Target

Corporation (TGT) operates general merchandise stores in the United States and

Canada. Target is a dividend champion, which has paid

dividends since and raised them every year for 47 years in a row.

The most recent dividend increase was in June 2014, when

the Board of Directors approved a 20.90% increase in the quarterly dividend to 52

cents/share.

The company’s largest competitors include Wal-Mart (WMT),

Costco (COST) and Amazon (AMZN).

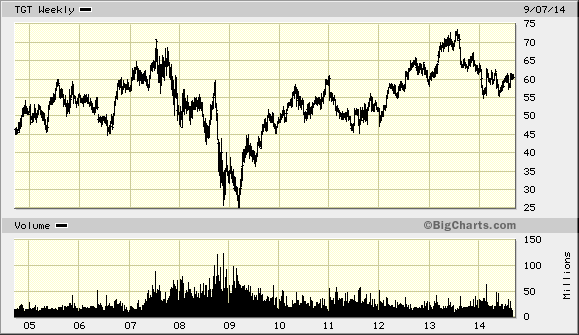

Over the past decade this dividend growth stock has delivered an annualized total

return of 4.80% to its shareholders. Future returns will be dependent on growth

in earnings and dividend yields obtained by shareholders.

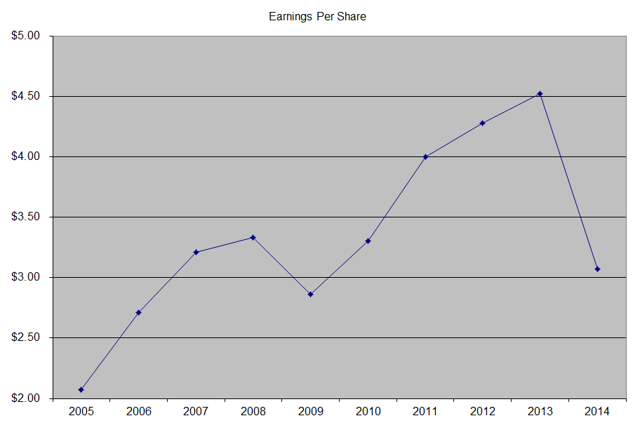

The company has managed to deliver a 4.40% average increase in annual EPS over the past decade. Target is expected to earn $3.25 per share in 2015 (minus losses on exiting Canada) and $3.88 per share in 2016. In comparison, the company earned $3.07/share in 2013. Earnings per share have been depressed by steep losses in the company’s Canadian division, where expansion has been difficult.

Between 2005 and 2014, the number of shares outstanding has

decreased from 912 million to 638 million. The decrease in shares outstanding

through consistent share buybacks adds an extra growth kick to earnings

per share over time. The thing however is that the net income between 2005 and 2013, which was the last year before Canadian operations were started, actually decreased from $3.198 billion to $2.999 billion.

The past year has been characterized by difficulty in the expansion in Canada as well as the credit card breach from late 2013. Those short-term risks have reduced the share price, and lowered expectations for many investors. If Target manages to turn around Canadian operations, this would surely bring earnings per share to $4.50 - $5. In the unlikely scenario that the company loses even more ground in Canada, it can shut those stores, sell them, and also return to earning more than $4.50/share. I think that the most likely scenario is that the company learns from this experience, and Canada becomes a case study for further growth North of the US border as well as in other places abroad. The company is still getting started internationally, which alone could propel earnings per share forward for the next 20 years.

I also believe that the credit card problems are important, but are already discounted in the price. Actually, in this interconnected world of ours, everyone is at risk of credit card information being stolen by unauthorized persons. This includes both brick and mortar as well as online retailers.

The other major risk that might or might not be overblown is the competition from the likes of Amazon.com. When you have a competitor that purposefully sells at cost, and customers do not pay sales taxes at that competitors in most states, you are at a disadvantage. That being said, it is highly unlikely that retailers like Target will be driven away from online competitors. It is very likely that Target would keep expanding its online presence, and offer something to consumers that Amazon cannot - the online to store shipment method. I also believe that not everything is worth purchasing online, nor are online sales a good venue to do convenience shopping. When a customer gets to a store for one thing at a physical location, they are very likely to buy something else on their journey throughout the store. Plus, some items are much better to personally try and touch, rather than have someone else deliver them for you. The value of repeatability and those customers who do their weekly/monthly visits to the Target stores is very powerful force for Target as well. That being said, Target can surely expand its online presence, which would actually be good for the business overall.

Growth for Target would also be driven by expansion of number of stores in the US by approximately 1%/year, plus growth in same-store sales. Target is targeting more affluent consumers with its upscale stores. Its customer base is somewhat different than that of competitor Wal-Mart. Many of Target's customers enjoy shopping there, and are attracted by the appeal of offerings and overall atmosphere within the stores. Target's stores are generally more appealing than those of Wal-Mart, and are cleaner. In addition, Target manages to retain shoppers with its RedCard. Shoppers who use the Target Card get a discount, but also tend to spend more than the average purchaser. In addition, the company has been able to drive more traffic with sales of grocery/food items.

Overall, Target is targeting earnings of $8/share by 2017. However, even if it misses those estimates and earns $6 - $7/share by 2017-2018, shares could deliver a very good return to investors who are willing to weather near-term turbulence at the company.

On a side note, I have noticed that anytime I wrote anything about Target on my personal website or here at Seeking Alpha, there were one or two individuals who would post negative things about the company. Needless to say, I found that very interesting, as if someone wanted to "silence me" about the fact that Target is a bargain today.

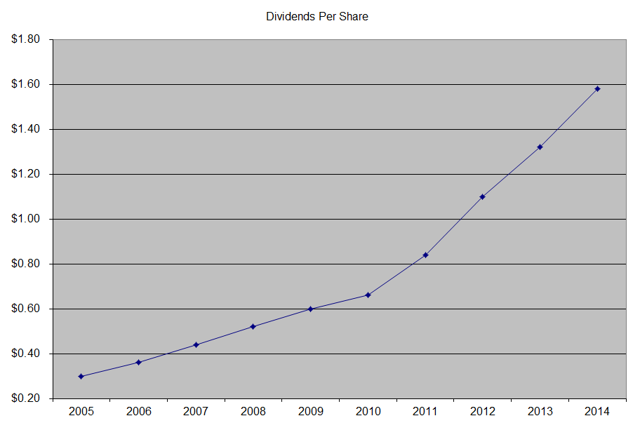

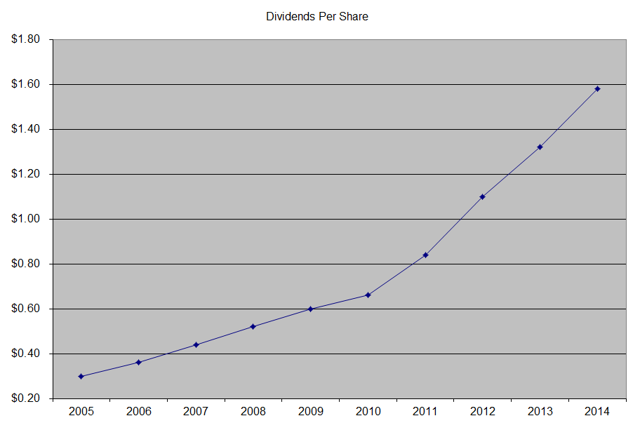

The annual dividend payment has increased by 19.80% per year over the past decade, which is much higher than the growth in EPS. Future growth in dividends will be much lower than that however, and will be limited by the growth in earnings per share in the future.

A 20% growth in distributions translates into the dividend payment doubling every three and a half years on average. If we check the dividend history, going as far back as 1985, we could see that Target has managed to double dividends almost every six years on average.

