One of my favorite investing activities is testing various ideas and then crunching numbers. I spend quite a lot of time thinking about investing from various angles.

I recently tested whether high rates of historical annual dividend growth had any predictive value.

I did that by obtaining a list of Dividend Growth Stocks with a historically high rate of annualized dividend growth as of December 2012.

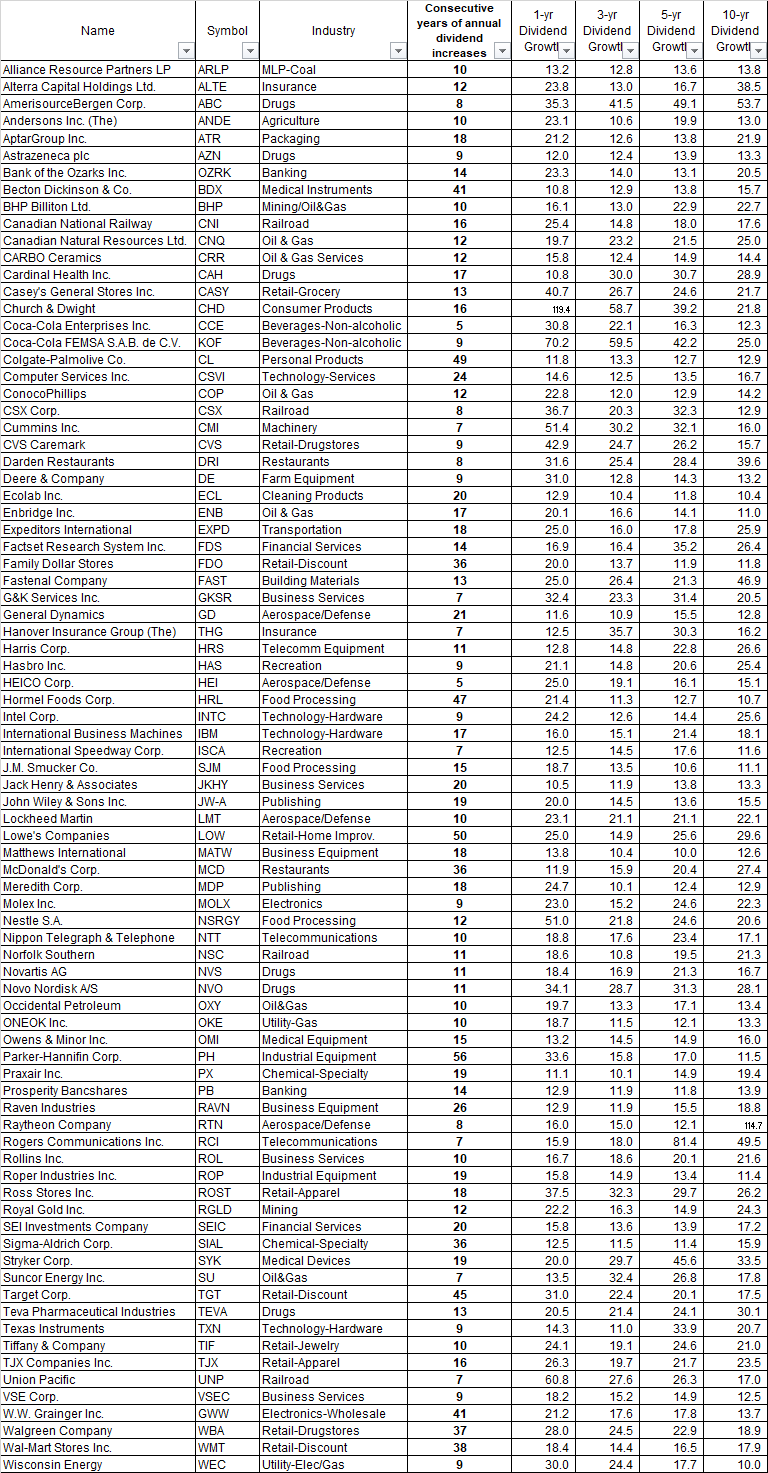

The list below includes:

1) Companies that had raised annual dividends for at least 5 years in a row as of December 2012

2) Companies that had managed to grow annualized dividends by at least 10%/year, over the previous 1, 3 ,5 and 10 years

This resulted in a list of the following 83 companies below:

After that, I went ahead and checked to see how these companies did over the next decade (through November 2022).

I went ahead, and looked at companies, which had managed to grow dividends at 10%/year over the preceding decade. I included companies that continued to at least pay a dividend over the next decade, even if they didn't continue raising it every year. But it doesn't include dividend cuts

There were 33 companies that managed to grow dividends at an annualized rate of 10%/year over the preceding decade.

Not all companies from the original 86 remained continued raising dividends each year.

For example, CVS didn't raise dividends each year, but it still managed to grow them at an annualized rate exceeding 10%/year.

For companies that were non US based, like Canadian National Railway, I compared subsequent dividend growth rates in US dollars.

