less than 20 cents/day. Sing up for a free trial today:

The next edition comes out on Sunday, November 25. It would include ten dividend companies I am including in my portfolio. I will make a real money investment in those companies on Monday, November 26.

I have a special deal for you on through this Black Friday and Cyber Monday. I would like to offer a subscription to my premium newsletter for a low price of $65/year. You can sign up for a 7 day free trial below:

Instead of waking up early after your Thanksgiving feast, and waiting in line in the cold, you can simply sign up online and gain a wealth of knowledge at your finger tips.

As part of this limited time promotion, you will receive the following:

- Ten Dividend Stock Ideas I am investing in for the month

- A list of dividend portfolio holdings

- Valuable Education to help you towards your journey to financial independence

The goal of this dividend newsletter is to provide a real-world and real-time educational tool, to help achieve dividend investing goals. I provide a listing of ten companies that I will purchase with my own money, and show you how I build and manage a portfolio from scratch. The newsletter includes detailed analysis of each company, and includes bonus materials on dividend growth investing.

In my investing, I believe in the following principles:

- Buy and hold investing

- Dividend Growth Investing

- Dividend Safety

- Value Investing

- Diversification

- Equal weighting

- Keeping investment costs low

I put all of these concepts together in building and managing the portfolio in the Dividend Growth Investor newsletter.

I believe that this newsletter will provide educational insights to investors in the accumulation phase, as well as those who are at or near retirement. The concepts discussed in the newsletter are the same ones I have used for over a decade to build my dividend growth stock portfolio.

If you subscribe today at the low introductory price of $65/year, your price will never increase. I believe that this newsletter is a bargain at less than 20 cents/day. Sing up for a free trial today:

The next edition comes out on Sunday, November 25. It would include ten dividend companies I am including in my portfolio. I will make a real money investment in those companies on Monday, November 26.

Monday, November 19, 2018

Record Week Leaves Investors Thankful For Dividend Increases

I review dividend increases every week as part of my monitoring process. I usually focus on the companies with at least a ten year streak of annual dividend increases. This is then followed by a brief overview of each company, followed by a decision to do a more detailed research on the company or pass on it for whatever reason (valuation or fundamentals).

After reviewing the dividend increases over the past year, it looks like the past week had the most dividend increases so far in 2018. Those increased dividend incomes should definitely work well for dividend investors pocketbooks this Thanksgiving.

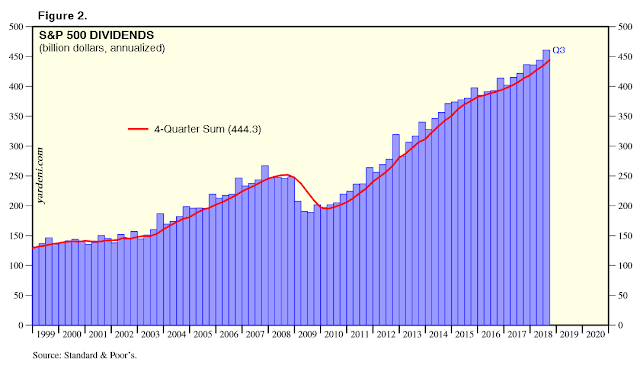

Overall, companies in the US are flush with cash and distributing record dividend amounts as well. This is evidenced by the record amounts of dividends paid by companies in the S&P 500:

The companies raising dividends over the past week include:

Brown-Forman Corporation (BF.B) manufactures, bottles, imports, exports, markets, and sells various alcoholic beverages worldwide. It provides spirits, wines, ready-to-drink cocktails, whiskeys, vodkas, tequilas, champagnes, brandy, and liqueurs. The company raised its quarterly dividend by 5.10% to 16.60 cents/share. This marked the 35th year of dividend increases for this dividend champion. Over the past decade, it has managed to boost dividends at an annual rate of 8.50%/year.

The company grew its earnings from $0.76/share in 2008 to $1.48/share in 2018. Analysts expect earnings of $1.71/share in 2019. The stock is overvalued at 28.40 times forward earnings and yields 1.40%. I would be interested in adding to my position in Brown-Forman on dips below $34/share.

Sysco Corporation (SYY), through its subsidiaries, markets and distributes a range of food and related products primarily to the foodservice or food-away-from-home industry. It operates through three segments: U.S. Foodservice Operations, International Foodservice Operations, and SYGMA. The company raised its quarterly dividend by 8.30% to 39 cents/share. This marked the 49th year of dividend increases for this dividend champion. Over the past decade, it has managed to boost dividends at an annual rate of 5.70%/year.

The company grew its earnings from $1.81/share in 2008 to $2.70/share in 2018. Analysts expect earnings of $3.40/share in 2019.

The stock looks fairly valued at 19.50 times forward earnings and yields 2.30%. I may have to add the stock to my list for further research.

MDU Resources Group, Inc. (MDU) engages in regulated energy delivery, and construction materials and services businesses in the United States. The company operates through five segments: Electric, Natural Gas Distribution, Pipeline and Midstream, Construction Materials and Contracting, and Construction Services. The company raised its quarterly dividend by 2.50% to 20.25 cents/share. This marked the 28h year of dividend increases for this dividend champion. MDU Resources Group has managed to boost dividends at an annual rate of 3.40%/year during the past decade.

MDU Resources earnings declined from $2.36/share in 2007 to $1.43/share in 2017. Analysts expect earnings of $1.39/share in 2019.

The stock yields 18.90 times forward earnings and yields 3.10%. Given the lack of earnings growth, I will take a pass on the stock today.

Matthews International Corporation (MATW) provides brand solutions, memorialization products, and industrial products in the United States, Central and South America, Canada, Europe, Australia, and Asia. It operates through three segments: SGK Brand Solutions, Memorialization, and Industrial Technologies.

The company raised its quarterly dividend by 5.30% to 20 cents/share. This marked the 24h year of dividend increases for this dividend achiever. Matthews International has managed to boost dividends at an annual rate of 12%/year during the past decade.

The company grew its earnings from $2.07/share in 2007 to $3.37/share in 2018. Analysts expect earnings of $4.18/share in 2019. The stock is cheap at 10.40 times forward earnings and yields 1.80%. I would add it to my list for further research.

National Bankshares, Inc. (NKSH) operates as the bank holding company for the National Bank of Blacksburg that provides retail and commercial banking services to individuals, businesses, non-profits, and local governments. The bank raised its semi-annual dividend to 63 cents/share. This was a 3.30% increase over the semi-annual dividend paid in the second half of 2017. National Bankshares is a dividend achiever with a 19 year history of annual dividend hikes. Over the past decade, this dividend achiever has managed to boost distributions at an annual rate of 4.40%/year. The company grew its earnings from $1.82/share in 2007 to $2.03/share in 2017. Analysts expect earnings of $2.55/share in 2018. The stock is selling at 17.30 times forward earnings and yields 2.70%. Given the slow rate of earnings growth over the past decade, as well as the decrease in earnings in every single year over the past decade, I will give the company a pass at this time.

NIKE, Inc. (NKE), together with its subsidiaries, designs, develops, markets, and sells athletic footwear, apparel, equipment, and accessories worldwide. The company offers NIKE brand products in six categories: running, NIKE basketball, the Jordan brand, football, training, and sportswear. Nike raised its quarterly dividend by 10% to 22 cents/share. This marked the 17th consecutive annual dividend increase for this dividend achiever. Nike has managed to boost its dividend at an annual rate of 13.90%/year over the past decade.

The company grew its earnings from $0.94/share in 2008 to an estimated $2.65/share in 2019. Nike earned $2.42/share in 2018 (this amount was adjusted by the $1.25 one-time impact to earnings from the new tax laws signed at the end of 2017).

Nike is overvalued at 28.20 times forward earnings and yields 1.20%. It may be worth a second look on dips below $53/share.

Spire Inc. (SR), through its subsidiaries, engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas customers in the United States. It operates through two segments, Gas Utility and Gas Marketing. The company raised its quarterly dividends by 5.30% to 59.25 cents/share. This marked the 16th consecutive annual dividend increase for this dividend achiever. Over the past decade, Spire has managed to boost dividends at an annual rate of 3.70%/year.

The company grew its earnings from $2.31/share in 2007 to $4.33/share in 2017. Analysts expect earnings of $3.70/share in 2018.

The stock is overvalued at 21.30 times forward earnings and yields 3%. It may be worth researching on dips below $74/share.

American Equity Investment Life Holding Company (AEL), through its subsidiaries, provides life insurance products and services in the United States. The company issues fixed index and rate annuities; and single premium immediate annuities, as well as life insurance products. The company raised its quarterly dividends by 7.70% to 28 cents/share. Over the past decade, the stock has raised its dividends at an annual rate of 15.80%/year.

The company grew its earnings from $0.50/share in 2007 to $1.93/share in 2017. Analysts expect earnings of $4.58/share in 2018. The stock seems cheap at 7.50 times forward earnings and yields 3.30%.

Royal Gold, Inc. (RGLD), together with its subsidiaries, acquires and manages precious metal streams, royalties, and related interests. It focuses on acquiring stream and royalty interests or to finance projects that are in production or in development stage in exchange for stream or royalty interests, which primarily consists of gold, silver, copper, nickel, zinc, lead, cobalt, and molybdenum. The company raised its quarterly dividend by 6% to 26.60 cents/share. This marked the 18th year of annual dividend increases for Royal Gold. Over the past decade, it has managed to grow dividends at an annual rate of 14%. The company grew its earnings from $0.79/share in 2007 to an estimated $1.65/share in 2019.

The stock is overvalued at 46.10 times forward earnings and yields 1.40%. I would give the stock a pass at this time.

Lancaster Colony Corporation (LANC) manufactures and markets specialty food products for the retail and foodservice markets in the United States. The company operates through two segments, Retail and Foodservice. Lancaster Colony raised its quarterly dividend by 8.30% to 65 cents/share. This marked the 56th consecutive annual dividend increase for this dividend king. Over the past decade, it has managed to boost dividends at an annual rate of 7.50%/year.

The company grew its earnings from $1.28/share in 2008 to $4.92/share in 2018. Analysts expect earnings of $5.45/share in 2019.

The stock is overvalued at 33.50 times forward earnings and yields 1.40%. I do like the grow trajectory in earnings, but would need a better entry valuation before researching this company further. I will take another look at Lancaster Colony if it dips below $109/share.

Acme United Corporation (ACU), together with its subsidiaries, supplies cutting, measuring, first aid, and sharpening products to the school, home, office, hardware, sporting good, and industrial markets in the United States, Canada, Europe, and Asia. Acme United raised its quarterly dividend by 9.10% to 12 cents/share. This marked the 15th consecutive annual dividend increase for this dividend achiever. Over the past decade, this company has managed to grow its dividends at a rate of 10.80%/year.

The company grew its earnings from $1.09/share in 2007 to $1.42/share in 2017. Analysts expect earnings of $1.30 /share in 2018.

The stock is cheap at 11.80 times forward earning and it yields 3.10%. Given the slow rate of earnings growth however, the valuation multiple seems justified. I believe that future dividend growth through 2028 will probably be half of the dividend growth from the past decade.

Roper Technologies, Inc. (ROP) designs and develops software, and engineered products and solutions. It operates in four segments: RF Technology; Medical & Scientific Imaging; Industrial Technology; and Energy Systems & Controls. The company raised its quarterly dividend by 12.10% to 46.25 cents/share. This marked the 26th consecutive annual dividend increase for this dividend champion. Over the past decade, it has managed to boost dividends at an annual rate of 18.30%/year.

The company grew its earnings from $2.68/share in 2007 to $7.31/share in 2017. The 2017 results are adjusted to exclude a one-time net gain of $2.08/share resulting from the Tax Cuts and Jobs Act. Analysts expect earnings of $11.72 /share in 2018. The stock is overvalued at 25.80 times forward earnings. Roper Technologies yields a low 0.60% today as well. However, I do like the growth trajectory in earnings in the past. I would be interested in Roper Technologies on dips below $234/share.

Tennant Company (TNC) designs, manufactures, and markets floor cleaning equipment. The company raised its quarterly dividend by 4.80% to 22 cents/share. This marked the 47th consecutive annual dividend increase for this dividend champion. Over the past decade, Tennant has managed to boost dividends by 5.80%/year. If Tennant had not raised dividends this year, it would have lost its streak of dividend increases.

The company grew its earnings from $2.08/share in 2007 to an estimated $2.11/share in 2018. Given the lack of earnings growth over the past decade, and the valuation at 28.50 times forward earnings today, I will give the stock a pass today.

Assurant, Inc. (AIZ), through its subsidiaries, provides risk management solutions for housing and lifestyle markets in North America, Latin America, Europe, and the Asia Pacific. The company operates through three segments: Global Housing, Global Lifestyle, and Global Preneed. Assurant raised its quarterly dividend by 7.10% to 60 cents/share. This marked the 15th consecutive annual dividend increase for this dividend achiever. Over the past decade, this company has been able to increase dividends at an annual rate of 16.70%/year.

