McDonald’s Corporation (MCD) franchises and operates McDonald's

restaurants in the United States, Europe, the Asia/Pacific, the Middle East,

Africa, Canada, and Latin America. As of December 31, 2013, it operated 35,429

restaurants, including 28,691 franchised and 6,738 company-operated

restaurants. McDonald’s is a dividend champion which has increased distributions for

38 years in a row.

The most recent dividend increase was in September 2013, when the Board of Directors approved a 5.20% increase in the quarterly dividend to 81 cents/share. The largest competitors for McDonald's include Burger King (BKW), YUM! Brands (YUM) and Starbucks (SBUX).

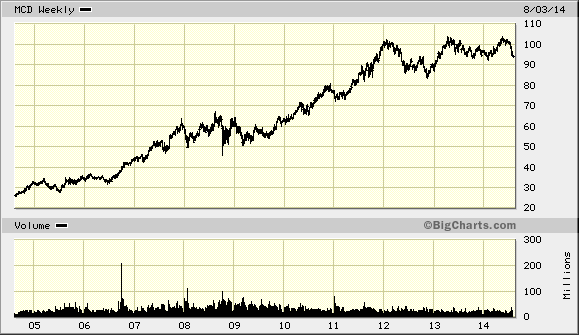

Over the past decade this dividend growth stock has delivered an annualized total

return of 17.90% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

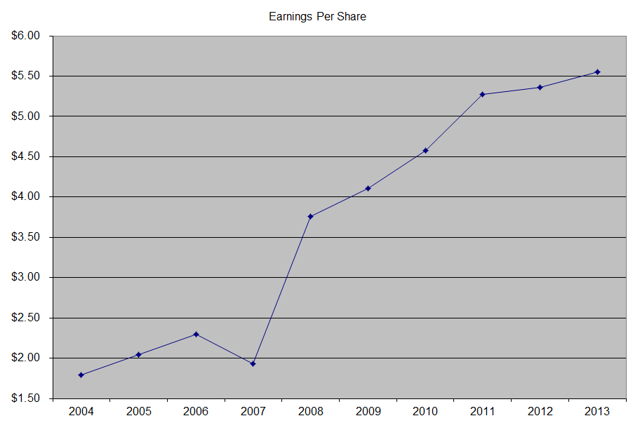

The company has managed to deliver 16.70% average increase in annual EPS over the past decade. McDonald's is expected to earn $5.65 per share in 2014 and $6.11 per share in 2015. In comparison, the company earned $5.55/share in 2013.

Between 2004 and 2014, McDonald's has been able to reduce the number of shares from 1.274 billion to 993 million through consistent share buybacks.

In the past three years, the company's earnings per share have largely stagnated. That being said, I am still a big fan of McDonald's at current prices. This is because I believe that there is an inherent margin of safety in the company at current levels, which can result in returns even if the business itself doesn't grow by much.

I like the fact that the company can still generate low revenue growth, and still generate good returns to shareholders. For example, the company can refranchise more of its company owned existing units, which would reduce capital needs for the business. Revenues from franchised locations are more stable and require less resources for the company. This could result in more cash for dividends and share buybacks. In addition, the company could also package its prime real estate locations under the restaurants it owns in a real estate investment trust, and thus lower taxes. A tax-free spin-off like that could immediately unlock more value for shareholders.

Of course, many investors forget that McDonald's is essentially a play on real estate, since it owns land and buildings under a large portion of restaurants. Those are prime heavily trafficked locations, whose value appreciates over time. For example, approximately 65% of revenues generated from franchised restaurants comes in the form of rent, while approximately one-third comes from royalties. The company owns 70% of restaurants and the land behind 45% of restaurants in its consolidated markets. Next time you look at their balance sheet, please remember that land and buildings are there at historical cost.

Now of course, we can also look for the power of share buybacks as well. McDonald's spend $1.81 billion on share repurchases in 2013 and $2.60 billion in 2012. If the company manages to repurchase $2 billion worth of stock each year, this would effectively reduce number of shares outstanding by approximately 2%/year. This automatically increases earnings per share by about 2%, assuming net income is flat. Hence, the value per share increases by 2%. If a shareholder now owns a higher stake in the firm, and also earns a dividend yield of 3%-3.50%, they can generate a total return of 5%-5.5% even if net income is flat until the end of time. The yields and amount of shares repurchased can vary from year to year, which is why this is not going to be straightforward growth each year. These numbers of course are wildly pessimistic, and merely shown to illustrate that even a small growth in organic revenues or earnings per share can result in very good dividend growth and total returns for shareholders over time.

Of course, the company can still grow through the opening of new restaurants. Of course, this would be more difficult in established markets in North America or Europe. However, there is that untapped and growing middle class in emerging markets that is slowly rising out of obscurity, and will be adding hundreds of millions of people in the next 15-20 years. Those people are busy, and will need convenience of quick service restaurants such as McDonald's. In 2013, the company opened 1,393 traditional restaurants and 45 satellite restaurants (small, limited-menu restaurants for which the land and building are generally leased), and closed 295 traditional restaurants and 194 satellite restaurants. In 2012, the company opened 1,404 traditional restaurants and 35 satellite restaurants and closed 269 traditional restaurants and 200 satellite restaurants.

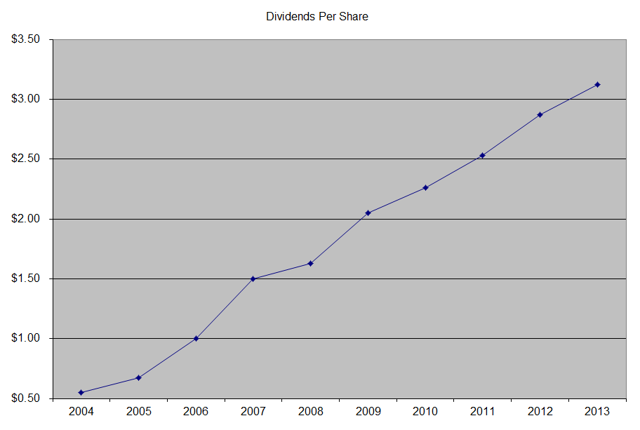

The annual dividend payment has increased by 22.80% per year over the past decade, which is higher than the growth in EPS. I expect future growth in dividends to be in the range of 7%-10% per year in the next decade.

A 7% growth in distributions translates into the dividend payment doubling every ten years on average. If we check the dividend history going as far back as 1976, we could see that McDonald's has actually managed to double dividends almost every four years on average.

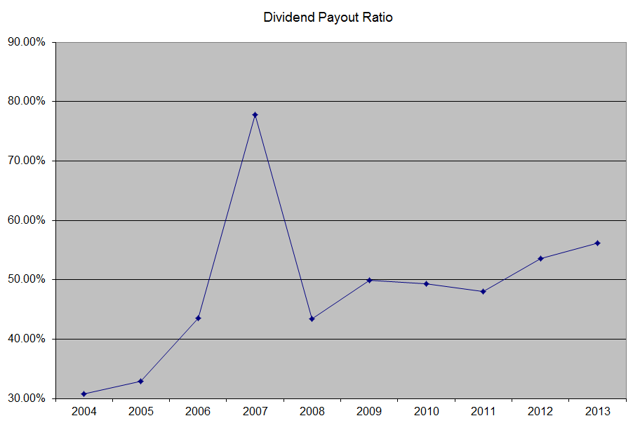

In the past decade, the dividend payout ratio increased from 30.70% in 2004 to 56.20% in 2013. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

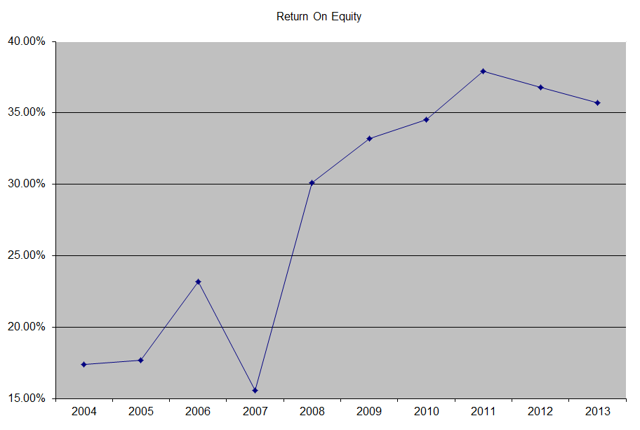

The return on equity increased from 17.40% in 2004 to 35.70% in 2013. I generally like seeing a high return on equity, which is also relatively stable over time.

Currently, the stock is attractively valued at 16.70 times earnings and a current yield

of 3.50%. There is an increasingly negative sentiment toward the company. I believe

McDonald’s will overcome its problems, and reward patient shareholders who have

a long-term horizon. I also find it easier to buy shares in a company when

there is some known hang-up, which keeps price depressed. I would be even more

excited if shares fell further from here, because this would mean more shares

and more dividend income for every dollar I put to work. I have been adding to

my position in the stock slowly throughout 2014.

Full Disclosure: Long MCD and YUM

Relevant Articles:

- 7 Dividend Paying Stocks I Purchased Without Paying Commissions- Six Notable Dividend Increases so far in September- 14 Dividend Growth Stocks I Bought On the Dip Last Week- Are you drowning in cash?- How to buy dividend stocks with as little as $10