Berkshire Hathaway is the holding company of super-investor Warren Buffett. He transformed a struggling textile mill into a conglomerate with a significant portfolio of equites and significant interests in railroads, insurance, utilities, industrials etc.

Because of the size of his equity portfolio investments, Berkshire Hathaway has to report its US equity holdings every quarter to the SEC. Some foreign investments are also reported to the corresponding Foreign securities regulator.

You can find the updated portfolio holdings for Berkshire Hathaway (BRK.A)(BRK.B) as of June 30, 2023

Name | Symbol | Shares | Ownership Percentage | Market Price | Market Value | Percentage of portfolio |

Apple Inc | AAPL | 915,560,382 | 5.90% | $177.87 | $162,850,725,146 | 45.80% |

Bank of America Corp | BAC | 1,032,852,006 | 13.00% | $30.02 | $31,006,217,220 | 8.70% |

American Express Company | AXP | 151,610,700 | 20.60% | $162.03 | $24,565,481,721 | 6.90% |

Coca-Cola Co | KO | 400,000,000 | 9.20% | $60.63 | $24,252,000,000 | 6.80% |

Chevron Corporation | CVX | 123,120,120 | 6.50% | $160.09 | $19,710,300,011 | 5.50% |

Occidental Petroleum Corp | OXY | 224,129,192 | 25.30% | $63.81 | $14,301,683,742 | 4.00% |

Kraft Heinz Co | KHC | 325,634,818 | 26.50% | $33.78 | $10,999,944,152 | 3.10% |

Moody’s Corp | MCO | 24,669,778 | 13.40% | $333.59 | $8,229,591,243 | 2.30% |

Mitsubishi Corp | 8058:TYO | 119,497,600 | 8.30% | $49.27 | $5,888,000,106 | 1.70% |

Mitsui & Co | 8031:TYO | 125,022,300 | 8.10% | $38.36 | $4,795,863,204 | 1.30% |

Itochu Corporation | 8001:TYO | 118,331,800 | 7.50% | $39.24 | $4,643,303,267 | 1.30% |

HP Inc | HPQ | 120,952,818 | 12.30% | $31.87 | $3,854,766,310 | 1.10% |

Davita Inc | DVA | 36,095,570 | 39.50% | $104.73 | $3,780,289,046 | 1.10% |

BYD Co. Ltd | BYDDF | 98,603,142 | 9.00% | $29.50 | $2,908,792,689 | 0.80% |

Verisign, Inc. | VRSN | 12,815,613 | 12.40% | $206.19 | $2,642,451,244 | 0.70% |

Citigroup Inc | C | 55,244,797 | 2.90% | $43.39 | $2,397,071,742 | 0.70% |

Kroger Co | KR | 50,000,000 | 7.00% | $47.77 | $2,388,500,000 | 0.70% |

Marubeni Corp | 8002:TYO | 141,000,200 | 8.30% | $16.69 | $2,352,653,028 | 0.70% |

Sumitomo Corp | 8053:TYO | 101,210,400 | 8.20% | $20.41 | $2,066,065,894 | 0.60% |

Visa Inc | V | 8,297,460 | 0.40% | $240.37 | $1,994,460,460 | 0.60% |

Charter Communications Inc | CHTR | 3,828,941 | 2.60% | $427.66 | $1,637,484,908 | 0.50% |

Mastercard Inc | MA | 3,986,648 | 0.40% | $395.15 | $1,575,323,957 | 0.40% |

Amazon.com, Inc. | AMZN | 10,551,000 | 0.10% | $137.89 | $1,454,877,390 | 0.40% |

Paramount Global Class B | PARA | 93,730,975 | 15.40% | $15.39 | $1,442,519,705 | 0.40% |

Aon PLC | AON | 4,335,000 | 2.10% | $318.52 | $1,380,784,200 | 0.40% |

Capital One Financial Corp. | COF | 12,471,030 | 3.30% | $106.98 | $1,334,150,789 | 0.40% |

Activision Blizzard Inc | ATVI | 14,658,121 | 1.90% | $91.00 | $1,333,889,011 | 0.40% |