The company grew its earnings from $5.38/share in 2007 to $9.39/share in 2017. Analysts expect earnings of $6.08 /share in 2018. The stock looks attractively valued at 16.50 times forward earnings and yields 2.40%. I do not like the fact that earnings per share are volatile, although this is pretty normal for insurers. Rising interest rates are typically good for insurers however, because their fixed income investments can generate more yield and thus more profits.

DTE Energy Company (DTE), together with its subsidiaries, operates as an electric and natural gas utility company in Michigan. The company raised its quarterly dividend by 7.10% to 94.50 cents/share. This marked the 10th consecutive year of dividend increase for this newly minted dividend achiever. Over the past decade, this utility company has managed to compound dividends at an annual rate of 4.50%/year.

The company grew its earnings from $3.34/share in 2008 to $6.32/share in 2017. Analysts expect earnings of $6.29/share in 2018. DTE Energy sells at 18.90 times forward earnings and yields 3.20%. While I personally find 19 times forward earnings to be a high multiple for a utility company, I like the growth in earnings, which is why I will put this stock on my list for further research.

Relevant Articles:

- How to invest in dividend stocks

- How to select dividend stocks?

- The Future for Dividend Investors

- Ten Dividend Stocks Beating Inflation

After reviewing the dividend increases over the past year, it looks like the past week had the most dividend increases so far in 2018. Those increased dividend incomes should definitely work well for dividend investors pocketbooks this Thanksgiving.

Overall, companies in the US are flush with cash and distributing record dividend amounts as well. This is evidenced by the record amounts of dividends paid by companies in the S&P 500:

The companies raising dividends over the past week include:

Brown-Forman Corporation (BF.B) manufactures, bottles, imports, exports, markets, and sells various alcoholic beverages worldwide. It provides spirits, wines, ready-to-drink cocktails, whiskeys, vodkas, tequilas, champagnes, brandy, and liqueurs. The company raised its quarterly dividend by 5.10% to 16.60 cents/share. This marked the 35th year of dividend increases for this dividend champion. Over the past decade, it has managed to boost dividends at an annual rate of 8.50%/year.

The company grew its earnings from $0.76/share in 2008 to $1.48/share in 2018. Analysts expect earnings of $1.71/share in 2019. The stock is overvalued at 28.40 times forward earnings and yields 1.40%. I would be interested in adding to my position in Brown-Forman on dips below $34/share.

Sysco Corporation (SYY), through its subsidiaries, markets and distributes a range of food and related products primarily to the foodservice or food-away-from-home industry. It operates through three segments: U.S. Foodservice Operations, International Foodservice Operations, and SYGMA. The company raised its quarterly dividend by 8.30% to 39 cents/share. This marked the 49th year of dividend increases for this dividend champion. Over the past decade, it has managed to boost dividends at an annual rate of 5.70%/year.

The company grew its earnings from $1.81/share in 2008 to $2.70/share in 2018. Analysts expect earnings of $3.40/share in 2019.

The stock looks fairly valued at 19.50 times forward earnings and yields 2.30%. I may have to add the stock to my list for further research.

MDU Resources Group, Inc. (MDU) engages in regulated energy delivery, and construction materials and services businesses in the United States. The company operates through five segments: Electric, Natural Gas Distribution, Pipeline and Midstream, Construction Materials and Contracting, and Construction Services. The company raised its quarterly dividend by 2.50% to 20.25 cents/share. This marked the 28h year of dividend increases for this dividend champion. MDU Resources Group has managed to boost dividends at an annual rate of 3.40%/year during the past decade.

MDU Resources earnings declined from $2.36/share in 2007 to $1.43/share in 2017. Analysts expect earnings of $1.39/share in 2019.

The stock yields 18.90 times forward earnings and yields 3.10%. Given the lack of earnings growth, I will take a pass on the stock today.

Matthews International Corporation (MATW) provides brand solutions, memorialization products, and industrial products in the United States, Central and South America, Canada, Europe, Australia, and Asia. It operates through three segments: SGK Brand Solutions, Memorialization, and Industrial Technologies.

The company raised its quarterly dividend by 5.30% to 20 cents/share. This marked the 24h year of dividend increases for this dividend achiever. Matthews International has managed to boost dividends at an annual rate of 12%/year during the past decade.

The company grew its earnings from $2.07/share in 2007 to $3.37/share in 2018. Analysts expect earnings of $4.18/share in 2019. The stock is cheap at 10.40 times forward earnings and yields 1.80%. I would add it to my list for further research.

National Bankshares, Inc. (NKSH) operates as the bank holding company for the National Bank of Blacksburg that provides retail and commercial banking services to individuals, businesses, non-profits, and local governments. The bank raised its semi-annual dividend to 63 cents/share. This was a 3.30% increase over the semi-annual dividend paid in the second half of 2017. National Bankshares is a dividend achiever with a 19 year history of annual dividend hikes. Over the past decade, this dividend achiever has managed to boost distributions at an annual rate of 4.40%/year. The company grew its earnings from $1.82/share in 2007 to $2.03/share in 2017. Analysts expect earnings of $2.55/share in 2018. The stock is selling at 17.30 times forward earnings and yields 2.70%. Given the slow rate of earnings growth over the past decade, as well as the decrease in earnings in every single year over the past decade, I will give the company a pass at this time.

NIKE, Inc. (NKE), together with its subsidiaries, designs, develops, markets, and sells athletic footwear, apparel, equipment, and accessories worldwide. The company offers NIKE brand products in six categories: running, NIKE basketball, the Jordan brand, football, training, and sportswear. Nike raised its quarterly dividend by 10% to 22 cents/share. This marked the 17th consecutive annual dividend increase for this dividend achiever. Nike has managed to boost its dividend at an annual rate of 13.90%/year over the past decade.

The company grew its earnings from $0.94/share in 2008 to an estimated $2.65/share in 2019. Nike earned $2.42/share in 2018 (this amount was adjusted by the $1.25 one-time impact to earnings from the new tax laws signed at the end of 2017).

Nike is overvalued at 28.20 times forward earnings and yields 1.20%. It may be worth a second look on dips below $53/share.

Spire Inc. (SR), through its subsidiaries, engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas customers in the United States. It operates through two segments, Gas Utility and Gas Marketing. The company raised its quarterly dividends by 5.30% to 59.25 cents/share. This marked the 16th consecutive annual dividend increase for this dividend achiever. Over the past decade, Spire has managed to boost dividends at an annual rate of 3.70%/year.

The company grew its earnings from $2.31/share in 2007 to $4.33/share in 2017. Analysts expect earnings of $3.70/share in 2018.

The stock is overvalued at 21.30 times forward earnings and yields 3%. It may be worth researching on dips below $74/share.

American Equity Investment Life Holding Company (AEL), through its subsidiaries, provides life insurance products and services in the United States. The company issues fixed index and rate annuities; and single premium immediate annuities, as well as life insurance products. The company raised its quarterly dividends by 7.70% to 28 cents/share. Over the past decade, the stock has raised its dividends at an annual rate of 15.80%/year.

The company grew its earnings from $0.50/share in 2007 to $1.93/share in 2017. Analysts expect earnings of $4.58/share in 2018. The stock seems cheap at 7.50 times forward earnings and yields 3.30%.

Royal Gold, Inc. (RGLD), together with its subsidiaries, acquires and manages precious metal streams, royalties, and related interests. It focuses on acquiring stream and royalty interests or to finance projects that are in production or in development stage in exchange for stream or royalty interests, which primarily consists of gold, silver, copper, nickel, zinc, lead, cobalt, and molybdenum. The company raised its quarterly dividend by 6% to 26.60 cents/share. This marked the 18th year of annual dividend increases for Royal Gold. Over the past decade, it has managed to grow dividends at an annual rate of 14%. The company grew its earnings from $0.79/share in 2007 to an estimated $1.65/share in 2019.

The stock is overvalued at 46.10 times forward earnings and yields 1.40%. I would give the stock a pass at this time.

Lancaster Colony Corporation (LANC) manufactures and markets specialty food products for the retail and foodservice markets in the United States. The company operates through two segments, Retail and Foodservice. Lancaster Colony raised its quarterly dividend by 8.30% to 65 cents/share. This marked the 56th consecutive annual dividend increase for this dividend king. Over the past decade, it has managed to boost dividends at an annual rate of 7.50%/year.

The company grew its earnings from $1.28/share in 2008 to $4.92/share in 2018. Analysts expect earnings of $5.45/share in 2019.

The stock is overvalued at 33.50 times forward earnings and yields 1.40%. I do like the grow trajectory in earnings, but would need a better entry valuation before researching this company further. I will take another look at Lancaster Colony if it dips below $109/share.

Acme United Corporation (ACU), together with its subsidiaries, supplies cutting, measuring, first aid, and sharpening products to the school, home, office, hardware, sporting good, and industrial markets in the United States, Canada, Europe, and Asia. Acme United raised its quarterly dividend by 9.10% to 12 cents/share. This marked the 15th consecutive annual dividend increase for this dividend achiever. Over the past decade, this company has managed to grow its dividends at a rate of 10.80%/year.

The company grew its earnings from $1.09/share in 2007 to $1.42/share in 2017. Analysts expect earnings of $1.30 /share in 2018.

The stock is cheap at 11.80 times forward earning and it yields 3.10%. Given the slow rate of earnings growth however, the valuation multiple seems justified. I believe that future dividend growth through 2028 will probably be half of the dividend growth from the past decade.

Roper Technologies, Inc. (ROP) designs and develops software, and engineered products and solutions. It operates in four segments: RF Technology; Medical & Scientific Imaging; Industrial Technology; and Energy Systems & Controls. The company raised its quarterly dividend by 12.10% to 46.25 cents/share. This marked the 26th consecutive annual dividend increase for this dividend champion. Over the past decade, it has managed to boost dividends at an annual rate of 18.30%/year.

The company grew its earnings from $2.68/share in 2007 to $7.31/share in 2017. The 2017 results are adjusted to exclude a one-time net gain of $2.08/share resulting from the Tax Cuts and Jobs Act. Analysts expect earnings of $11.72 /share in 2018. The stock is overvalued at 25.80 times forward earnings. Roper Technologies yields a low 0.60% today as well. However, I do like the growth trajectory in earnings in the past. I would be interested in Roper Technologies on dips below $234/share.

Tennant Company (TNC) designs, manufactures, and markets floor cleaning equipment. The company raised its quarterly dividend by 4.80% to 22 cents/share. This marked the 47th consecutive annual dividend increase for this dividend champion. Over the past decade, Tennant has managed to boost dividends by 5.80%/year. If Tennant had not raised dividends this year, it would have lost its streak of dividend increases.

The company grew its earnings from $2.08/share in 2007 to an estimated $2.11/share in 2018. Given the lack of earnings growth over the past decade, and the valuation at 28.50 times forward earnings today, I will give the stock a pass today.

Assurant, Inc. (AIZ), through its subsidiaries, provides risk management solutions for housing and lifestyle markets in North America, Latin America, Europe, and the Asia Pacific. The company operates through three segments: Global Housing, Global Lifestyle, and Global Preneed. Assurant raised its quarterly dividend by 7.10% to 60 cents/share. This marked the 15th consecutive annual dividend increase for this dividend achiever. Over the past decade, this company has been able to increase dividends at an annual rate of 16.70%/year.

The company grew its earnings from $5.38/share in 2007 to $9.39/share in 2017. Analysts expect earnings of $6.08 /share in 2018. The stock looks attractively valued at 16.50 times forward earnings and yields 2.40%. I do not like the fact that earnings per share are volatile, although this is pretty normal for insurers. Rising interest rates are typically good for insurers however, because their fixed income investments can generate more yield and thus more profits.

DTE Energy Company (DTE), together with its subsidiaries, operates as an electric and natural gas utility company in Michigan. The company raised its quarterly dividend by 7.10% to 94.50 cents/share. This marked the 10th consecutive year of dividend increase for this newly minted dividend achiever. Over the past decade, this utility company has managed to compound dividends at an annual rate of 4.50%/year.

The company grew its earnings from $3.34/share in 2008 to $6.32/share in 2017. Analysts expect earnings of $6.29/share in 2018. DTE Energy sells at 18.90 times forward earnings and yields 3.20%. While I personally find 19 times forward earnings to be a high multiple for a utility company, I like the growth in earnings, which is why I will put this stock on my list for further research.

Relevant Articles:

- How to invest in dividend stocks

- How to select dividend stocks?

- The Future for Dividend Investors

- Ten Dividend Stocks Beating Inflation

Thursday, November 15, 2018

Franklin Resources (BEN) Dividend Stock Analysis

Franklin Resources Inc. (BEN) is a publicly owned asset management holding company. The firm provides its services to individuals, institutions, pension plans, trusts, and partnerships. This dividend champion has paid dividends since 1981 and managed to increase them for 37 years in a row.

The most recent dividend increase was in December 2017, when the Board of Directors approved a 15% increase in the quarterly dividend to 23 cents/share.

