"Timing the market is a fool's game, whereas time in the market is your greatest natural advantage."

- Nick Murray

I am a firm believer in the concept of buy and hold investing. I invest regularly every single month, in a group of attractively valued companies. I do not accumulate cash, waiting for a crash, nor do I get in and out of stocks based on moving averages or even valuation targets. Once I buy a company, I hold it, and reinvest dividends, for as long as it doesn't cut or eliminate the dividend. I simply follow my own strategy, through thick or thin.

Many investors seem to believe that they can score extra points by timing the market. In my opinion, they are needlessly complicating investing.

In order to be successful with market timing, you need to make two correct decisions:

1. When to get out

2. When to get back in

I believe that this is impossible to do. Hence, it's best to just buy and hold.

I've interacted with countless investors who missed most of the bull market of the past 14 - 15 years.

The story usually goes like this:

They sold after a decline in the stock market, and then stayed in cash for years.

The first question I always get is: "Do you think the market is too high"

It is a shame to get out of stocks because "they are too high". Or because you are afraid of stock market fluctuations.

It's always sad to see this happen. I once spoke to a gentleman who sold in 2009, and never got back in. They locked in losses, and missed out on a lot of appreciation and dividends.

Of course, if you witnessed 2000-2010, you were trained that once S&P 500 reaches 1,500 points, we are due for a 50% decline. However, the issue is that over the long-run, US stocks tend to rise due to growth in earnings, revenues, dividends. Even if stocks stay flat, investors would generate returns through dividends and their reinvestment.

A good cure for market timing is to create your own investment system. It can help reduce guesswork, and keep you invested.

In my case, I invest every month in several quality companies with long streaks of annual dividend increases. I then stay invested for as long as these companies do not cut dividends. I reinvest those dividends, and hold these shares. It is best to avoid trading in and out of positions, and selling for some "reason", which usually happens to be fear, or exaggerating on a recent event. Other reasons could include greed, by selling a perfectly good companies because the valuation went a little too high, and reinvesting into a higher yielding stock that is a higher risk stock. I am very diversified, which helps me sleep well at night.

In other cases, folks tend to buy ETFs, which may cost a little in fees, but automates the investing process. The behavioral aspect is always the hard part with ETFs, because there are so many of them, which makes a lot of perfectionists out there tinker with their portfolios, until they try to find the perfect ETF ( Note: It doesn't exist)

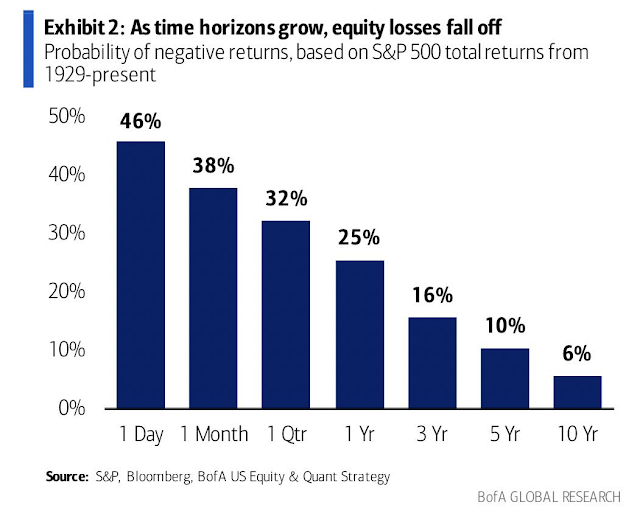

In general, investors make money by buying equities, and holding on to them. While share prices are volatile in the short-run and can result in unrealized losses in a given day, week, month or even year, it is unlikely that over the course of a decade or two there will be losses. This of course works for diversified portfolios of course.

Stocks go up in the long run, because they are ownership pieces of real businesses. Over time, these businesses earn more money, and reinvest a portion to grow the business. They end up generating more than they know what to do with, on aggregate, and send those excess profits to shareholders. All of this tends to grow the values of those businesses as well. It is a true virtuous cycle, which lets the long-term investor take full advantage of the power of compounding.

This is my favorite chart. In the long-run, US stocks have built a lot of wealth for patient long-term investors. It was never easy, and not always a straight line up. However, patience for US investors has been historically well rewarded. Market timing on the other hand has not been well rewarded.

Source: Stocks for the Long Run

Another favorite statistic I have has to do with staying fully invested, versus missing the best days. If you try to time the short-term movement of security prices, you risk the chance of missing out on the best days. This reduces your future returns significantly.

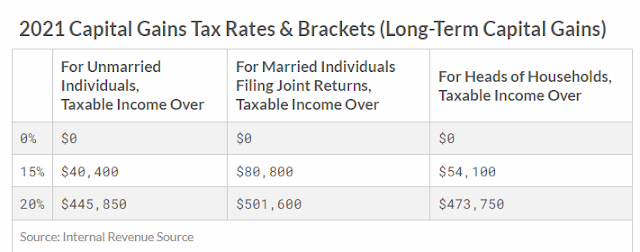

Source: PutnamThe best and worst days are usually clustered together. If you jump in and out of stocks due to fear and greed that short-term fluctuations cause for you, you risk the chance of missing out on returns, compounding losses, and paying taxes, commissions and fees on top of that. You do not want to be compounding losses.

There’s no need to time the market when you have such a high chance of success through a long-term buy and hold.

I also wanted to share this amazing video of Peter Lynch, on how to handle stock market volatility.

"Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs. … Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years. So I think — the market is about 3,800 today, or 3,700 — I'm pretty convinced the next 3,800 points will be up; it won't be down. The next 500 points, the next 600 points — I don’t know which way they’ll go. So, the market ought to double in the next eight or nine years. They’ll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That's all there is to it."

As my friend Chris D’Agnes says, "Don’t just do something, stand there."

This Buffett quote sums up my approach to just sitting there: