PepsiCo, Inc. (NYSE:PEP) manufactures, markets, and sells various foods, snacks, and carbonated and non-carbonated beverages worldwide. The company operates in four divisions: PepsiCo Americas Foods (PAF), PepsiCo Americas Beverages (PAB), PepsiCo Europe, and PepsiCo Asia, Middle East and Africa (AMEA). The company is a dividend champion, which has increased distributions for 42 years in a row. PepsiCo is also one of the 60 companies, which could be purchased commission-free using Loyal3, with as little as $10.

The most recent dividend increase was in May 2014, when the Board of Directors approved a 15.40% increase in the quarterly dividend to 65.50 cents/share. PepsiCo's largest competitors include Coca Cola (NYSE:KO) and Dr Pepper Snapple Group (NYSE:DPS).

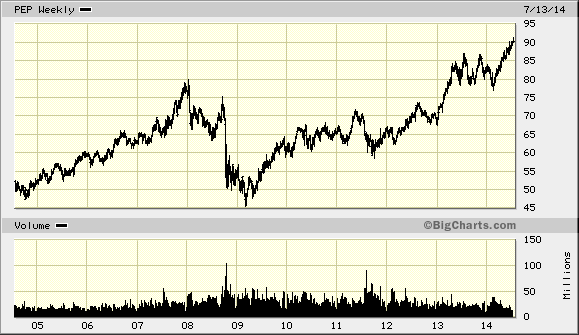

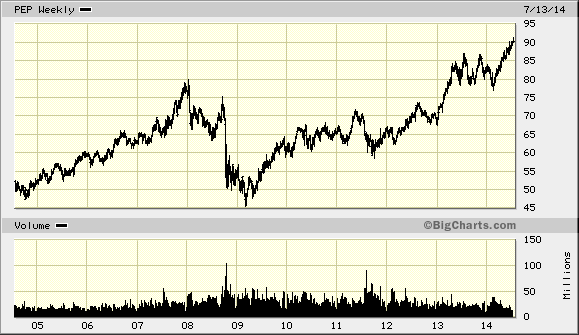

Over the past decade, this dividend growth stock has delivered an annualized total return of 6.60% to its shareholders.

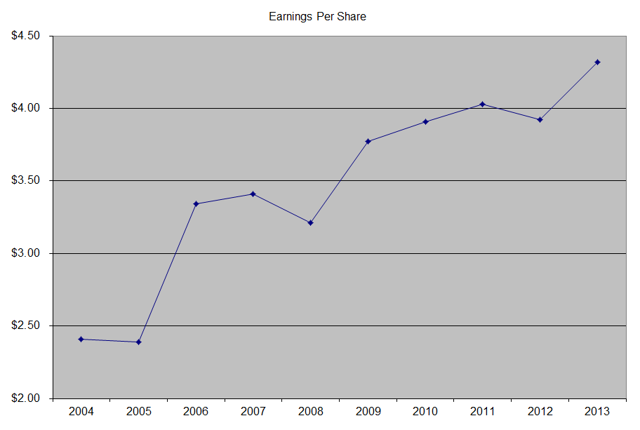

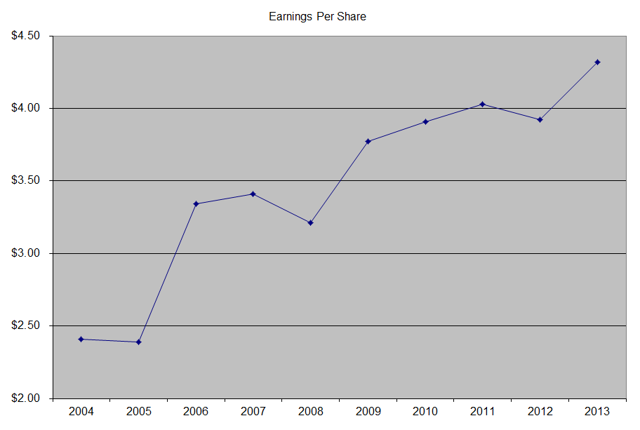

The company has managed to deliver 7.70% average increase in annual EPS over the past decade. PepsiCo is expected to earn $4.53 per share in 2014 and $4.89 per share in 2015. In comparison, the company earned $4.32/share in 2013.

Share buybacks have resulted in the decrease in outstanding shares from 1,729 million in 2004 to 1,532 million in 2014. A history of consistent share repurchases is helpful, because it shows that the company is willing to help out long-term holders of stock with increased proportional share of earnings and the business over time.

PepsiCo has a wide moat, due to strong recognizable brands it owns, scale of operations, relationships with retailers and having a distribution network of bottlers that will take billions of dollars to create and replicate. Because of the consumer affinity for branded snacks and beverages that PepsiCo makes, they are less likely to switch to a cheaper product. Hence, PepsiCo is part of a sort of unregulated monopoly, which has pricing power.

Future growth in earnings will come from international expansion, particularly in emerging markets. The number of servings that consumers abroad consume is much lower than that in North America, which is why I believe there will be years of growth ahead. In addition, I like the fact that the company sells not only beverages, but snacks as well. As an investor, I like to be diversified; hence, I like it when the companies I own are diversified in products and geography. In addition, it is estimated that the company achieves close to a billion in synergies by operating both a beverage and a snack business.

Earnings can also increase through organic growth for those snacks and beverages, and price increases to offset cost pressures. Strategic cost initiatives to streamline operations, increase productivity and reduce redundancies are another tool to increase shareholder earnings.

PepsiCo has also focused on fast growing non-carbonated soft drinks. The company's innovation in the area has been successful with the introduction of Aquafina, Gatorade and Propel, Lipton teas and Tropicana.

Future earnings growth could also come from synergies associated with the acquisitions of its bottlers, streamlining of operations and cost cutting. The distribution networks of the bottlers acquired could be used to push some of PepsiCo's non-beverage products such as snacks and other foods. Earnings growth could also come from other strategic acquisitions, as well as product innovations in health and wellness food and beverage section.

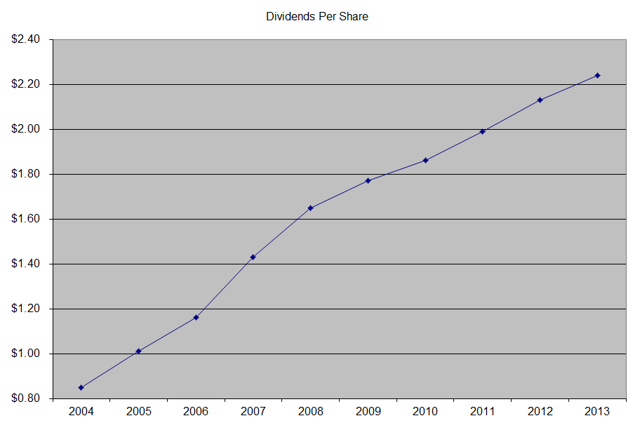

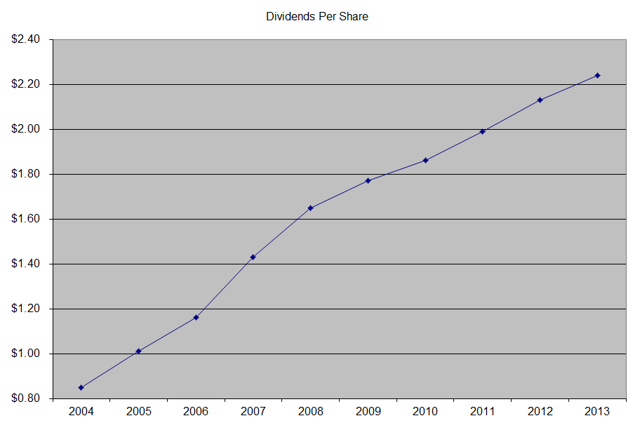

The annual dividend payment has increased by 13.50% per year over the past decade, which is higher than the growth in EPS.

A 13% growth in distributions translates into the dividend payment doubling every five and a half years on average. If we check the dividend history, going as far back as 1970, we could see that PepsiCO has actually managed to double dividends every five years on average.

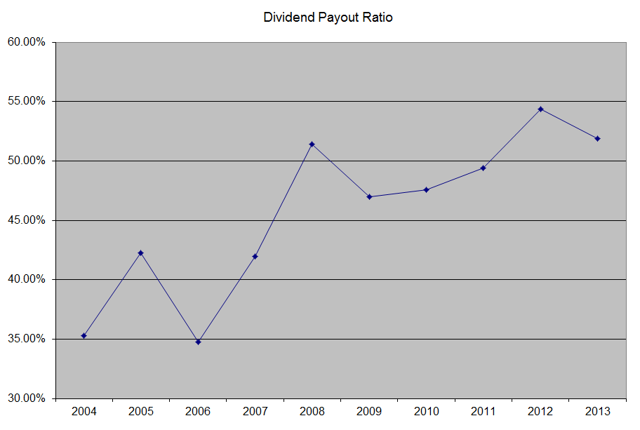

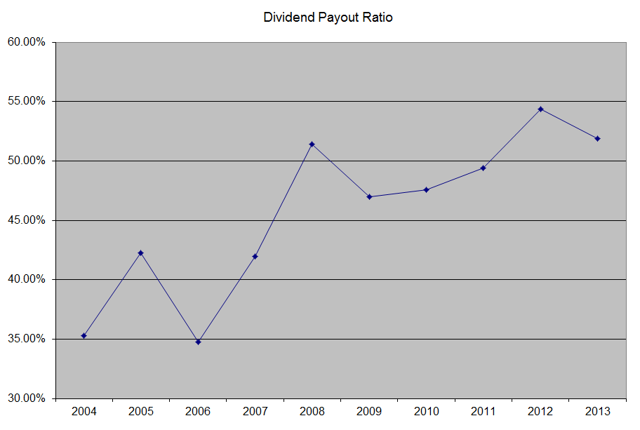

In the past decade, the dividend payout ratio increased from 35% in 2004 to almost 52% in 2013. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

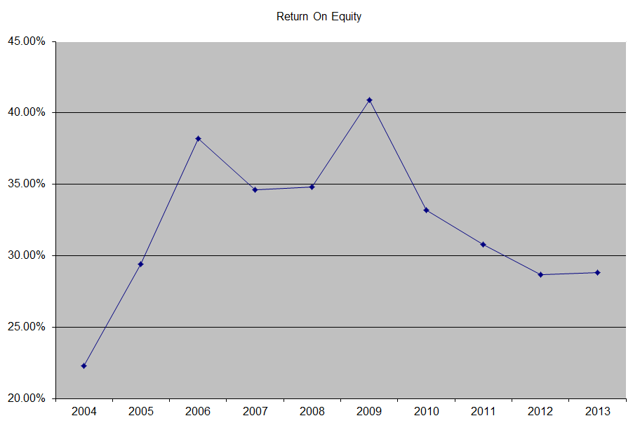

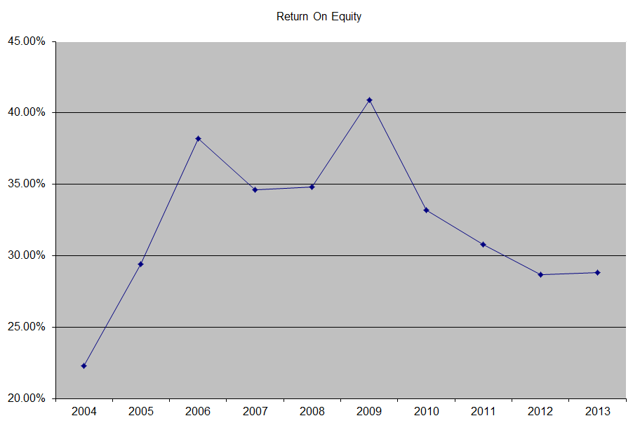

The return on equity increased from 22.30% in 2004 to 40.90% in 2009, before decreasing to a still pretty high 28.80%. The decline was caused by the 2010 acquisition of Pepsi Bottling interests in North America, which require more capital than your regular soda syrup. I generally like seeing a high return on equity, which is also relatively stable over time.

Currently, the company is close to overvalued as it sells for 19.70 times forward earnings and yields 2.90%. It is slightly more expensive than Coca-Cola, which sells for 19 times forward earnings and has the same yield. The pure play on North American soda is Dr. Pepper Snapple is cheaper at 17 times forward earnings and a current yield of 2.70%. I like PepsiCo, but it is selling at the highest point I would be willing to put money at. As a result, I would likely not put money there, unless valuation gets better or unless I run out of other ideas. However, I do like PepsiCo, and find it to be one of the quality dividend paying cornerstones of my dividend portfolio. Thus, I plan on holding on to this dividend machine, and eagerly wait for drops in the stock price.

The most recent dividend increase was in May 2014, when the Board of Directors approved a 15.40% increase in the quarterly dividend to 65.50 cents/share. PepsiCo's largest competitors include Coca Cola (NYSE:KO) and Dr Pepper Snapple Group (NYSE:DPS).

Over the past decade, this dividend growth stock has delivered an annualized total return of 6.60% to its shareholders.

The company has managed to deliver 7.70% average increase in annual EPS over the past decade. PepsiCo is expected to earn $4.53 per share in 2014 and $4.89 per share in 2015. In comparison, the company earned $4.32/share in 2013.

Share buybacks have resulted in the decrease in outstanding shares from 1,729 million in 2004 to 1,532 million in 2014. A history of consistent share repurchases is helpful, because it shows that the company is willing to help out long-term holders of stock with increased proportional share of earnings and the business over time.

PepsiCo has a wide moat, due to strong recognizable brands it owns, scale of operations, relationships with retailers and having a distribution network of bottlers that will take billions of dollars to create and replicate. Because of the consumer affinity for branded snacks and beverages that PepsiCo makes, they are less likely to switch to a cheaper product. Hence, PepsiCo is part of a sort of unregulated monopoly, which has pricing power.

Future growth in earnings will come from international expansion, particularly in emerging markets. The number of servings that consumers abroad consume is much lower than that in North America, which is why I believe there will be years of growth ahead. In addition, I like the fact that the company sells not only beverages, but snacks as well. As an investor, I like to be diversified; hence, I like it when the companies I own are diversified in products and geography. In addition, it is estimated that the company achieves close to a billion in synergies by operating both a beverage and a snack business.

Earnings can also increase through organic growth for those snacks and beverages, and price increases to offset cost pressures. Strategic cost initiatives to streamline operations, increase productivity and reduce redundancies are another tool to increase shareholder earnings.

PepsiCo has also focused on fast growing non-carbonated soft drinks. The company's innovation in the area has been successful with the introduction of Aquafina, Gatorade and Propel, Lipton teas and Tropicana.

Future earnings growth could also come from synergies associated with the acquisitions of its bottlers, streamlining of operations and cost cutting. The distribution networks of the bottlers acquired could be used to push some of PepsiCo's non-beverage products such as snacks and other foods. Earnings growth could also come from other strategic acquisitions, as well as product innovations in health and wellness food and beverage section.

The annual dividend payment has increased by 13.50% per year over the past decade, which is higher than the growth in EPS.

A 13% growth in distributions translates into the dividend payment doubling every five and a half years on average. If we check the dividend history, going as far back as 1970, we could see that PepsiCO has actually managed to double dividends every five years on average.

In the past decade, the dividend payout ratio increased from 35% in 2004 to almost 52% in 2013. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

The return on equity increased from 22.30% in 2004 to 40.90% in 2009, before decreasing to a still pretty high 28.80%. The decline was caused by the 2010 acquisition of Pepsi Bottling interests in North America, which require more capital than your regular soda syrup. I generally like seeing a high return on equity, which is also relatively stable over time.

Currently, the company is close to overvalued as it sells for 19.70 times forward earnings and yields 2.90%. It is slightly more expensive than Coca-Cola, which sells for 19 times forward earnings and has the same yield. The pure play on North American soda is Dr. Pepper Snapple is cheaper at 17 times forward earnings and a current yield of 2.70%. I like PepsiCo, but it is selling at the highest point I would be willing to put money at. As a result, I would likely not put money there, unless valuation gets better or unless I run out of other ideas. However, I do like PepsiCo, and find it to be one of the quality dividend paying cornerstones of my dividend portfolio. Thus, I plan on holding on to this dividend machine, and eagerly wait for drops in the stock price.

Full Disclosure: Long PEP, KO, DPS

Relevant Articles:

- How to buy dividend stocks with as little as $10

- 7 Dividend Paying Stocks I Purchased Without Paying Commissions

- Seven wide-moat dividends stocks to consider

- Dividend Growth Stocks are Compounding Machines

- Let dividends do the heavy lifting for your retirement