Over the past decade this dividend growth stock has delivered an annualized total return of 6.10% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

The company has managed to deliver a 3.70% average increase in earnings per share over the past decade. Franklin Resources is expected to earn $2.87 per share in 2019 and $2.96 per share in 2020. In comparison, the company earned $3.19/share in 2018 ( the amount includes a one-time adjusting item of $1.80/share related to the new tax law that was signed at the end of 2017).

Between 2008 and 2018, the number of shares outstanding has decreased from 715 million to 538 million. The consistent decrease in shares outstanding adds an extra growth kick to earnings per share over time.

Overall I am bullish on asset managers, who have the odds stacked in their favor for future success. Essentially, the goal of the game is to get as much in assets under management, and then try to have low costs relative to competitors. As a large portion of customers stay with a manager, this generates fees for years to come.

Since asset prices tend to rise over time, asset managers who earn a fixed fee based on amount of money they manage are destined to earn more as well. This would not be a smooth ride up, but nevertheless the rising tide is destined to lift all boats up. Even if stock markets end going up by 6 - 7% in price annually for the next 2 - 3 decades, those asset managers are going to earn 6-7% more per year merely because they manage those assets. As long as the amount redeemed equal amount of new money invested, the asset manager will earn more money for shareholders simply for being there.

It is a pretty sweet model after all, where if you come up with a mutual fund idea and raise hundreds of millions from investors, you get to earn an annuity like income stream, as long as asset levels are at least maintained. There is no risk for the manager, and the risk is borne by investors in the funds.

Of course, if those asset managers also find ways to market their products and receive more in inflows from investors, their earnings per share could grow much faster than overall profits from other US sectors.

The main problem behind mutual fund companies and asset managers is the rise in passive investing approaches, which have been popularized by Vanguard. It is tough to compete against an organization which runs its passively managed funds at cost, thus minimizing expenses for shareholders in those funds. However, I do believe that not all assets will end up in index funds, although the competition will much tougher than before. Even the passively managed index funds are not a panacea for the ordinary mom and pop investor, who needs some guidance for managing their retirement money. From my personal experience , ordinary investors tend to focus on their jobs and lives, and are not very focused on investing decisions. This is why it is quite possible that traditional asset managers who manage to reach to those individuals, and sell relevant investment products that generate recurring revenues to them, will benefit.

It is very easy to buy and sell an investment these days, which makes "asset stickiness" a potential problem. In the case of Franklin Resources, assets under management have been in a decline for several years. This has pressured revenues and profits down. Other assets managers such as T.Rowe Price and Eaton Vance have managed to grow assets under management in recent years. Earnings per share have been aided by share buybacks. I do not like the fact that this asset manager is losing assets under management during a bull market. How bad would things get when we get a bear market? Of course, the tide could always turn. New products can increase revenues, plus strategic acquisitions could also boost assets under management, and then profits. The risk with acquisitions is that a very high price is paid out of desperation to get some growth, which could turn out to be a poor decision in the long run. Given the high level of assets under management, I wonder if Franklin Resources can become an acquisition target itself. It is obvious that the mutual fund business is not in the same position as the one enjoyed in the past 30 - 40 years. However, these businesses still generate fat profit margins and a lot of excess cashflows, which can enrich shareholders for a long time.

I am actually more bullish on investment advisers such as Ameriprise Financial (AMP) than mutual fund companies such as Franklin Resources . However, many individuals who buy an investment such as a mutual fund, tend to hold on to that investment for years. In addition, fewer individuals have company pensions, which means that they would have to manage their own money, or otherwise risk not retiring. This is why professionally managed money will still be around, and earn fees for decades to come.

The annual dividend payment has increased by 13.90% per year over the past decade, which is higher than the growth in EPS. I expect dividends to grow in the low single digits over the next decade. While Frankln Resources has a low dividend payout, and a low dividend yield, it has managed to distribute special dividend payments to shareholders on several occasions over the past decade as well.

A 14% growth in distributions translates into the dividend payment doubling every five years on average. If we check the dividend history, going as far back as 1992, we could see that Franklin Resources has managed to double dividends almost every five years on average.

In the past decade, the dividend payout ratio has increased from 11.30% in 2008 to 28.80% in 2018. The company has done a combination of special dividends, share buybacks and dividend increases. If the underlying business keeps contracting however, there will be a limit to future dividend growth. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently, Franklin Resources is selling for times 10.80 times forward earnings and yields 3%. The stock seems cheap, and has a very good safe dividend for now. What worries me as a long-term investor is the fact that assets under management have been declining over the past four years, amidst a strong bull market. This has brought revenues and net income down. While I appreciate the special dividends and share buybacks at low valuations, I am hesitant to invest in a business whose fundamentals are declining. If management turns the business around, investors today will be handsomely rewarded by the dividends, special dividends and share buybacks, while the valuation multiple will likely expand too. A prolonged bear market could be crippling to a company whose customers are withdrawing their investments and the value of those investments goes down due to stock price declines.

Relevant Articles:

- Should I have a minimum yield requirement?

- Dividend Macro trends: The Baby Boomer Retirement Investment

- Dividend Aristocrats List

- Five Dividend Hikes In the News

- Top Dividend Growth Stocks of the past decade

The most recent dividend increase was in December 2017, when the Board of Directors approved a 15% increase in the quarterly dividend to 23 cents/share.

Over the past decade this dividend growth stock has delivered an annualized total return of 6.10% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

The company has managed to deliver a 3.70% average increase in earnings per share over the past decade. Franklin Resources is expected to earn $2.87 per share in 2019 and $2.96 per share in 2020. In comparison, the company earned $3.19/share in 2018 ( the amount includes a one-time adjusting item of $1.80/share related to the new tax law that was signed at the end of 2017).

Between 2008 and 2018, the number of shares outstanding has decreased from 715 million to 538 million. The consistent decrease in shares outstanding adds an extra growth kick to earnings per share over time.

Overall I am bullish on asset managers, who have the odds stacked in their favor for future success. Essentially, the goal of the game is to get as much in assets under management, and then try to have low costs relative to competitors. As a large portion of customers stay with a manager, this generates fees for years to come.

Since asset prices tend to rise over time, asset managers who earn a fixed fee based on amount of money they manage are destined to earn more as well. This would not be a smooth ride up, but nevertheless the rising tide is destined to lift all boats up. Even if stock markets end going up by 6 - 7% in price annually for the next 2 - 3 decades, those asset managers are going to earn 6-7% more per year merely because they manage those assets. As long as the amount redeemed equal amount of new money invested, the asset manager will earn more money for shareholders simply for being there.

It is a pretty sweet model after all, where if you come up with a mutual fund idea and raise hundreds of millions from investors, you get to earn an annuity like income stream, as long as asset levels are at least maintained. There is no risk for the manager, and the risk is borne by investors in the funds.

Of course, if those asset managers also find ways to market their products and receive more in inflows from investors, their earnings per share could grow much faster than overall profits from other US sectors.

The main problem behind mutual fund companies and asset managers is the rise in passive investing approaches, which have been popularized by Vanguard. It is tough to compete against an organization which runs its passively managed funds at cost, thus minimizing expenses for shareholders in those funds. However, I do believe that not all assets will end up in index funds, although the competition will much tougher than before. Even the passively managed index funds are not a panacea for the ordinary mom and pop investor, who needs some guidance for managing their retirement money. From my personal experience , ordinary investors tend to focus on their jobs and lives, and are not very focused on investing decisions. This is why it is quite possible that traditional asset managers who manage to reach to those individuals, and sell relevant investment products that generate recurring revenues to them, will benefit.

It is very easy to buy and sell an investment these days, which makes "asset stickiness" a potential problem. In the case of Franklin Resources, assets under management have been in a decline for several years. This has pressured revenues and profits down. Other assets managers such as T.Rowe Price and Eaton Vance have managed to grow assets under management in recent years. Earnings per share have been aided by share buybacks. I do not like the fact that this asset manager is losing assets under management during a bull market. How bad would things get when we get a bear market? Of course, the tide could always turn. New products can increase revenues, plus strategic acquisitions could also boost assets under management, and then profits. The risk with acquisitions is that a very high price is paid out of desperation to get some growth, which could turn out to be a poor decision in the long run. Given the high level of assets under management, I wonder if Franklin Resources can become an acquisition target itself. It is obvious that the mutual fund business is not in the same position as the one enjoyed in the past 30 - 40 years. However, these businesses still generate fat profit margins and a lot of excess cashflows, which can enrich shareholders for a long time.

I am actually more bullish on investment advisers such as Ameriprise Financial (AMP) than mutual fund companies such as Franklin Resources . However, many individuals who buy an investment such as a mutual fund, tend to hold on to that investment for years. In addition, fewer individuals have company pensions, which means that they would have to manage their own money, or otherwise risk not retiring. This is why professionally managed money will still be around, and earn fees for decades to come.

The annual dividend payment has increased by 13.90% per year over the past decade, which is higher than the growth in EPS. I expect dividends to grow in the low single digits over the next decade. While Frankln Resources has a low dividend payout, and a low dividend yield, it has managed to distribute special dividend payments to shareholders on several occasions over the past decade as well.

A 14% growth in distributions translates into the dividend payment doubling every five years on average. If we check the dividend history, going as far back as 1992, we could see that Franklin Resources has managed to double dividends almost every five years on average.

In the past decade, the dividend payout ratio has increased from 11.30% in 2008 to 28.80% in 2018. The company has done a combination of special dividends, share buybacks and dividend increases. If the underlying business keeps contracting however, there will be a limit to future dividend growth. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently, Franklin Resources is selling for times 10.80 times forward earnings and yields 3%. The stock seems cheap, and has a very good safe dividend for now. What worries me as a long-term investor is the fact that assets under management have been declining over the past four years, amidst a strong bull market. This has brought revenues and net income down. While I appreciate the special dividends and share buybacks at low valuations, I am hesitant to invest in a business whose fundamentals are declining. If management turns the business around, investors today will be handsomely rewarded by the dividends, special dividends and share buybacks, while the valuation multiple will likely expand too. A prolonged bear market could be crippling to a company whose customers are withdrawing their investments and the value of those investments goes down due to stock price declines.

Relevant Articles:

- Should I have a minimum yield requirement?

- Dividend Macro trends: The Baby Boomer Retirement Investment

- Dividend Aristocrats List

- Five Dividend Hikes In the News

- Top Dividend Growth Stocks of the past decade

Monday, November 12, 2018

Six Companies Growing Dividends for Shareholders

I review the list of dividend increases every week, in an effort to monitor existing holdings as well as identify companies for further research. In my weekly reviews on the blog, I usually focus on companies that have raised distributions for at least a decade, unless I already own shares of said companies.

Over the past week, there were six companies that raised dividends to shareholders. I reviewed each one briefly below:

AbbVie Inc. (ABBV) discovers, develops, manufactures, and sells pharmaceutical products worldwide. The company was created in 2013, when Abbott Laboratories split into two companies – Abbvie and Abbott. Last week Abbvie raised its dividends for a second time this year, from 96 cents/share to $1.07/share. Abbvie has continued raising dividends to shareholders for the five years since becoming a separate publicly traded company. The current payment is much higher than the quarterly distribution of 40 cents/share that was paid in 2013. The stock sells 11.20 times forward earnings and yields 4.80%.

When I reviewed the stock in September, I liked the valuation but didn’t like the growth prospects for Abbvie. Unfortunately, the company generates too high of a percentage of sales and profits from one blockbuster drug. That drug is going to lose patent protection, and will start seeing a lot more competition over the next 5 years. Others may argue that this uncertainty is already priced in, even more so after the recent declines after I passed on the stock in September. Either way, I will continue holding on to my existing Abbvie shares.

Vectren Corporation (VVC) provides energy delivery services to residential, commercial, and industrial and other contract customers. The company raised its quarterly dividend by 6.70% to 48 cents/share. The dividend increase marked the 59th consecutive year that Vectren (VVC) has increased the annual dividends to shareholders. Over the past decade, Vectren has managed to boost its annual dividends at a rate of 3%/year. This dividend king has managed to grow earnings from $1.87/share in 2007 to $2.60/share in 2017. The company is expected to earn $2.88/share in 2018.

The long streak of dividend increases for this dividend king is the result of the company’s continued successful execution of key strategic initiatives. Vectren has recognized the value of our long history of dividend growth and the role it has played in delivering above average shareholder returns. Unfortunately, the company is going to be acquired soon, which means that its long history of dividend increases will cease. While many fear mongers discuss dividend cuts, my experience is that many dividend investors end up having to sell their shares, because the businesses they own get acquired. Vectren is another company that is part of this statistic. That being said, the stock is overvalued at 24.90 times forward earnings and yields 2.70%.

AmerisourceBergen Corporation (ABC) sources and distributes pharmaceutical products in the United States and internationally. The company raised its quarterly dividend by 5.30% to 40 cents/share. This marked the 14th consecutive annual dividend increase for this dividend achiever. Over the past decade, the company has managed to grow distributions at a rate of 29.30%/year. Between 2007 and 2018, the company has grown earnings per share from $1.25 to an adjusted $6.49/share. The company is expecting to earn $6.65 to $6.95/share in 2019, which means that it is selling at 13.40 times forward earnings at the low range of estimates and that it yields 1.80%. In general, low yielding securities should be growing distributions at a high rate. While the stock seems cheap, I need to research further why there is a deceleration of dividend growth.

Automatic Data Processing, Inc. (ADP) provides business process outsourcing services worldwide. It operates through two segments, Employer Services and Professional Employer Organization Services. The company raised its quarterly dividend by 14.50% to 79 cents/share, which is the second dividend increase in an year. The new $0.79 quarterly dividend represents a 25.40% increase in the quarterly dividend compared to a year ago, and is a strong signal of the board's confidence in ADP's future and its commitment to shareholder friendly actions. Over the past decade, the company has managed to grow distributions at a rate of 11%/year. This dividend champion has managed to grow earnings from $2.34/share in 2008 to $3.66/share in 2018. The company expects diluted earnings per share to hit $4.25/share in 2019. The stock is overvalued at 34.60 times forward earnings and yields 2.10%. Given the high valuation, I would have to take a pass on for now. I would be interested to add to ADP on dips below $85/share.

Emerson Electric Co. (EMR), a technology and engineering company, provides various solutions to industrial, commercial, and residential markets worldwide. The company raised its quarterly dividend by 1% to 49 cents/share. This marked the 62nd consecutive annual dividend increase for this dividend king. The ten year dividend growth is 5.90%/year. The company grew earnings from $2.66/share in 2007 to $3.46/share in 2018. Emerson Electric provided a 2019 guidance of $3.55 - $3.70/share. The stock is fully valued at 19.30 times forward earnings and yields 2.90%.

Spectra Energy Partners, LP (SEP) operates as an investment arm of Spectra Energy Corp. Spectra Energy Partners, LP, through its subsidiaries, engages in the transportation of natural gas through interstate pipeline systems, and the storage of natural gas in underground facilities in the United States. The partnership raised its quarterly distribution to 77.625 cents/unit. This was a 6.90% increase over the distribution paid during the same time last year. Spectra Energy Partners has raised distributions for 11 years in a row. Since the end of 2007, the MLP has managed to grow distributions every single quarter, which is not a small achievement. Right now this MLP yields 8.70%.

Relevant Articles:

- 2018 Dividend Kings List

- October 2018 Dividend Champions List

- Ten Dividend Growth Stocks I Purchased In October

- November 2018 Dividend Champions List

- How to avoid dividend cuts

Over the past week, there were six companies that raised dividends to shareholders. I reviewed each one briefly below:

AbbVie Inc. (ABBV) discovers, develops, manufactures, and sells pharmaceutical products worldwide. The company was created in 2013, when Abbott Laboratories split into two companies – Abbvie and Abbott. Last week Abbvie raised its dividends for a second time this year, from 96 cents/share to $1.07/share. Abbvie has continued raising dividends to shareholders for the five years since becoming a separate publicly traded company. The current payment is much higher than the quarterly distribution of 40 cents/share that was paid in 2013. The stock sells 11.20 times forward earnings and yields 4.80%.

When I reviewed the stock in September, I liked the valuation but didn’t like the growth prospects for Abbvie. Unfortunately, the company generates too high of a percentage of sales and profits from one blockbuster drug. That drug is going to lose patent protection, and will start seeing a lot more competition over the next 5 years. Others may argue that this uncertainty is already priced in, even more so after the recent declines after I passed on the stock in September. Either way, I will continue holding on to my existing Abbvie shares.

Vectren Corporation (VVC) provides energy delivery services to residential, commercial, and industrial and other contract customers. The company raised its quarterly dividend by 6.70% to 48 cents/share. The dividend increase marked the 59th consecutive year that Vectren (VVC) has increased the annual dividends to shareholders. Over the past decade, Vectren has managed to boost its annual dividends at a rate of 3%/year. This dividend king has managed to grow earnings from $1.87/share in 2007 to $2.60/share in 2017. The company is expected to earn $2.88/share in 2018.

The long streak of dividend increases for this dividend king is the result of the company’s continued successful execution of key strategic initiatives. Vectren has recognized the value of our long history of dividend growth and the role it has played in delivering above average shareholder returns. Unfortunately, the company is going to be acquired soon, which means that its long history of dividend increases will cease. While many fear mongers discuss dividend cuts, my experience is that many dividend investors end up having to sell their shares, because the businesses they own get acquired. Vectren is another company that is part of this statistic. That being said, the stock is overvalued at 24.90 times forward earnings and yields 2.70%.

AmerisourceBergen Corporation (ABC) sources and distributes pharmaceutical products in the United States and internationally. The company raised its quarterly dividend by 5.30% to 40 cents/share. This marked the 14th consecutive annual dividend increase for this dividend achiever. Over the past decade, the company has managed to grow distributions at a rate of 29.30%/year. Between 2007 and 2018, the company has grown earnings per share from $1.25 to an adjusted $6.49/share. The company is expecting to earn $6.65 to $6.95/share in 2019, which means that it is selling at 13.40 times forward earnings at the low range of estimates and that it yields 1.80%. In general, low yielding securities should be growing distributions at a high rate. While the stock seems cheap, I need to research further why there is a deceleration of dividend growth.

Automatic Data Processing, Inc. (ADP) provides business process outsourcing services worldwide. It operates through two segments, Employer Services and Professional Employer Organization Services. The company raised its quarterly dividend by 14.50% to 79 cents/share, which is the second dividend increase in an year. The new $0.79 quarterly dividend represents a 25.40% increase in the quarterly dividend compared to a year ago, and is a strong signal of the board's confidence in ADP's future and its commitment to shareholder friendly actions. Over the past decade, the company has managed to grow distributions at a rate of 11%/year. This dividend champion has managed to grow earnings from $2.34/share in 2008 to $3.66/share in 2018. The company expects diluted earnings per share to hit $4.25/share in 2019. The stock is overvalued at 34.60 times forward earnings and yields 2.10%. Given the high valuation, I would have to take a pass on for now. I would be interested to add to ADP on dips below $85/share.

Emerson Electric Co. (EMR), a technology and engineering company, provides various solutions to industrial, commercial, and residential markets worldwide. The company raised its quarterly dividend by 1% to 49 cents/share. This marked the 62nd consecutive annual dividend increase for this dividend king. The ten year dividend growth is 5.90%/year. The company grew earnings from $2.66/share in 2007 to $3.46/share in 2018. Emerson Electric provided a 2019 guidance of $3.55 - $3.70/share. The stock is fully valued at 19.30 times forward earnings and yields 2.90%.

Spectra Energy Partners, LP (SEP) operates as an investment arm of Spectra Energy Corp. Spectra Energy Partners, LP, through its subsidiaries, engages in the transportation of natural gas through interstate pipeline systems, and the storage of natural gas in underground facilities in the United States. The partnership raised its quarterly distribution to 77.625 cents/unit. This was a 6.90% increase over the distribution paid during the same time last year. Spectra Energy Partners has raised distributions for 11 years in a row. Since the end of 2007, the MLP has managed to grow distributions every single quarter, which is not a small achievement. Right now this MLP yields 8.70%.

Relevant Articles:

- 2018 Dividend Kings List

- October 2018 Dividend Champions List

- Ten Dividend Growth Stocks I Purchased In October

- November 2018 Dividend Champions List

- How to avoid dividend cuts

Thursday, November 8, 2018

How to avoid dividend cuts

As a dividend growth investor, my goal is generate enough dividend income to pay for my expenses in retirement. I focus on dividend income, since it is more stable and more reliable portion of total returns, which makes it easier to predict that stock prices. I have shared with you my process for screening, identifying and analyzing companies. While the risk of dividend cuts is out there, there are ways to minimize the number of dividend cuts and also to reduce their impact on the overall dividend income. Although I have had dividend cuts in my history as an investor, these have not derailed me from hitting my goals. After watching the investment environment for the past two decades, I have seen a few things. The best thing about dividend cuts are the lessons learned from the experience.

In order to reduce the chance of dividend cuts, the investor needs to focus on several key metrics:

1) Dividend Payout Ratio

The dividend payout ratio is calculated by dividing the annual dividend income over earnings per share. In other words, this is the portion of earnings which are distributed to shareholders in the form of dividends. A lower number is usually better, because it allows for a better margin of safety on the dividend stream from earnings. The margin of safety is helpful when earnings decrease in the short run, due to a soft economy for example. Companies that have ample room for maneuvering can continue paying and even increasing those dividends when earnings are temporarily down and the payout ratio temporarily spikes up.

In my analysis, I look for a payout ratio that is less than 60%. I also look at the trends in the dividend payout ratio, in order to see if it is growing or decreasing. I do not want to see companies that grow the dividend by expanding the payout ratio. I want companies to grow the dividend, while keeping the payout ratio around a range and keeping a lid on the payout ratio.

However, certain companies in certain industries can afford to pay higher portions of their earnings to shareholders. Many utilities for example tend to distribute over 60% - 70% and even 80% of their earnings to shareholders in the form of dividends. These companies are regulated monopolists, which tend to generate stable earnings and revenues over time. Due to this stability of the business model, they can afford to have high payout ratios. The dividend analyst can usually evaluate the sustainability of the dividend by reviewing the trends in the payout ratio. A public utility that has paid between 70% and 80% of earnings as dividends over the past decade has a sustainable dividend. An industrial company that grows its dividend and sees its payout ratio rise from 35% to 80% however does not strike me as an investment with a sustainable distribution. In another example, a company like Altria (MO) with a stated target of 80% and a history of a high payout ratio and rising earnings per share is another exemption that I consider.

2) Earnings Per Share

In general, we want earnings per share which are stable and growing. While some fluctuations in earnings per share do occur as a result of the economic cycle, we want to see a steady climb upwards over time. Without growth in earnings per share, a company cannot afford to raise distributions to shareholders as there is a natural limit to future increases. This will be evident when the dividend payout ratio starts increasing, while earnings are stagnant.

Rising earnings provide the fuel behind future dividend increases. In general, a healthy company will grow earnings over time, distribute a portion to shareholders in the form of dividends, and reinvest the rest to maintain or grow the business. A business with stable earnings can provide more reliable dividend payments than a business with more volatile earnings streams however. For example, most automotive companies in the world are cyclical companies. This means that their earnings ebb and flow with the ebb and flow of the economy. As a result, earnings go from highs to lows rather violently. When times are great, earnings are at their peak just as the economy is at its peak. The dividend payout ratio looks high, but this is usually a mirage, because earnings are about to take a dive just at the economy is taking a dive. This rapid fluctuation in earnings is the reason why there are no auto companies which are members of the dividend achievers index.

3) Business model

The stability of the business cannot be emphasized enough. Companies with strong earnings and revenue streams, which are less sensitive to the economic cycles can afford to pay dividends come rain or shine. When reviewing the longest streaks of dividend increases, I have found quite a few utilities and consumer staples companies. When the demand for the products or services is relatively inelastic, you can afford to maintain and grow dividends, since you have better visibility about the near term business prospects. That doesn’t mean to focus only on a few industries however, since things can change over time. This is why we need to be diversified, but also not to diversify for the sake of diversification either.

4) Debt and acquisitions

I rarely discuss debt in my analysis. In my experience, I have found that debt in the normal course of business is not a major issue when it comes to dividend safety. Debt can become an issue when it is coupled with a major acquisition. When you take on debt, you are essentially spending money today that you do not have, and as a result the future you has to pay for a period of time. Leverage is a two-way street that enhances your performance on the upside or the downside. If you acquire a business with all debt, and the business performs well, it can pay for itself from those profits. This leaves you with the debt paid off, and the business being your own letting you get future dividends in perpetuity. If you the business fails however, you have to still pay that debt and interest on it, which will hurt performance. If you are too leveraged, it may mean increased risk of bankruptcy if you have less wiggle room if business turns soft.

When you acquire a company, there are a lot of good things that can occur – namely synergies, increase in scale of operations, adding new products and expanding the business reach. However, a lot of things can happen that can derail acquisitions including having different cultures, integrating different systems and actually realizing those efficiencies of scale.

In my experience, there have been several companies that cut dividends after large acquisitions that were paid for with debt. Those include Pfizer (PFE) and Cedar Fair (FUN). If we talk purely about debt, we have Kinder Morgan (KMI) which had to cut dividends in 2015 after its credit rating took a hit after an acquisition.

In general, I do not look at debt too much. Again, as stated above debt can be an issue when combined with a major acquisition. This usually leads to a halt to future dividend increases, and sometimes even to dividend cuts. Many investors look at debt to equity or debt to assets. I prefer looking at interest coverage from earnings.

So if a company earns $100 million in profits, and spends $20 million on interest expense, I would argue that debt shouldn't be an issue.

I think that this is the only article I have written on debt.

5) Things Change

Unfortunately, sometimes things happen. When you buy a security with bright prospects, great valuation and attractive payout ratio today, you may not be aware that changes may be coming years or decades down the road. Technologies disrupts businesses, but also consumer tastes change as well. The economic cycle can be ravaging for businesses, and poor management may also be to blame. This is why we need to diversify as investors, in order to mitigate the effect of disasters on our retirement projections.