Successful people identify their goals, break them down into small actionable steps, and take action towards achieving them.

Unsuccessful people identify their goals, get discouraged and give up.

For example, assume that you need $12,000 in annual dividend income for your retirement. In theory, given todays environment, someone needs about $400,000 invested at a 3% yield to get to $12,000 in annual dividend income.

The ones that never make it would get discouraged, because having $400,000 looks like a big and insurmountable amount of money. They get discouraged, and give up.

The investors that make it, break this goal down to small manageable steps. They know that Rome was not built in a day. In other words, by regularly saving and investing, and holding patiently over a period of time, they can reach their goals and objectives. Good things take time.

I try to be in the second group of investors by investing with the end goal in mind. My goal has always been to reach a certain level of dividend income that covers expenses. This is the coveted dividend crossover point.

Getting to the dividend crossover point, where dividends cover expenses, is a function of:

1. Savings rate

2. Dividend Yield + Dividend Growth

3. Time you invest for

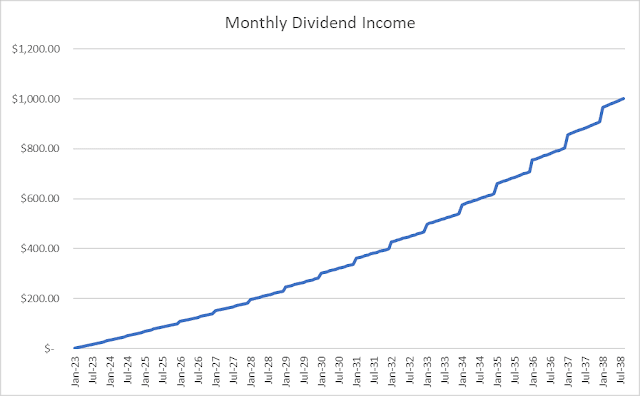

To put it into actionable steps, let's assume that this investor can save and invest $1,000/month. They can find reasonably priced dividend growth stocks that yield 3% today, which can also grow annualized dividends by 6%/year. Their process helps them identify such companies on a consistent basis.

A program of regular investments over a period of time can yield good results for patient investors after 10 - 15 years.

My basic rule of thumb is that by investing $1,000/month for 15 years, I can generate $1,000 in monthly dividend income in 15 years.

Once they invest the first $1,000, they have about $30 in annual dividend income. The next month, they invest another $1,000, and annual dividend income doubles to $60.

After an year of saving and investing, their annualized dividend income would surely be over $360. That's because most companies would have raised dividends by an average of 6% and they would also have reinvested that annual dividend income into more dividend growth stocks.

Slowly, but surely, the investor would be able to monitor and measure their progress towards their goals and objectives. Once you start measuring your progress based on your inputs, your outputs will naturally line up with it.

The investor also keeps costs low by investing directly, using a commission free brokerage and not paying a mutual fund manager or a financial advisor. They invest through retirement and other tax-deferred accounts first, in order to minimize tax costs too.

This is of course just a projection, using a set of inputs such as amounts saved and invested, estimates for dividend yield and dividend growth, as well as amount of time to invest for. It presumes no transaction costs, no advisor fees and no taxes. In todays environment, US investors have a ton of tax-deferred/retirement accounts to choose from, which can help them defer or eliminate taxes on dividends and capital gains.

You can play around with the estimates using this spreadsheet. Check this post for more detail.

This is the model I use in my premium Dividend Growth Investor Newsletter in general.

Thank you for reading!

Relevant Articles:

- The Dividend Crossover Point

- The million dollar dividend portfolio for retirement