The Interpublic Group of Companies, Inc. (IPG) provides advertising and marketing services worldwide. It operates in three segments: Media, Data & Engagement Solutions, Integrated Advertising & Creativity Led Solutions, and Specialized Communications & Experiential Solutions.

The company initiated a dividend in 2011 and has been increasing it every single year starting in 2013. It has managed to increase dividends at an annualized rate of 10%/year over the past five years.

Interpublic has managed to grow earnings per share from $0.62 in 2013 to $2.40 in 2022. The company is expected to earn $2.93/share in 2023.

The company reduced shares outstanding by about 10% between 2013 and 2018. Since then, the number of shares outstanding have increased slightly. The stock price was largely flat between 2014 – 2019.

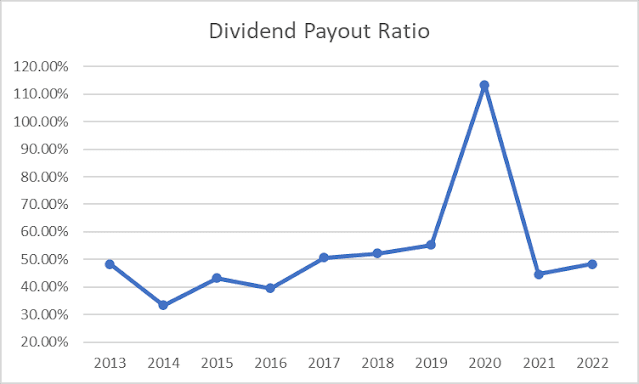

The dividend payout ratio has remained below 60% over the past decade, with the exception of the tumultuous 2020 and the related Covid Shutdowns. It’s impressive to find a company that has managed to grow earnings and dividends, while largely retaining the same payout ratio over time. That’s because it has an asset light model that prints cashflow.

The stock is attractively valued today, selling at 12.86 times forward earnings and yielding 3.30%.