However, I think I didn't stress enough the fact that most of my income in retirement would be coming from qualified dividends. This will be my bread and butter, because dividends provide the best tax-efficient method of income in the US.

Did you know that if you were single, and your taxable income does not exceed $40,400 in 2021, you would owe zero dollars in Federal taxes on your qualified dividend income? If you were married, filing jointly, you won’t owe a dime in taxes on qualified dividends at the Federal level as long as your taxable income does not exceed $80,800 in 2021.

This means that if you are single, living on your own, and only claiming yourself as a dependent, you can essentially make $52,950 in annual qualified dividend income, and pay zero taxes on that. This includes the Standard Deduction of $12,550. This calculation also assumes you have no other sources of income and no other deductions for the sake of simplicity and to illustrate the point. In order for you to generate so much in income, your portfolio would likely be worth around $1.765 million at a dividend yields of 3%. If you made your selections wisely, your dividend income should at least keep up with inflation over time. With most dividend growth stocks, I expect a 5% - 6% annual dividend increase in the long run, ahead of the long-term annual inflation rate of 3%.

This net dividend income for the single individual above is equivalent to $65,298 in salary earnings. In other words, if you are single, it would take you to earn $65,298 from a day job in order to end up with the same amount of net income that the same individual can achieve with “only” $52,950 in qualified dividend income. And you were wondering why Warren Buffett’s secretary is so vocal about her bosses taxes.

Let’s see how this translates for a married couple, filing jointly, without any kids, mortgages and student loans. They could essentially earn $105,900 in annual qualified dividend income, before owing a single cent to the Federal government in 2021. This includes the standard deductions of $25,100 added to the $80,800 maximum threshold for married couples. In order for this couple to generate so much in income, their dividend growth portfolio would likely be worth around $3.523 million at yields of 3%.

This net dividend income for the single individual above is equivalent to $65,298 in salary earnings. In other words, if you are single, it would take you to earn $65,298 from a day job in order to end up with the same amount of net income that the same individual can achieve with “only” $52,950 in qualified dividend income. And you were wondering why Warren Buffett’s secretary is so vocal about her bosses taxes.

Let’s see how this translates for a married couple, filing jointly, without any kids, mortgages and student loans. They could essentially earn $105,900 in annual qualified dividend income, before owing a single cent to the Federal government in 2021. This includes the standard deductions of $25,100 added to the $80,800 maximum threshold for married couples. In order for this couple to generate so much in income, their dividend growth portfolio would likely be worth around $3.523 million at yields of 3%.

This net dividend income for the married individuals above is equivalent to $130,597 in salary earnings. In other words, if you are married with no children, it would take the couple to earn $130,597 from a day job in order to end up with the same amount of net income they can achieve with “only” $105,900 in qualified dividend income.

For the sake of simplicity, and to illustrate a point about the tax efficiency of dividends, I have compared salary only income versus dividend only income. The tax code is so complicated, that it would probably take me years and hundreds of pages before I can explain every single possible scenario affecting those sample single and married individuals.

I claim that the dividend income is the most efficient form of income in the US, because it can increase over time to compensate for inflation. With municipal bonds, you do not pay any income tax, no matter how much you make. However, since your income is fixed, your “real” purchasing power is decreasing over time. As a result, you are worse off than with dividend stocks over extended periods of time.

Some readers may be more fortunate than others, and wonder about the taxation of qualified dividends and long-term capital gains above $105,900/year for a married couple filing jointly.

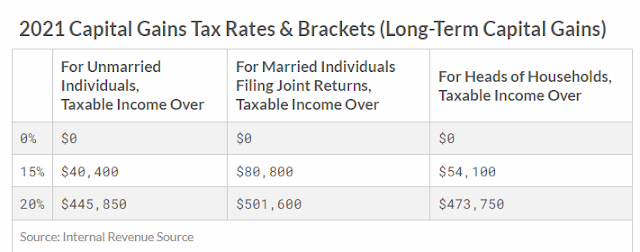

I found the following table, which shows the income levels for various brackets, and how much taxes will be owed on that income.

This means that for a single filer, qualified dividend income up to $458,400 ($445,850 plus 12,550 standard deduction) will be taxed at only 15%. For the married filing jointly couple, qualified dividend income up to $526,700 ($501,600 plus $25,100 standard deduction) will be taxed at only 15%.

If the modified adjusted gross income exceeds $200,000 ($250,000 if married filing jointly), the 3.8% net investment income tax still applies.

You can view the updated table for 2022 here:

The standard deduction for single payers rose to $12,950, while the standard deduction for married, filing jointly rose to $25,900.

This means that a married couple that is earning up to $109,250 in annual dividend income would pay zero in Federal Income taxes. That's a pretty sweet deal in my opinion.

Long-term capital gains are taxed the same way as qualified dividends. In order to have your gain classified as long-term capital gain, you should have held the asset that you sold for a profit for at least one calendar year. If you held for less than one year, your income will be treated as an ordinary gain, subject to your marginal tax rate.

Under the new tax law, REIT investors to deduct 20% of the income, with the remainder of the income taxed at the filer’s marginal rate. It is available even if the taxpayer doesn’t itemize deductions.

Shareholders of REITs who now pay the top income-tax rate of 37% on dividends received would see that rate drop to 29.6%, according to NAREIT, formerly the National Association of Real Estate Investment Trusts.

I purposefully also avoided included MLP distributions, because these are even hairier at tax time. These distributions might not even be taxable to you as long as your cost basis is above zero.

Foreign dividends are another type of income which is taxed usually as qualified dividends. The twist is that some governments withhold the tax at the source, which entitles you to a credit. Therefore, if you paid $15 in dividend taxes to Canada on your $100 dividend check from Canadian National Railway (CNI), you don’t also have to pay Uncle Sam $15 additional dollars in dividend income. You can essentially get a credit for this. If you are single earning under $46,250 in dividend income, you might even get a check in the mail for $15.

Full Disclosure: I am not a tax advisor, and this article should not be considered as individual tax advice. Please discuss your individual tax situation with a licensed CPA. I have no position in the companies listed above.

Relevant Articles:

- Best International Dividend Stocks

- My Retirement Strategy for Tax-Free Income

- How to Retire Early With Tax-Advantaged Accounts

- Six Dividend Paying Stocks I Purchased for my IRA

- Should income investors worry about higher dividend taxes?