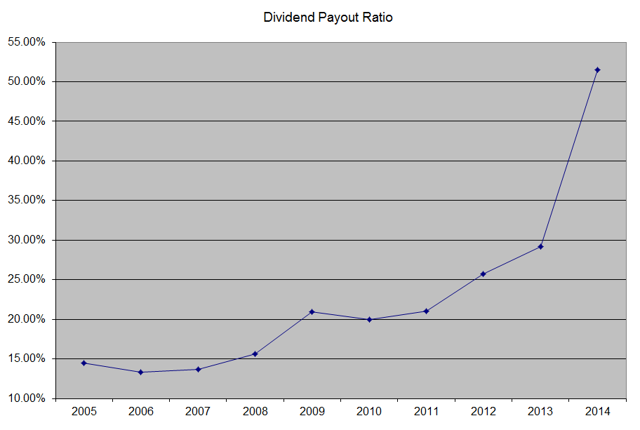

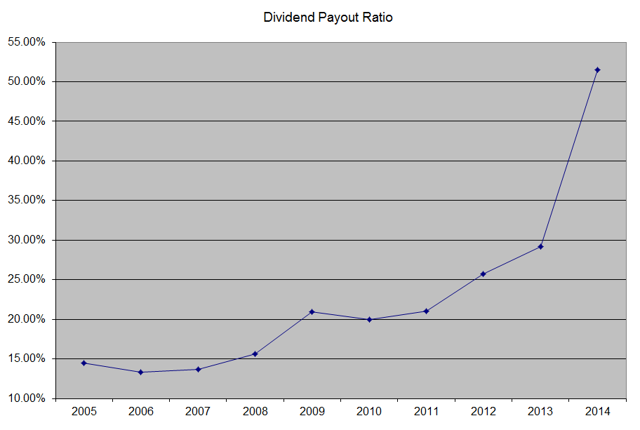

In the past decade, the dividend payout ratio has increased from 12.60% in 2005 to 51.50% by 2014. I believe that Target is perfectly capable of earning $4.00 - $4.50/share, which is why I believe the current high dividend payout ratio to be an aberration, than anything else. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

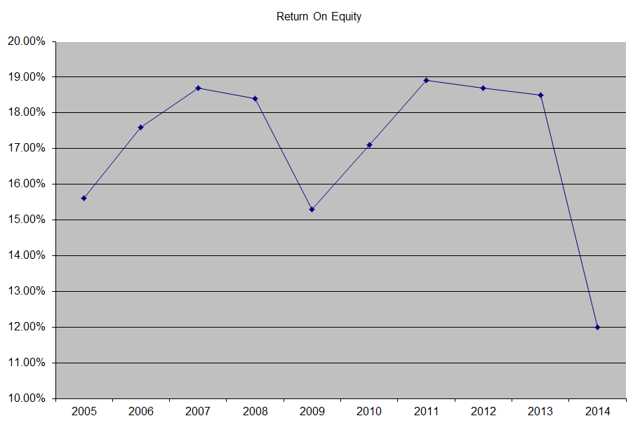

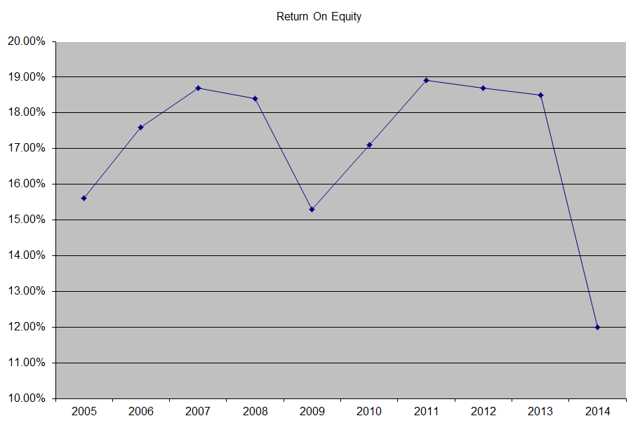

The return on equity has generally remained between 15% and 19% over the past decade, with the exception of the past year. If Target earnings rebound, which I think they will within a year, this indicator would return to its normal range. I generally like seeing a high return on equity, which is also relatively stable over time.

The past year has been characterized by difficulty in the expansion in Canada as well as the credit card breach from late 2013. Those short-term risks have reduced the share price, and lowered expectations for many investors. If Target manages to turn around Canadian operations, this would surely bring earnings per share to $4.50 - $5. In the unlikely scenario that the company loses even more ground in Canada, it can shut those stores, sell them, and also return to earning more than $4.50/share. I think that the most likely scenario is that the company learns from this experience, and Canada becomes a case study for further growth North of the US border as well as in other places abroad. The company is still getting started internationally, which alone could propel earnings per share forward for the next 20 years.

I also believe that the credit card problems are important, but are already discounted in the price. Actually, in this interconnected world of ours, everyone is at risk of credit card information being stolen by unauthorized persons. This includes both brick and mortar as well as online retailers.

The other major risk that might or might not be overblown is the competition from the likes of Amazon.com. When you have a competitor that purposefully sells at cost, and customers do not pay sales taxes at that competitors in most states, you are at a disadvantage. That being said, it is highly unlikely that retailers like Target will be driven away from online competitors. It is very likely that Target would keep expanding its online presence, and offer something to consumers that Amazon cannot - the online to store shipment method. I also believe that not everything is worth purchasing online, nor are online sales a good venue to do convenience shopping. When a customer gets to a store for one thing at a physical location, they are very likely to buy something else on their journey throughout the store. Plus, some items are much better to personally try and touch, rather than have someone else deliver them for you. The value of repeatability and those customers who do their weekly/monthly visits to the Target stores is very powerful force for Target as well. That being said, Target can surely expand its online presence, which would actually be good for the business overall.

Growth for Target would also be driven by expansion of number of stores in the US by approximately 1%/year, plus growth in same-store sales. Target is targeting more affluent consumers with its upscale stores. Its customer base is somewhat different than that of competitor Wal-Mart. Many of Target's customers enjoy shopping there, and are attracted by the appeal of offerings and overall atmosphere within the stores. Target's stores are generally more appealing than those of Wal-Mart, and are cleaner. In addition, Target manages to retain shoppers with its RedCard. Shoppers who use the Target Card get a discount, but also tend to spend more than the average purchaser. In addition, the company has been able to drive more traffic with sales of grocery/food items.

Overall, Target is targeting earnings of $8/share by 2017. However, even if it misses those estimates and earns $6 - $7/share by 2017-2018, shares could deliver a very good return to investors who are willing to weather near-term turbulence at the company.

On a side note, I have noticed that anytime I wrote anything about Target on my personal website or here at Seeking Alpha, there were one or two individuals who would post negative things about the company. Needless to say, I found that very interesting, as if someone wanted to "silence me" about the fact that Target is a bargain today.

The annual dividend payment has increased by 19.80% per year over the past decade, which is much higher than the growth in EPS. Future growth in dividends will be much lower than that however, and will be limited by the growth in earnings per share in the future.

A 20% growth in distributions translates into the dividend payment doubling every three and a half years on average. If we check the dividend history, going as far back as 1985, we could see that Target has managed to double dividends almost every six years on average.

In the past decade, the dividend payout ratio has increased from 12.60% in 2005 to 51.50% by 2014. I believe that Target is perfectly capable of earning $4.00 - $4.50/share, which is why I believe the current high dividend payout ratio to be an aberration, than anything else. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

The return on equity has generally remained between 15% and 19% over the past decade, with the exception of the past year. If Target earnings rebound, which I think they will within a year, this indicator would return to its normal range. I generally like seeing a high return on equity, which is also relatively stable over time.

Currently, Target is selling for 23.60 times expected current year earnings and 19.80 times next year's earnings and yields 2.70%. So far in 2014, I was slowly building my position in the stock by dollar cost averaging my way. At this stage I am not planning on adding more to Target.

Relevant Articles:

- How to buy when there is blood on the streets

- Why Did I Purchase This Dividend Paying Company For a 3rd Month in a Row?

- How to think like a long term dividend investor

- Top Dividend Growth Stocks of the past decade