Visa Inc. (V), a payments technology company, operates as a retail

electronic payments network worldwide. The company facilitates commerce through

the transfer of value and information among financial institutions, merchants,

consumers, businesses, and government entities. The company went public in

2008, and has managed to pay and increase dividends ever since. I initiated a

position in 2011, after witnessing the strong dividend growth, the attention of Berkshire Hathaway,

and the fact that the stock was available at 20 times earnings.

The most recent dividend increase was in October 2013, when the Board of Directors approved a 21.20% increase in the quarterly dividend to 40 cents/share. Visa's major competitors include MasterCard (NYSE:MA), American Express (NYSE:AXP), and Discover Financial Services (NYSE:DFS).

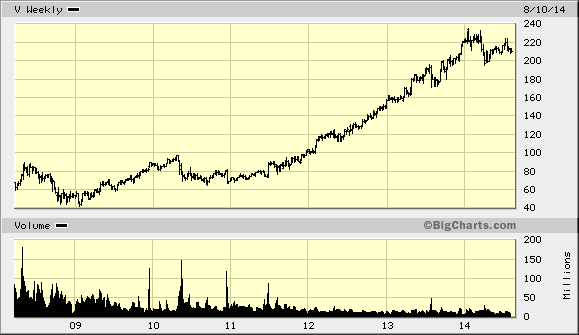

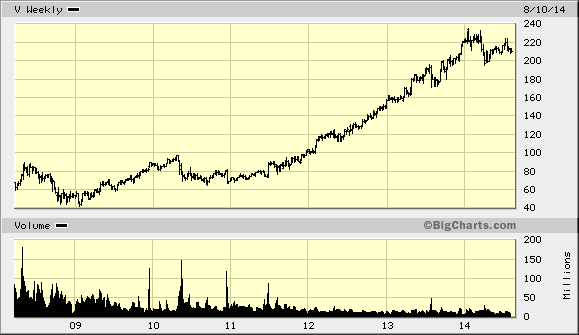

An investment in Visa at the time the dividend was initiated in June 2008 resulted in a gain of over 170%. This includes reinvestment of dividend income as well.

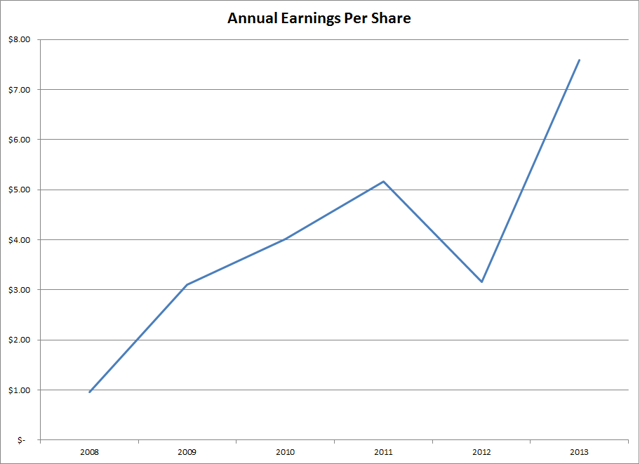

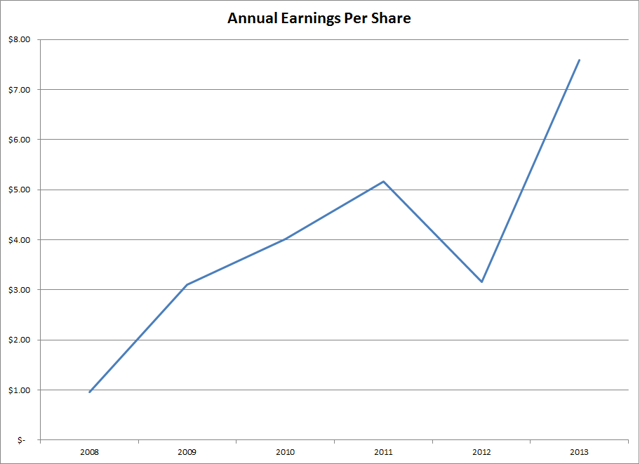

The company has managed to increase earnings per share from 96 cents in 2008 to $7.59 in 2013. Visa is expected to earn $8.99 per share in 2014 and $10.37 per share in 2015.

