Warren Buffett needs no introduction. If you have read "The Snowball", you would know that he was entrepreneurial and focused on investments and making money from an early age.

Back when he was 20, he set a goal to work for Ben Graham. He learned everything there is about him, and his investment style. He had noticed that Ben Graham sat on the board of GEICO, and had a significant ownership of the company.

This is why Buffett ended up taking a train to GEICO's headquarters on a weekend, in order to learn more about the company and its operations. He was only 21 years old at the time. He ended up knocking on the door, until the Janitor let him in and introduced him to the company's CEO. The CEO managed to explain the whole business model, the competitive advantages of the business. This conversation planted the seeds behind Buffett's future endeavors in Insurance, which ultimately led to his investment in Berkshire Hathaway, and transforming it to what it is today.

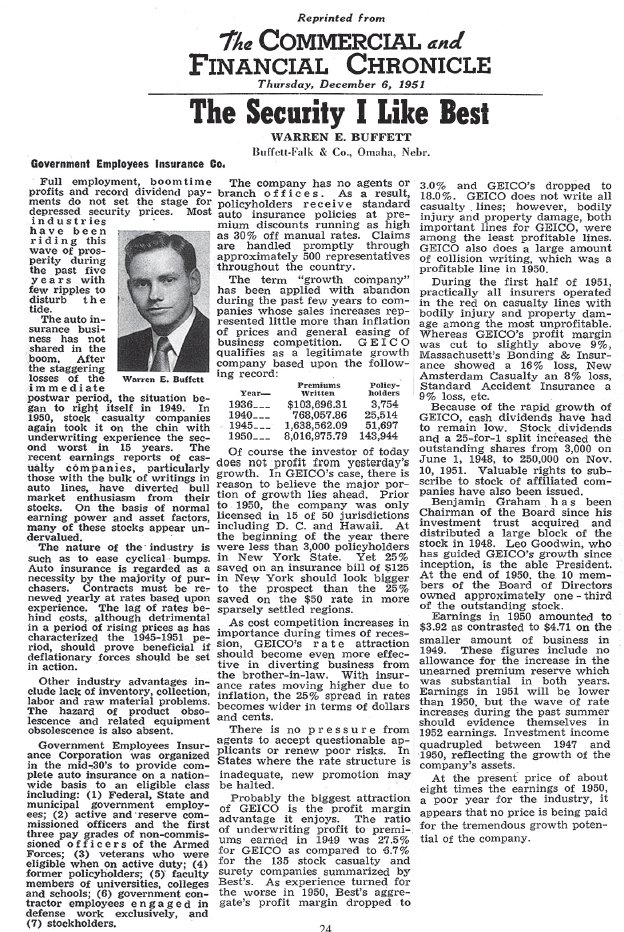

After the conversation, and reviewing filings and reports, Warren Buffett wrote this analysis of GEICO at the young age of 21. This is very impressive, given his young age. You can read it as PDF from here: The Security I Like Best

Source: The Security I Like Best

This is a good lesson in learning. When you write something down, this forces you to think hard about the topic at heart. By trying to distill your thoughts and teach others, you end up improving your communication skills and create a piece of research that is well supported with facts and strong arguments. This strengthens the research, because your thinking is clearer.

He invested $10,000 in the stock, and made a 50% profit in a single year. He did sell the stock however, and reinvested the proceeds elsewhere. That stock became a 130 bagger over the next 20 years. It would have turned that $10,000 into $1.30 million.

If Buffett had not sold the stock, it would have compounded to over $1.30million by 1972.

He was ultimately involved with saving GEICO in the 1970s, when the company had troubles. This investment led him to owning a big chunk of the car insurer. Berkshire invested $45.7 million in GEICO in 1976, and owned about a third of the stock.

The company ultimately rebounded its business, and returned to profitability. GEICO was a dividend achiever, which regularly raised dividends and repurchased shares. As a result of these share repurchases, Buffett's stake in the business increased at the expense of the remaining shareholders. He ultimately had a 50% ownership by 1995, which is when he decided to acquire the rest of GEICO.