I was confused by some of the feedback, mostly judging him for his frugal lifestyle. A lot of folks asked me if he really enjoyed his life.

I think that these folks do not understand the powerful force of compounding. It is likely that they do not understand frugality, and the fact that you need to save something, in order to find money to invest.

But what they really failed to understand the power of investing small amounts on a consistent basis, and then letting that money compound for long periods of time. This is how wealth is built in the stock market.

The problem with long term investing is that the investment balances and dividend incomes will be largest at the end of our journeys. If you compound money for a long period of time, most of the gains will be visible after 40 - 50 - 60 years. That would be the case even if your savings rate was around 10% - 20%, which is not extreme in any case shape or form.

Let’s start with the basics

$1 invested today at 10% turns into $1.10 in one year, and $1.21 in two years. The extra cent in year 2 is due to the power of compounding. If you never compounded that $1, you would be simply stacking 10 cents per year. When you reinvest, you end up earning profits on top of profits, which creates a virtuous cycle of wealth.

Compounding is a powerful force, especially when you have a good return and you let the snowball roll for a long period of time. Most of the results will be visible at the end of the journey however.

The initial grind is always the hardest, because right away the fruits of compounding are very small. That same dollar invested at 10%/year won’t double until year 7. And still, the mind will trick you into believing that it was not worth it to wait for 7 long year for one measly dollar. A lot of folks lose hope in the initial stages of compounding. This is further compounded by the fact that returns do not arrive at a steady and predictable 10%/year. To earn 10%/year in equities, you would have to endure long drawdowns, recessions, unemployment, and only those patient enough to stick to their plan and to persevere get to enjoy the power of compounding to their advantage.

If that $1 is invested for 50 years at 10% compounded annually, it turns int o$117.39 after half a century.

Therefore, if you are a 30-year-old with $70,000 invested, and you can compound the money for 50 years at 10%/year, you could be worth close to $8 million when you are an 80-year-old.

If you manage to compound money for 60 years, you only need to put $26,275 to work for you, in order to reach $8M in net worth.

It is even more interesting to observe the interaction between savings rates, equity returns and reaching out your goals and objectives. Having the perspective of running the numbers and alooking at different scenarios definitely helps us see things clearly.

Imagine that you earn $5,000/month.

1) If you save and invest $1,000/month and earn 10%/year, you will become a millionaire in 22 years. It would take you approximately 42 years in total to reach a net worth of $8 million. This is a savings rate of 20%, which is high for US standards but nothing extreme.

At this level of savings, our investor spends $4,000/month. If our portfolio has an average dividend yield of 3%, we would need close to $1.60 million to generate $48,000 in annual dividend income. It would take close to 27 years to reach financial independence at this rate of savings.

2) If you save and invest $2,000/month and earn 10%/year, you will become a millionaire in 16 years. It would take a little over 35 years at this savings rate to reach a net worth of $8 million.

At this level of savings, our investor spends $3,000/month. If our portfolio has an average dividend yield of 3%, we would need close to $1.20 million to generate $36,000 in annual dividend income. It would take close to 18 years to reach financial independence at this rate of savings.

3) If you save and invest $4,000/month, but earn 10%/year, you will become a millionaire in 11 years. It would take almost 29 years to reach a net worth of $8 million at this rate of return and this very high rate of savings. It would be very hard to save 80% of income for 3 decades.

At this level of savings, our investor spends $1,000/month. If our portfolio has an average dividend yield of 3%, we would need close to $400,000 to generate $12,000 in annual dividend income. It would take close to 6 years to reach financial independence at this rate of savings.

As you can see, if you want to get rich quickly you need to play a game of strong offense and strong defense. The strong offense is earning a high income, and a strong defense is keeping costs low and trying to avoid lifestyle inflation.

Why am I telling you all of this common sense?

That’s because any time I share a story of someone that ended up with a lot of money at an old age, people always say “I hope he/she enjoyed their money”.

When most folks think about having $1M, they imagine how they will spend it all. These are the folks that live paycheck to paycheck, and seldom advance financially. Another problem with these questions is assigning what's important to someone else as a benchmark of what should be important to him. This is very arbitrary measure of "success".

These comments show that the person making them is not understanding the power of compounding, and the fact that most of the visible gains are seen at the end of someone’s lifetime.

For example, Ronald Read died at the age of 90 in 2014 with an estate worth $8m. That same estate could have been worth $4M in 2007 or $2M in 2000. Most of the gains on this portfolio probably occurred after he retired with an adequate amount. It is very likely that he didn’t even become a millionaire before the age of 70 in the early 1990s.

I extrapolated that data through a review if the total return performance of the proxy for US stocks - a fund based on S&P 500 since 1990. It shows that a $100 investment in S&P 500 in early 1990 would have turned into $900 by 2014 and $2,350 by 2021.

Let's assume that Ronald Read had $8 million in his stock portfolio in 2014, and he just reinvested dividends for the past 25 years and didn't add a single dollar. This means that its value was close to $900,000 in 1990. While this is still an above average amount, it is not as mind-boggling as $8 million. Given the fact that he probably kept adding money to his portfolio, his net worth may have been even lower in 1990.

If he had simply invested $7,812.50 at the age of 22 or $15,625 at the age of 29, and never added a single cent, he would have been worth $8 million by the age of 92. That's merely due to the power of compounding, and assuming 10% annualized returns.

Using the rule of 72, if I generate 10% annualized returns, my money would double roughly every 7 years. The table below illustrates this simple concept:

Because of the nature of compounding, Ronald Read most probably generated 90% of his net worth after the age of 70.

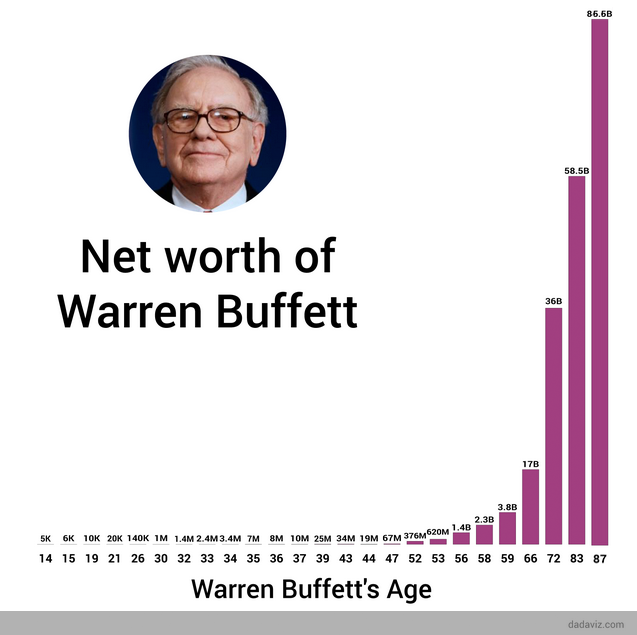

The power of compounding is truly visible with Warren Buffett. He first became a billionaire at the age of 56 in 1986. Today, his net worth is over $100 billion at the age of 91. And that’s after he donated tens of billions of stock to charity. You can see that due to compounding, over 99% of his net worth was built after the age of 56.

I like researching different stories and viewpoints, and then trying to take the best lessons that apply in my situation. Ultimately, you are successful if you do something you enjoy.

Thank you for reading!

Relevant Articles:

- The Most Successful Dividend Investors of all time

- The importance of investing for retirement as early as possible

- Dow 370,000

- Warren Buffett’s Eight Billion Dollar Mistake