In March 2000, Cisco Systems (CSCO) reached an all time high of $82/share. It became the largest company in the world, with a market capitalization of around half a trillion dollars. It was also the largest company in the Nasdaq 100.

Investors were excited about the growth prospects of New Economy companies. As a result, they were willing to overpay massively for their growth prospects.

In the case of Cisco Systems, the company had gone public in 1990. It sold for about 20 - 30 times earnings in 1990. The company then managed to grow earnings per share 150 fold since its IPO in 1990. As a result, the stock had a high total return fueled by that + valuation expansion in 1990s.

In the case of Cisco (CSCO) investors assigned a $450 billion valuation in 2000 on a company that earned $2 Billion in 1999 and $2.7 billion in 2000.

Cisco just reported a net income of $11.8 Billion for 2022.

On a per/share basis, things look like this:

Cisco Systems (CSCO) has managed to grow earnings per share from $0.30 in 1999 to $2.82 in 2022.

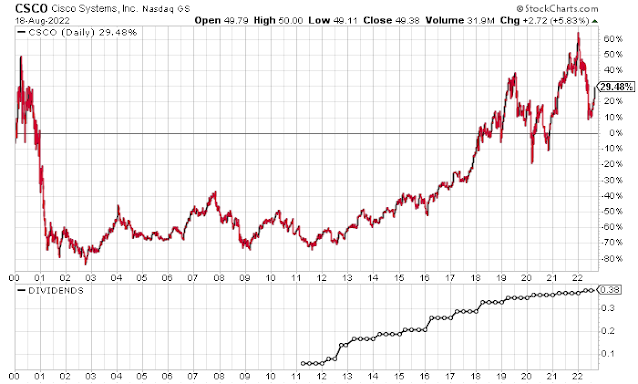

The stock has failed to exceed the record levels from the dot-com bubble despite a 7 fold increase in earnings per share since 2000. Investors generated a total return of 29% since the end of 1999

That's because the stock was selling for 165 times earnings in 2000.

The Lesson is that: Overpaying for future growth is costly to investment returns

That's the total returns chart since 1/1/2000: