By the time this crisis is over, the list of dividend aristocrats and dividend champions will include bulletproof companies that managed to increase dividends during a global pandemic that caused a temporary global depression. These companies would have managed to increase dividends throughout the most difficult economic environment since the Great Depression. There is a very high chance that these companies are already on the lists of dividend aristocrats and dividend champions too.

Most of the companies cutting dividends today are companies in cyclical industries that usually cut dividends during a recession. However, I am also seeing companies that have been relatively recession resistant before to also start cutting dividends. There are some companies that are cutting dividends as a precautionary move, since they do not know how long, deep and severe this economic contraction is going to be. My review of dividend announcements used to focus mainly on dividend increases, since these typically account for most dividend actions.

The list nowadays includes dividend cuts as well. But those are only for companies I own or have owned. Hopefully that won't be too long and I won't do it for too long, but you never know.

Last week, I received several dividend cuts. One was Disney, which “temporarily” suspended dividends.

The other was Kontoor Brands (KTB), which also suspended dividends. This was spun-off from V.F. Corp (VFC) in 2019.

I sell after a dividend cut or suspension, and redeploy the funds elsewhere.

There were several companies that bucked the trend of dividend cuts, and actually raised dividends to shareholders. Just as usual, I focus my review only on those companies that raised dividends last week, which also have at least a ten-year history of annual dividend increases.

Ameriprise Financial, Inc. (AMP) provides various financial products and services to individual and institutional clients in the United States and internationally. It operates through five segments: Advice & Wealth Management, Asset Management, Annuities, Protection, and Corporate & Other.

The company raised its quarterly dividend by 7.20% to $1.04/share. This dividend achiever has managed to grow annual distributions in every year since it was spun-off in 2005. During the past decade, it managed to grow dividends at an annualized rate of 18.80%.

Between 2010 and 2019, Ameriprise managed to grow earnings from $4.18/share to $13.92/share

The company is expected to earn $15.01/share in 2020.

The stock sells for 8.40 times forward earnings and yields 3.30%.

Expeditors International of Washington, Inc. (EXPD) provides logistics services in the Americas, North Asia, South Asia, Europe, the Middle East, Africa, and India.

The company raised its quarterly dividend by 4% to 52 cents/share. This marked the 26th consecutive annual dividend increase for this dividend aristocrat. During the past decade, it has managed to grow dividends at an annualized rate of 10.20%.

Between 2010 and 2019, the company managed to grow earnings from $1.59/share to $3.39/share. The company is expected to earn $3.09/share in 2020.

The stock is richly valued at 24.20 times forward earnings and yields 2.80%.

PetMed Express, Inc. (PETS), doing business as 1-800-PetMeds, operates as a pet pharmacy in the United States.

The company increased its quarterly dividend by 3.70% to 28 cents/share. This marked the 11th consecutive annual dividend increase for this dividend achiever. PetMed Express has managed to hike dividends at an annualized rate of 18.40% over the past decade.

Between 2010 and 2019, the company grew earnings from $1.14/share to $1.84/share. The company is expected to earn $1.23/share in 2020.

The stock sells for 30.10 times forward earnings and yields 3%.

FactSet Research Systems Inc. (FDS) provides integrated financial information and analytical applications to the investment and corporate communities in the United States, Europe, and the Asia Pacific.

The company raised its quarterly dividend by 6.90% to 77 cents/share. This was the 21st year of annual dividend increases for this dividend achiever. During the past decade, it has managed to grow dividends at an annualized rate of 13.60%/year.

Between 2010 and 2019, the company grew earnings from $3.13/share to $9.08/share.

The company is expected to earn $10/share in 2020.

This is a great company, but unfortunately seems a little richly valued at the moment at 27.60 times forward earnings and a dividend yield of 1.10%.

One thing I noticed about FactSet Research is that the company’s press release mentioned that the company has managed to increase dividends for 15 years in a row. Source: Company Press Release

When I reviewed the company’s historical record of annual dividend increases however, it looked like it has managed to grow dividends annually since it initiated a dividend in February 1999. Source: Seeking Alpha

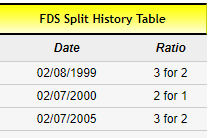

I believe that the disconnect stems from the three stocks splits on the stock between 1999 and 2005. I believe that the corporate team at FDS is not taking into account the splits on dividends paid in their press releases.

Source: FDS Stock Split History

As a result, they are treating the dividends as cuts, when in fact they were increased. I sent a note to the company, so hopefully they will research and get back to me. They are selling themselves short if that’s the case, because their track record should be 21 years of dividend increases, not 15.

Relevant Articles:

- Dividend Achievers versus Dividend Contenders & Champions

- Replacing dividend stocks sold

- Dividend Aristocrats Keep Performing Well in 2020

- My Take On Covid-19 Dividend Cuts