Liberty SiriusXM Series C | LSXMK | 43,208,291 | 19.80% | $23.91 | $1,033,110,238 | 0.30% |

Snowflake Inc | SNOW | 6,125,376 | 1.90% | $152.50 | $934,119,840 | 0.30% |

Nu Holdings Ltd | NU | 107,118,784 | 2.30% | $7.89 | $845,167,206 | 0.20% |

Ally Financial Inc | ALLY | 29,000,000 | 9.60% | $27.55 | $798,950,000 | 0.20% |

DR Horton Inc | DHI | 5,969,714 | 1.80% | $126.25 | $753,676,393 | 0.20% |

General Motors Co | GM | 22,000,000 | 1.60% | $33.40 | $734,800,000 | 0.20% |

T-Mobile Us Inc | TMUS | 5,242,000 | 0.40% | $138.94 | $728,323,480 | 0.20% |

Markel Group Inc | MKL | 471,661 | 3.60% | $1,492.72 | $704,057,808 | 0.20% |

Celanese Corporation | CE | 5,358,535 | 4.90% | $119.73 | $641,577,396 | 0.20% |

Liberty Formula One Series C | FWONK | 7,722,451 | 3.70% | $69.97 | $540,339,896 | 0.20% |

Floor & Decor Holdings Inc | FND | 4,780,000 | 4.50% | $104.69 | $500,418,200 | 0.10% |

Liberty SiriusXM Series A | LSXMA | 20,207,680 | 20.60% | $23.72 | $479,326,170 | 0.10% |

Louisiana-Pacific Corp | LPX | 7,044,909 | 9.80% | $62.36 | $439,320,525 | 0.10% |

Globe Life Inc | GL | 2,515,574 | 2.60% | $112.90 | $284,008,305 | 0.10% |

StoneCo Ltd | STNE | 10,695,448 | 3.40% | $13.33 | $142,570,322 | 0.00% |

NVR Inc | NVR | 11,112 | 0.30% | $6,175.00 | $68,616,600 | 0.00% |

Johnson & Johnson | JNJ | 327,100 | 0.00% | $174.06 | $56,935,026 | 0.00% |

Procter & Gamble Co | PG | 315,400 | 0.00% | $155.34 | $48,994,236 | 0.00% |

MONDELEZ INTERNATIONAL INC Common Stock | MDLZ | 578,000 | 0.00% | $72.60 | $41,962,800 | 0.00% |

Diageo plc | DEO | 227,750 | 0.00% | $171.40 | $39,036,350 | 0.00% |

Liberty Latin America Ltd Class A | LILA | 2,630,792 | 5.90% | $9.30 | $24,466,366 | 0.00% |

Lennar Corp | LEN | 152,572 | 0.10% | $125.70 | $19,178,300 | 0.00% |

Vanguard 500 Index Fund ETF | VOO | 43,000 | 0.00% | $407.95 | $17,541,850 | 0.00% |

SPDR S&P 500 ETF Trust | SPY | 39,400 | 0.00% | $443.99 | $17,493,206 | 0.00% |

Jefferies Financial Group Inc | JEF | 433,558 | 0.20% | $34.31 | $14,875,375 | 0.00% |

Liberty Latin America Ltd Class C | LILAK | 1,284,020 | 0.80% | $9.22 | $11,838,664 | 0.00% |

United Parcel Service, Inc. | UPS | 59,400 | 0.00% | $173.39 | $10,299,366 | 0.00% |

Liberty Live Series A | LLYVA | 5,051,920 | 19.70% | | | |

Liberty Live Series C | LLYVK | 11,132,594 | 17.50% | | | |

TOTAL | | | | | $355,718,194,104 | 100.00% |

You can see that Apple (AAPL) accounts for over 45% of the equity portfolio as of June 30, 2023. This position has generated over $100 billion in profits for Buffett's Berkshire Hathaway.

Buffett has managed to accumulate the position between 2016 and 2018 at a total cost of approximately $36 billion. He did sell about $11 billion worth of Apple stock in 2020. In addition, Apple sends $820 million in dividends each year to Berkshire Hathaway.

He did make large investments in Apple, Bank of America, Coca-Cola, American Express and Kraft Heinz. His portfolio is concentrated mostly as a result of letting winners run, and not selling prematurely.

You can view the dividend contribution from each of his portfolio holdings from the table below. Berkshire Hathaway is generating almost $5.50 billion in annual dividend income from his portfolio.

Note this doesn't include dividends received from privately owned businesses such as See's Candies or Burlington Northern Santa Fe. Nor does it include $760 Million in annual dividends from Berkshire Hathaway's investment in Occidental Petroleum Preferred stock.

Name | Symbol | Shares | Market Value | Dividend Income |

Bank of America Corp | BAC | 1,032,852,006 | $31,006,217,220 | $ 991,537,925.76 |

Apple Inc | AAPL | 915,560,382 | $162,850,725,146 | $ 878,937,966.72 |

Chevron Corporation | CVX | 123,120,120 | $19,710,300,011 | $ 743,645,524.80 |

Coca-Cola Co | KO | 400,000,000 | $24,252,000,000 | $ 736,000,000.00 |

Kraft Heinz Co | KHC | 325,634,818 | $10,999,944,152 | $ 521,015,708.80 |

American Express Company | AXP | 151,610,700 | $24,565,481,721 | $ 363,865,680.00 |

Mitsubishi Corp | 8058:TYO | 119,497,600 | $5,888,000,106 | $ 164,224,008.80 |

Occidental Petroleum Corp | OXY | 224,129,192 | $14,301,683,742 | $ 161,373,018.24 |

Itochu Corporation | 8001:TYO | 118,331,800 | $4,643,303,267 | $ 130,097,491.93 |

Mitsui & Co | 8031:TYO | 125,022,300 | $4,795,863,204 | $ 128,862,399.51 |

HP Inc | HPQ | 120,952,818 | $3,854,766,310 | $ 127,000,458.90 |

Citigroup Inc | C | 55,244,797 | $2,397,071,742 | $ 117,118,969.64 |

Sumitomo Corp | 8053:TYO | 101,210,400 | $2,066,065,894 | $ 83,455,287.57 |

Moody’s Corp | MCO | 24,669,778 | $8,229,591,243 | $ 75,982,916.24 |

Marubeni Corp | 8002:TYO | 141,000,200 | $2,352,653,028 | $ 75,572,154.20 |

Kroger Co | KR | 50,000,000 | $2,388,500,000 | $ 58,000,000.00 |

Ally Financial Inc | ALLY | 29,000,000 | $798,950,000 | $ 34,800,000.00 |

Capital One Financial Corp. | COF | 12,471,030 | $1,334,150,789 | $ 29,930,472.00 |

Paramount Global Class B | PARA | 93,730,975 | $1,442,519,705 | $ 18,746,195.00 |

BYD Co. Ltd | BYDDF | 98,603,142 | $2,908,792,689 | $ 15,776,502.72 |

Celanese Corporation | CE | 5,358,535 | $641,577,396 | $ 15,003,898.00 |

Visa Inc | V | 8,297,460 | $1,994,460,460 | $ 14,935,428.00 |

Activision Blizzard Inc | ATVI | 14,658,121 | $1,333,889,011 | $ 14,511,539.79 |

Aon PLC | AON | 4,335,000 | $1,380,784,200 | $ 10,664,100.00 |

Mastercard Inc | MA | 3,986,648 | $1,575,323,957 | $ 9,089,557.44 |

Louisiana-Pacific Corp | LPX | 7,044,909 | $439,320,525 | $ 6,763,112.64 |

DR Horton Inc | DHI | 5,969,714 | $753,676,393 | $ 5,969,714.00 |

Globe Life Inc | GL | 2,515,574 | $284,008,305 | $ 2,264,016.60 |

Johnson & Johnson | JNJ | 327,100 | $56,935,026 | $ 1,556,996.00 |

Procter & Gamble Co | PG | 315,400 | $48,994,236 | $ 1,186,787.12 |

MONDELEZ INTERNATIONAL INC Common Stock | MDLZ | 578,000 | $41,962,800 | $ 982,600.00 |

