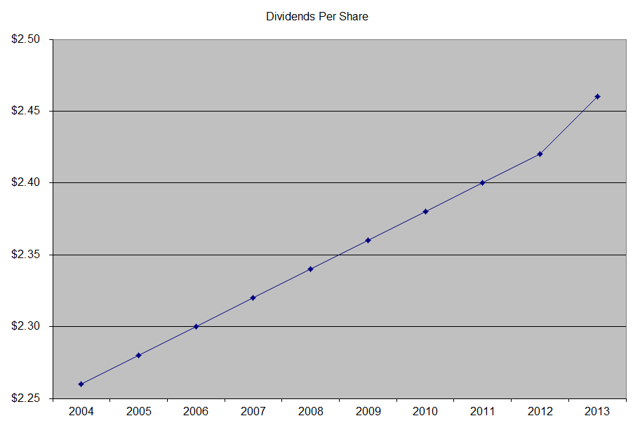

The most recent dividend increase was in January 2014, when the Board of Directors approved a 2.40% increase in the quarterly dividend to 63 cents/share.

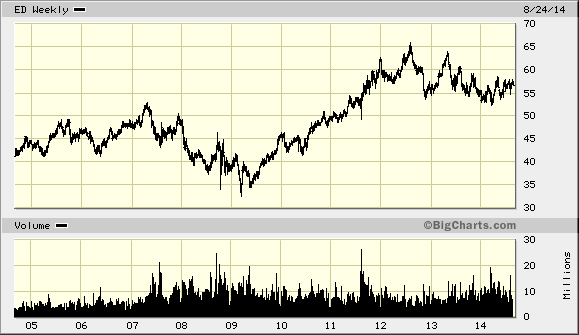

Over the past decade, this dividend growth stock has delivered an annualized total return of 8.20% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

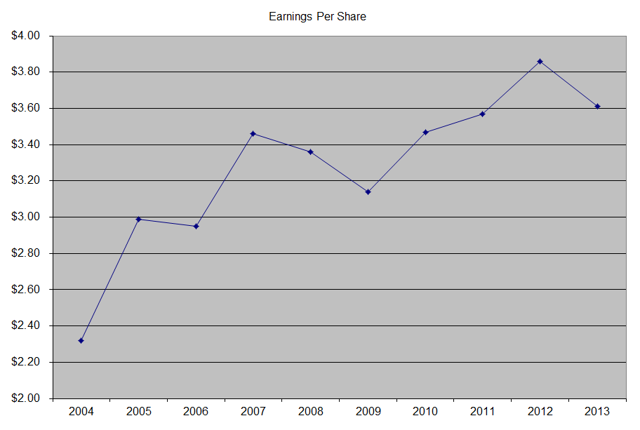

The company has managed to deliver an 4.30% average increase in annual EPS over the past decade. Con Edison is expected to earn $3.78 per share in 2014 and $3.90 per share in 2015. In comparison, the company earned $3.61/share in 2013.

In the past decade, the number of shares outstanding increased from 236 million in 2004 to 294 million in 2014. The company regularly financed new projects with share issuance, thus diluting current stockholders.

Con Edison is a regulated utility, whose returns on capital and prices are set by the state government's utility commission. With utilities, it is extremely unlikely that earnings will grow a lot over time. The problem is that with low returns on invested capital, it is difficult to earn a lot of money over time. Many investors are enticed by the high yields on utility companies, and therefore are ready to purchase more of their shares to earn the high current income. In the case of Con Edison, the company has been diluting existing shareholders by regularly selling more shares to finance its capital expenditures budgets.

The positive things about utilities are that they have natural monopolies in an area, meaning that they have the competitive advantage of being the only ones providing electricity or gas to residents and businesses. However, negotiating rate hikes for electricity rates is an arduous process, the outcome of which is dependent on regulators' willingness to approve/deny them. If the regulator does not approve of rate hikes, which would help a utility like Con Edison reach a certain return on investment, it might not be able to grow earnings and dividends over time.

A potential for growth could be from increases in the number of residents or the increase in energy consumed. This,of course, is very much tied to economic activity in the area being served, as well as conservation efforts. Overall, I believe that the area that Con Edison serves will consume more electricity and be attractive to more people over time. Another opportunity for growth could be through upgrading the old infrastructure, which would let the utility invest at regulated rates. With a 50/50 equity/fixed income capital raised to deploy capital, this could end up being slightly accretive to earnings per share.

The annual dividend payment has increased by 1% per year over the past decade, which is lower than the growth in EPS. I would expect the dividend growth rate to be slightly higher to 2% for the near future, as the dividend payout ratio is more sustainable these days.

A 1% growth in distributions translates into the dividend payment doubling every 72 years on average. If we check the dividend history going as far back as 1975, we could see that Con Edison has managed to double dividends every nineteen and a half years on average.

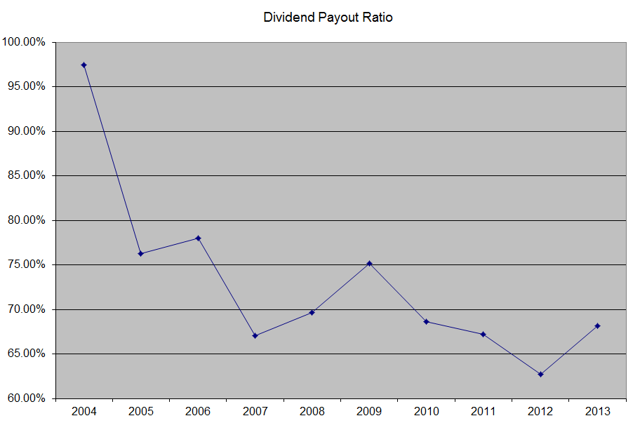

In the past decade, the dividend payout ratio has decreased from 97.40% in 2004 to 68.10% by 2013. As a result, future dividend growth is much more likely to match growth in earnings that will match historical rate of inflation over time. A lower payout is always a plus, since it leaves room for consistent dividend growth, minimizing the impact of short-term fluctuations in earnings.

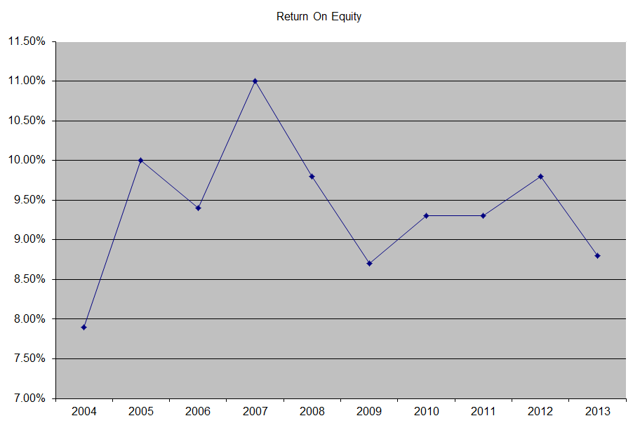

The return on equity increased from 7.90% in 2004 to 8.80% in 2013. Utilities are highly regulated, which limits the returns on capital put to use. I generally like seeing a high return on equity, which is also relatively stable over time.

Currently, Con Edison looks attractively valued on the surface at 16.30 times forward earnings, and has a dividend yield of 4%. However, due to the low earnings and dividend growth, I am not planning to initiate a position in the company anytime soon. The shares only make sense for investors who really need current income today, but are fine if their dividend income loses purchasing power over time, and their ability to generate capital gains is extremely limited at best.

Full Disclosure: None

Relevant Articles:

- High Dividend Utility Stocks – Are they a trap for dividend investors?

- Utility dividends for current income

- Why I am replacing ConEdison (ED) with ONEOK Partners

- How to analyze dividend stocks

- Focus on High Yielders with Growing Distributions