I review the list of dividend increases as part of my monitoring process. This process helps me review how the companies I own are doing. It also helps me identify companies for further research.

For this weekly review, I tend to focus my attention on companies with at least a ten year history of annual dividend increases, which also raised dividends last week. I provide a quick overview of each company that includes the amount of the most recent dividend increase, and compares it to its recent historical record. I also review the streak of annual dividend increases, and review earnings and valuation information.

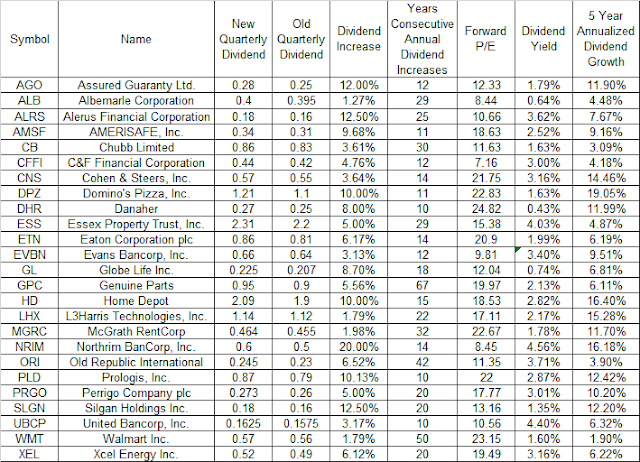

There were 68 companies that increased dividends last week. Twenty five of these companies that raised dividends also have a ten year history of annual dividend increases. The companies include:

This list is not a recommendation to buy or sell any securities. It is just a list of companies for further research. It is also a list to update my existing observations on companies I own or plan to own at the right price. I analyze companies before buying the,

If I were to evaluate the companies on this list, I would leverage my screening criteria, which I first outlined in 2010.

Notably I would look for the following:

1) Ten years of annual dividend increases

2) Earnings per share that are increasing over the past decade

3) Dividend Payout Ratio below 60% ( however I am willing to make exceptions for REITs, MLPs, Utilities and Tobacco companies)

4) Dividend growth rate that exceeds the rate of inflation ( however this also needs to take into account the rate of earnings and dividend growth)

5) A P/E ratio below 20

Since I have some experience evaluating dividend companies, I also modify my criteria based on the environment we are in and the availability of quality companies. If I see a company with a strong business model and certain characteristics that I like, I may require a dividend streak that is lower than a decade. I have also found success in looking beyond screening criteria by purchasing stocks a little above the borders contained in a screen.

It is important to be flexible, without being too lenient.