Essex Property Trust, Inc (ESS) is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in California and the Pacific Northwest. Essex currently has ownership interests in 253 apartment communities comprising approximately 63,000 apartment homes.

This REIT

is a dividend aristocrat, which has managed to increase annual dividends to

shareholders since going public in 1994.

The last

dividend increase occurred in February 2022, when Essex Property Trust hikedquarterly dividends by 5.26% to $2.20/share.

This REIT

has managed to increase dividends by 7.20% annualized over the past decade. The

pace of annualized dividend growth has slowed down to 4.90% over the past five

years.

The REIT

has managed to grow FFO/share from $6.71 to $14.24. It’s expected to generate

$15.14/share in FFO in 2022.

Future

growth in FFO/share will be a result of raising rents, buying new properties

and keeping debt costs in check. Large portion of the debt is fixed rate with

an average life of about 8 years. This bodes well in the current environment of

potentially rising long-term rates. Existing properties should be fine, but

acquiring new properties may come at higher interest costs. Financing further

expansion could come at an increased equity dilution, which should be accretive

for as long as yields on apartments is higher than yields on equity/debt.

Apartment

rents are cyclical, as is demand. They are dependent in the short-run on job

growth and the economic environment. In the long run they are driven by

household formation, and economic trends. The west cost is a vibrant economy,

and it would likely do great in the future. Owning existing properties may be a

nice asset to have, as zoning and red tape may make it harder to build

competing apartments nearby. On the other hand, some states like California

have tenant friendly laws, which make it harder to evict tenants during

downturns and cut into profitability.

Having

scale of operations, and specialization into its markets could be a form of

competitive advantage in my opinion.

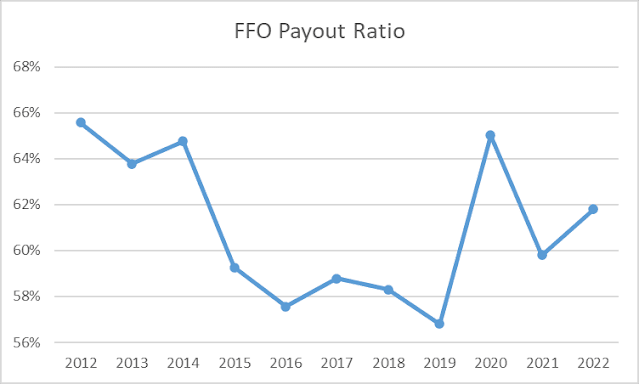

The FFO payout ratio has ranged between 56% and 66% over the past decade. This means that growth in dividends has closely tracked growth in FFO/share over the past decade.

The number

of shares outstanding has been largely flat over the past 5 – 7 years.

I find

this REIT to be attractively priced at 15.70 times forward FFO and a dividend

yield of 3.90%.

Relevant Articles:

- Dividend Aristocrats List for 2023