There were a few ticker changes (Bank of the Ozarks went from OZRK to OZK), and a few acquisitions/mergers. For example, Harris merged with L3 to form L3 Harris. The dividend record for LHX is a continuation of the dividend record for old Harris.

The fascinating part is that only 5 companies ended up having a consistently high dividend growth exceeding 10%/year over the past 1/3/5/10 years. Those include Canadian National Railways, Fastenal, Lowes, Texas Instruments and Union Pacific.

Another group of 24 companies managed to grow dividends, albeit at dividend growth rates below 10%/year over the ten year period ending in November 2022. The average annualized dividend growth is 7.19% over the past decade, which is pretty good in my opinion. Note there were some foreign companies at the end of 2012, and their dividend growth is in US Dollars.

Once again, there were companies that didn't raise dividends every single year. However, they still managed to grow dividends at a very good annualized pace. Example includes Deere (DE).

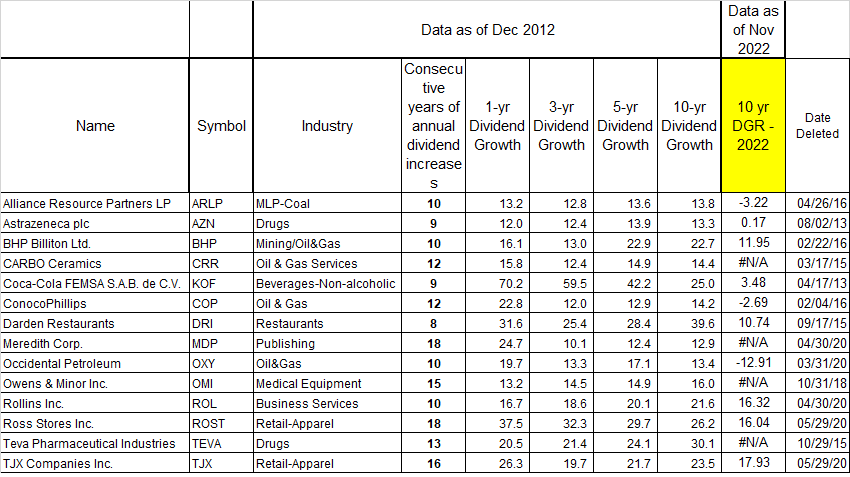

There were 14 companies that ended up cutting dividends over the next decade.

Only one of them ended up in bankruptcy - Carbo Ceramics. Meredith seems to have cut dividends in 2020, but then ended up getting acquired, so my data sources are murky on the dividend growth. I am keeping it in the dividend cuts section, because that preceded the acquisition.

Teva suspended dividends in 2017, never to initiate them again (as of the time of writing).

Some of the companies that ended up cutting dividends have a negative annualized dividend growth rate - examples include Alliance Resource Partners, ConocoPhillips, Occidental Petroleum.

The surprising fact is that 5 out of the 14 companies that cut dividends, ended up having an annualized dividend growth exceeding 10%/year over the past decade. I have no idea what to make of this.

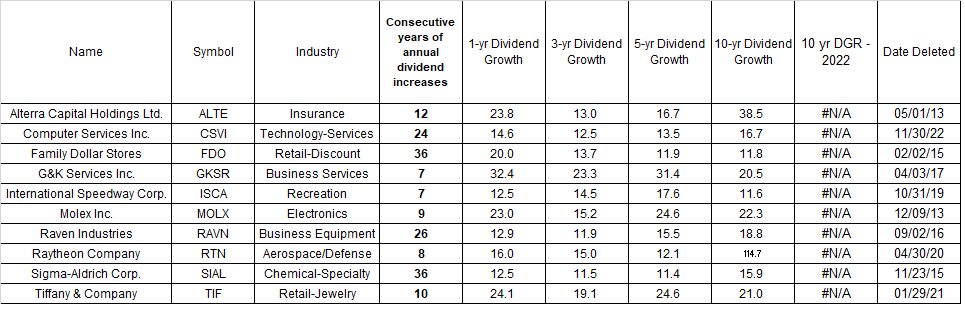

There were 10 companies that ended up getting acquired at different times throughout the decade:

Conclusion:

I believe that high rates of dividend growth are more likely to persist than not over time.

This applies to a large group of companies however. Individual cases can vary across the board, from one company to the next. When I say over time, I mean the immediate future of the next 5 - 10 years.

I would argue that afterward, there are a lot of pressures on dividend growth to be closer to earnings growth, which in itself is subject to competitive pressures. Even if you have a great business model, we all know that trees do not grow to the sky. It is important to be skeptical and more conservative than necessary.

Addendum:

I wanted to present the most current list of high dividend growth companies.

These companies have managed to:

1) Increase annual dividends for five years in a row

2) They have managed to grow annualized dividends by over 10%/year over the past 1/3/5/10 years:

You can check this list in Google Drive: