The company’s latest dividend increase was announced in April 2014 when the Board of Directors approved a 6.10% increase in the quarterly dividend to 70 cents /share. The company’s peer group includes Novartis (NVS), Pfizer (PFE) and Covidien (COV).

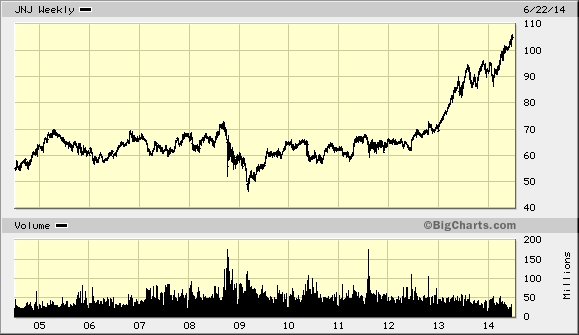

Over the past decade this dividend growth stock has delivered an annualized total return of 12.10% to its shareholders.

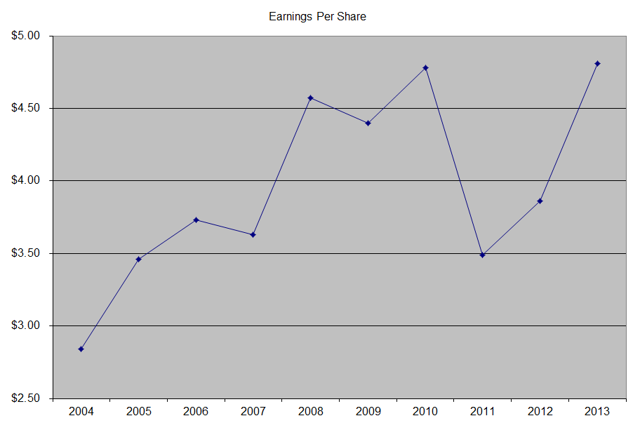

The company has managed to deliver 7.20% average increase in annual EPS over the past decade. Johnson & Johnson is expected to earn $5.89 per share in 2014 and $6.34 per share in 2015. In comparison, the company earned $4.81/share in 2013.

Johnson & Johnson also has managed to reduce number of shares outstanding. Between 2004 and 2014, the number of shares declined from 2,996 million to 2,881 million.

Johnson & Johnson has a diversified product line across medical devices, consumer products and drugs, which should serve it well in the future. This makes the company largely immune from economic cycles. In addition, the company has strong competitive advantages due to its scale, leadership role in various diverse healthcare segments, breadth of product offerings in its global distributions channels, continued investment in R&D, switching costs to users of its medical devices, as well as its stable financial position. The ability to generate strong cash flows, have enabled Johnson & Johnson to reward shareholders with a higher dividends for 52 consecutive years.

Future profits growth could come from new product offerings, which are the result of continued investment in research and development, and through strategic acquisitions.

Johnson & Johnson is expanding its business through strategic acquisitions. For example, the acquisition of Synthes, is expected to generate significant synergies for Johnson & Johnson and make it a leader in fast growing trauma market. This also allowed the company to use its overseas cash without having to pay the steep repatriation taxes. Emerging market growth and opportunities for cost restructurings should further help the company in squeezing out extra profits in the long run.

Sales in drugs like Simponi, Stelara, Zytiga, Xaralto and Olysio should more than offset the generic erosion from older drugs which are losing their patent protection. The fact that the company has exposure to other healthcare segments besides pharmaceuticals makes it a much safer play on the healthcare sector than pure pharma companies. I like the fact that there is diversity in the revenue generating behind each of the large segments. The three segments include Pharmaceutical with 39% of sales, Medical Devices & diagnostics with 40% of sales and the Consumer segment with approximately 21% of sales.

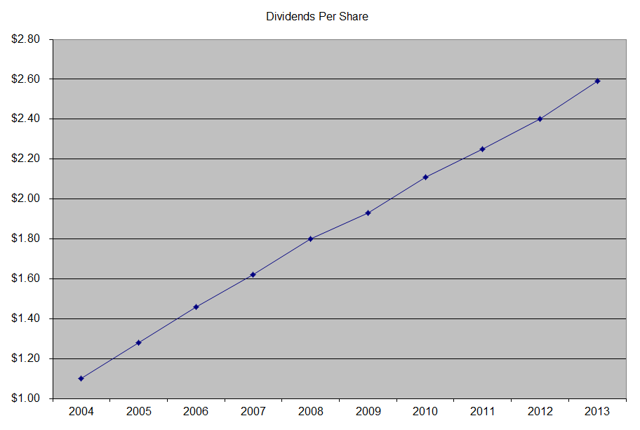

The annual dividend payment has increased by 10.80% per year over the past decade, which is higher than the growth in EPS.

An 11% growth in distributions translates into the dividend payment doubling every six and a half years on average. If we check the dividend history, going as far back as 1973, we could see that Johnson & Johnson has actually managed to double dividends every five years on average.

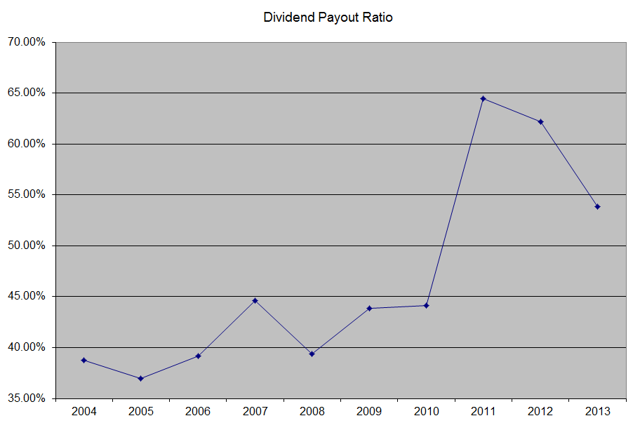

In the past decade, the dividend payout ratio increased from 38.70% in 2004 to a high of 64.50% in 2011, before decreasing to 53.90%. On a forward earnings basis, the dividend payout ratio is at 47.50%. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently, the stock is attractively valued at 17.80 times forward earnings and a current yield of 2.70%. I last purchased shares of the stock in 2013, and the only reason I am hesitating to add more is because the company is one of the five highest weighted in my portfolio.

Full Disclosure: Long JNJ

Relevant Articles:

- Multi-Generational Dividend investing

- Dividend Investors Will Make Money Even if the Stock Market Closed for Ten Years

- Can everyone achieve financial independence with Dividend Paying Stocks?

- Dividend Growth Stocks are Compounding Machines

- Two Dividend Kings Extending Their Dividend Growth Streaks