Diageo plc | DEO | 227,750 | $39,036,350 | $ 829,010.00 |

Jefferies Financial Group Inc | JEF | 433,558 | $14,875,375 | $ 520,269.60 |

United Parcel Service, Inc. | UPS | 59,400 | $10,299,366 | $ 384,912.00 |

Vanguard 500 Index Fund ETF | VOO | 43,000 | $17,541,850 | $ 266,600.00 |

SPDR S&P 500 ETF Trust | SPY | 39,400 | $17,493,206 | $ 256,888.00 |

Lennar Corp | LEN | 152,572 | $19,178,300 | $ 228,858.00 |

Davita Inc | DVA | 36,095,570 | $3,780,289,046 | $ - |

Verisign, Inc. | VRSN | 12,815,613 | $2,642,451,244 | $ - |

Charter Communications Inc | CHTR | 3,828,941 | $1,637,484,908 | $ - |

Amazon.com, Inc. | AMZN | 10,551,000 | $1,454,877,390 | $ - |

Liberty SiriusXM Series C | LSXMK | 43,208,291 | $1,033,110,238 | $ - |

Snowflake Inc | SNOW | 6,125,376 | $934,119,840 | $ - |

Nu Holdings Ltd | NU | 107,118,784 | $845,167,206 | $ - |

General Motors Co | GM | 22,000,000 | $734,800,000 | $ - |

T-Mobile Us Inc | TMUS | 5,242,000 | $728,323,480 | $ - |

Markel Group Inc | MKL | 471,661 | $704,057,808 | $ - |

Liberty Formula One Series C | FWONK | 7,722,451 | $540,339,896 | $ - |

Floor & Decor Holdings Inc | FND | 4,780,000 | $500,418,200 | $ - |

Liberty SiriusXM Series A | LSXMA | 20,207,680 | $479,326,170 | $ - |

StoneCo Ltd | STNE | 10,695,448 | $142,570,322 | $ - |

NVR Inc | NVR | 11,112 | $68,616,600 | $ - |

Liberty Latin America Ltd Class A | LILA | 2,630,792 | $24,466,366 | $ - |

Liberty Latin America Ltd Class C | LILAK | 1,284,020 | $11,838,664 | $ - |

Liberty Live Series A | LLYVA | 5,051,920 | | $ - |

Liberty Live Series C | LLYVK | 11,132,594 | | $ - |

TOTAL | | | $355,718,194,104 | $ 5,541,356,968.00 |

The total portfolio value was roughly $355 Billion dollars as of last night. It is on track to generate $5.54 Billion in annual dividend income. Approximately $339 Billion of value is related to dividend paying stocks. Only $16 Billion out of the whole $355 Billion is invested in non-dividend paying companies.

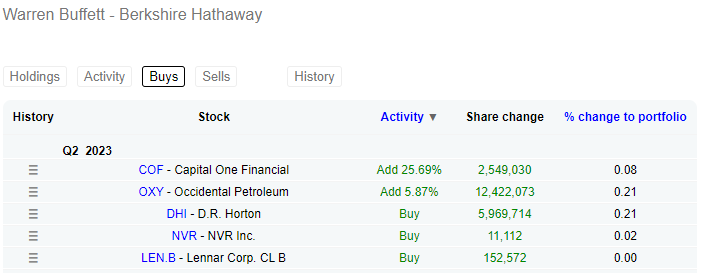

For the quarter ended on June 30, 2023, Warren Buffett and his lieutenants Todd and Ted added to the following existing positions:

Buffett seems to be a big fan of Oil and Gas companies as of recently, with his large investments in Occidental Petroleum. He also seems to be investing in financials such as Capital One Financial. The investments in homebuilders were likely from one of his top lieutenants Todd Combes or Ted Weschler.

They reduced ownership in the following companies: