Back in 1989, the Japanese stock market reached an all time high. Japan was growing rapidly, and there was no end in sight behind Japanese industry and innovation. The popular theme was that Japan would overpower the US soon. This is similar to the situation today, where China is viewed as the emerging dominant economic power that would dethrone the US as the number one economy in the world.

Japan was in the midst of a stock and real estate bubble in the 1980s. The Japanese equity market became larger than the US stock market in 1989, with a total market capitalization of over $4 Trillion, versus $3 Trillion for the US.

Japanese land prices were out of control too. The land below the Imperial Palace in Tokyo was worth more than the land in the entire state of California in 1989. (Source)

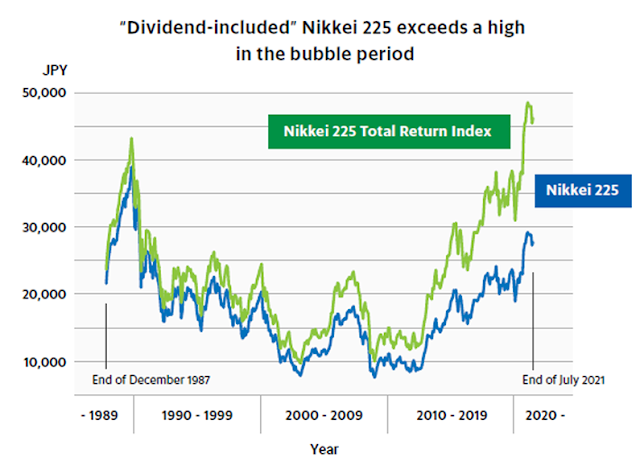

However, that bubble popped at the beginning of 1990. After over 30 years, the Japanese economy has stagnated, and share and real estate prices are still below the all-time-highs from 1989. The all time high for Nikkei 225 index was 38,915.87 from 1989.

There are many reasons why the stock market did not do as well.

The most obvious reason is that Japanese equities were very overvalued in 1989. They sold for over 50 times earnings by 1989. This was high.

Dividend yields were low at 0.50%, which was low too. Dividend yields had been decreasing since 1970, as share prices kept rising higher and higher. Investors didn't really care about dividends when share prices kept rising. This is usually what happens during a manic bull run that keeps going for a long period of time.

The most interesting fact however is that real earnings per share didn't grow between 1970 and 1990. Real earnings per share are EPS adjusted by inflation.

The source for the charts so far is the following paper from Kenneth French and James Poterba. "Were Japanese stock prices too high?"

As was already established above, Japanese equity prices were very high. An investor who planned to retire on Japanese equities in 1989 probably would have expected that stock prices keep going up. Unfortunately, that didn't work and if they had followed a 4% type rule where you sell 4% of stocks each year, they would have run out of money.

Someone who was a dividend investor would have seen the low dividend yield an concluded that they can only live off 0.50% of portfolio value, which is what the dividend yield was in 1989. It is low, and I would not base a retirement on such a low number as there are alternatives. However it does show that estimated future returns were low.

Fast forward to 2022, and the Nikkei 225 index is still below its all time high set in 1989.

However, Japanese companies started growing dividends about 15 - 20 years ago. Those tiny dividends, when compounded over time ended up accumulating to investor brokerage accounts to the point that Japanese equities are much more attractive than deposits or bonds.

However, it has taken Nikkei almost 32 long years to exceed its 1989 high using dividend reinvestment. Nikkei 225 Total Return hit a record high in 2021.

According to this researcher, if you invested regularly in Japanese stocks beginning in 1989, you would be sitting at a profit by now.

Today Nikkei has a dividend yield of 2.10% and a P/E of 13. (Source)

Conclusion:

So that was a lot of data to share. I have observed Japan for a while, and I have observed this data too.

I believe that buying an investment at a high valuation is risky. That's because there is a limited margin of safety in this investment, even if its fundamentals perform up to expectations. Even if earnings grow according to expectations, the investor that overpays may have to wait for a long time to make money.

A low dividend yield on a stock market shows that valuation is high. If valuation is high, perhaps an investor should not be spending more than what their investment can generate in dividends. They can theoretically bet that prices will be rising in the short run when they need to money to spend. But that's speculation, as nobody can consistently predict where share prices will be anyways.

If you are a know-nothing investor, building wealth over time through regular dollar cost averaging works. However, you have to be able to stick to that plan through thick or thin, the highs and the lows, and keep investing regularly. You also need to have a long timeframe.

When reviewing equities, we need to look at total returns. Only looking at stock prices is deceptive, as it doesn't show the full picture of investor returns. Nikkei is at 28,400 today, versus an all-time-high if 38,915 in 1989. Accounting for total returns, it has exceeded 1989 highs already. Dividends matter.

It's also important to take a lot of "predictions" about the future with a grain of salt, no matter how mainstream and widely accepted they are. Back in the late 1980s Japan was viewed very favorably, and it was supposed to overtake the US. The reality turned out differently about 30 years later. Nobody really knows anything.

In order to survive and thrive as an investor, you need to create your own process, manage risk and then stick to your plan through thick or thin. At the same time, you have to learn from your mistakes and try to improve continuously.

In my case, if I had invested in Japan, I probably would have stopped buying companies in the early 1980s. I would have held on to existing companies, but allocated money elsewhere globally if that was possible. US companies were much cheaper throughout the 1980s; many European companies were cheaper in the early part of the 1980s as well;

The hardest part would have been missing out on the 1980 - 1989 epic bull run in Japanese companies, and feeling out of touch with this "new reality", "new paradigm" etc. When someone is doing better than you, they may be louder than anyone else.

This experience would have taught everyone all the bad lessons that valuation does not matter, dividends don't matter, only share price gains matter etc. So as an investor, developing the patience to hold on to your stocks when they keep going up in price, and developing the patience to hold on to your stocks when they are flat or someone else's stocks do better, is a superpower.

Relevant Articles:

- Skate to where the puck is going