The company has returned money to shareholders through dividends and share buybacks since its IPO. Between 2008 and 2014, the number of shares outstanding has decreased from 1.393 billion to 636 million. The consistent decrease in shares outstanding adds an extra growth kick to earnings per share over time.

Visa has a wide moat due to its strong brand, scale of operations, and legal barriers to entry, as well as the Network Effect. When more retailers accept a given card, other merchants will be more willing to accept Visa as a payment method, in order to compete successfully for customers. When more retailers accept Visa, more customers are willing to use Visa as a payment method due to its convenience factor. When more customers are willing to use Visa, more retailers are willing to accept Visa as a payment method, in order to gain those customers. As a result, any additional new customer or a new retailer that is added to the network increases its depth and appeal, thus making it more valuable and needed. With the Network Effect, a service is more valuable when more participants use it.

When you have a payment network, you also achieve scale, as you have a large number of participants (both retailers and customers). Therefore, it is extremely difficult to set up a competing network for payments. In addition, there are high barriers to entry due to complicated legal and regulatory frameworks in different countries. Once you achieve a certain scale, the type that Visa and MasterCard possess, each additional transaction in the network is much more profitable.

The market for cashless transactions is destined to only increase in the future. Most transactions in the developing world are still done with cash currency, which causes a cost to merchants. Accepting, storing, and transporting cash is expensive because of the risk of theft, counterfeit currencies, and making errors in calculations. I expect the volume of cashless transactions using debit and credit cards to only increase in the coming two decades. I like the strong brand of Visa, which is essentially a duopoly with MasterCard, although American Express has an entrenched position with business customers. In addition, as more shopping is done online, the need for debit and credit cards increases as well. Retailers like plastic, because consumers end up spending more when they pay on credit and do not have to dole out physical cash right away.

In addition, I expect the amount of transactions to increase over time as well. Therefore, the company will benefit from growth of overall transaction volume and the increase in share of cashless transactions globally.

The risk to companies like Visa is a paradigm shift in technology, which could help consumers to use an alternative payment method for cashless transactions. However, those paradigm shifts will be difficult for competitors because of the regulatory barriers and the fact that the competing network would still need to get more customers to use it and more retailers to accept it. Building out a competing network from scratch could be costly and time-consuming. It would be much easier for such a paradigm-shifting technology to partner with the likes of Visa, rather than compete directly head-on with it.

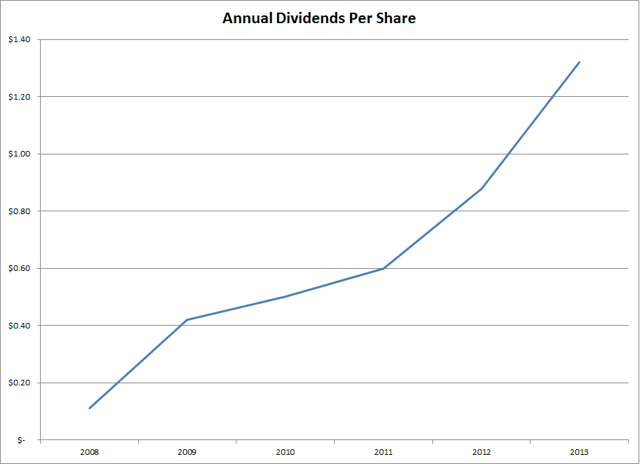

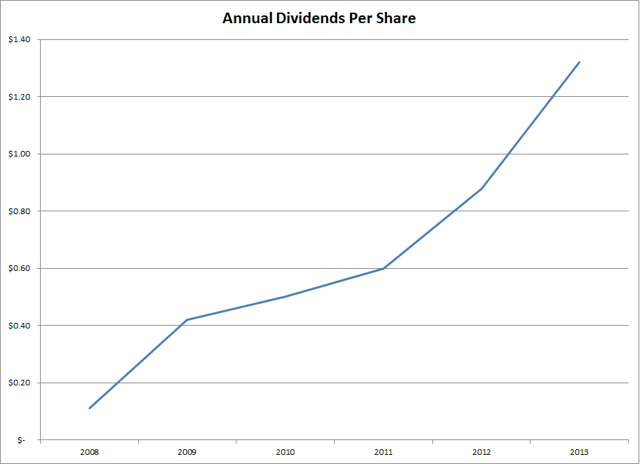

The company is in the initial phase of dividend growth, where dividends increase faster than earnings due to low initial payout ratio. The quarterly dividend payment has increased from 10.50 cents/share in 2008 to 40 cents/share by 2014. Future growth in dividends will likely exceed the rate of increase in earnings per share over the next decade, after which dividend growth would likely closely follow growth in earnings per share.

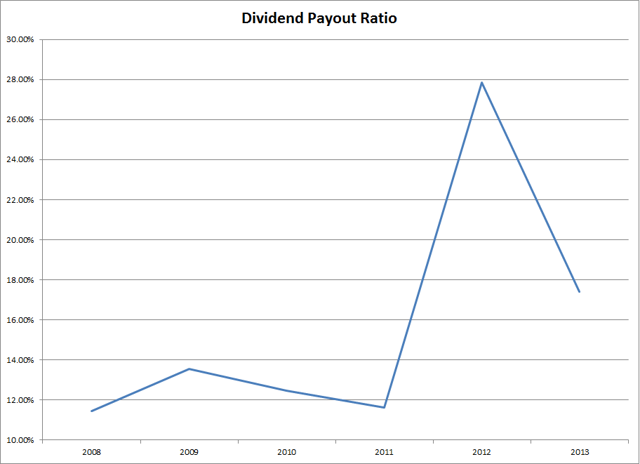

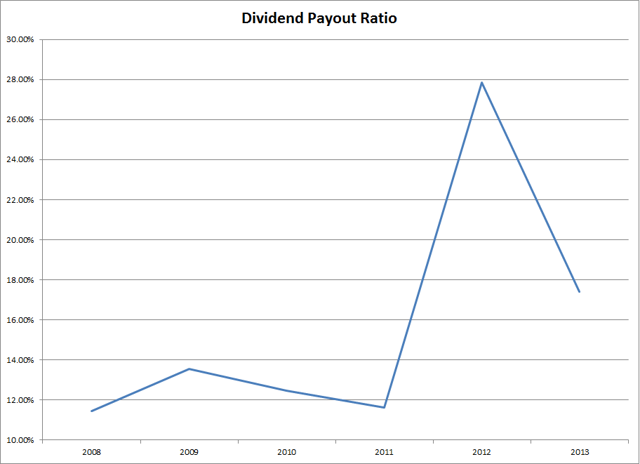

The dividend payout ratio increased from 11.50% in 2008 to 17.40% by 2013. A lower payout is always a plus, since it leaves room for consistent dividend growth, minimizing the impact of short-term fluctuations in earnings.

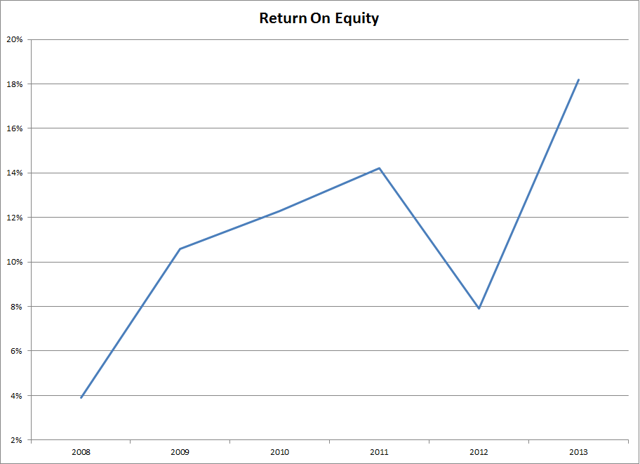

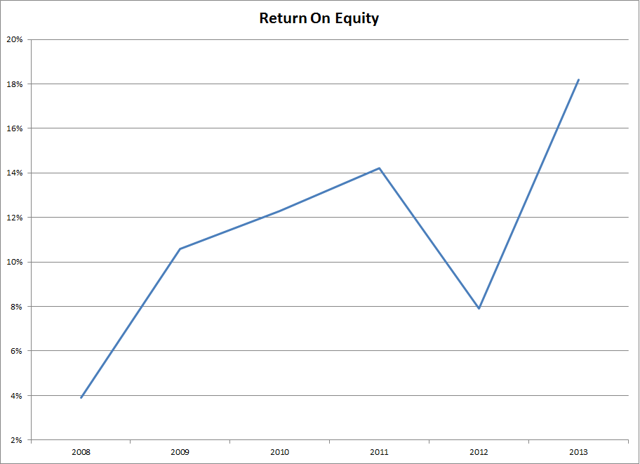

The return on equity has increased from 3.90% in 2008 to 18.20% in 2013. I generally like seeing a high return on equity which is also relatively stable over time.

The most recent dividend increase was in October 2013, when the Board of Directors approved a 21.20% increase in the quarterly dividend to 40 cents/share. Visa's major competitors include MasterCard (NYSE:MA), American Express (NYSE:AXP), and Discover Financial Services (NYSE:DFS).

An investment in Visa at the time the dividend was initiated in June 2008 resulted in a gain of over 170%. This includes reinvestment of dividend income as well.

The company has managed to increase earnings per share from 96 cents in 2008 to $7.59 in 2013. Visa is expected to earn $8.99 per share in 2014 and $10.37 per share in 2015.

The company has returned money to shareholders through dividends and share buybacks since its IPO. Between 2008 and 2014, the number of shares outstanding has decreased from 1.393 billion to 636 million. The consistent decrease in shares outstanding adds an extra growth kick to earnings per share over time.

Visa has a wide moat due to its strong brand, scale of operations, and legal barriers to entry, as well as the Network Effect. When more retailers accept a given card, other merchants will be more willing to accept Visa as a payment method, in order to compete successfully for customers. When more retailers accept Visa, more customers are willing to use Visa as a payment method due to its convenience factor. When more customers are willing to use Visa, more retailers are willing to accept Visa as a payment method, in order to gain those customers. As a result, any additional new customer or a new retailer that is added to the network increases its depth and appeal, thus making it more valuable and needed. With the Network Effect, a service is more valuable when more participants use it.

When you have a payment network, you also achieve scale, as you have a large number of participants (both retailers and customers). Therefore, it is extremely difficult to set up a competing network for payments. In addition, there are high barriers to entry due to complicated legal and regulatory frameworks in different countries. Once you achieve a certain scale, the type that Visa and MasterCard possess, each additional transaction in the network is much more profitable.

The market for cashless transactions is destined to only increase in the future. Most transactions in the developing world are still done with cash currency, which causes a cost to merchants. Accepting, storing, and transporting cash is expensive because of the risk of theft, counterfeit currencies, and making errors in calculations. I expect the volume of cashless transactions using debit and credit cards to only increase in the coming two decades. I like the strong brand of Visa, which is essentially a duopoly with MasterCard, although American Express has an entrenched position with business customers. In addition, as more shopping is done online, the need for debit and credit cards increases as well. Retailers like plastic, because consumers end up spending more when they pay on credit and do not have to dole out physical cash right away.

In addition, I expect the amount of transactions to increase over time as well. Therefore, the company will benefit from growth of overall transaction volume and the increase in share of cashless transactions globally.

The risk to companies like Visa is a paradigm shift in technology, which could help consumers to use an alternative payment method for cashless transactions. However, those paradigm shifts will be difficult for competitors because of the regulatory barriers and the fact that the competing network would still need to get more customers to use it and more retailers to accept it. Building out a competing network from scratch could be costly and time-consuming. It would be much easier for such a paradigm-shifting technology to partner with the likes of Visa, rather than compete directly head-on with it.

The company is in the initial phase of dividend growth, where dividends increase faster than earnings due to low initial payout ratio. The quarterly dividend payment has increased from 10.50 cents/share in 2008 to 40 cents/share by 2014. Future growth in dividends will likely exceed the rate of increase in earnings per share over the next decade, after which dividend growth would likely closely follow growth in earnings per share.

The dividend payout ratio increased from 11.50% in 2008 to 17.40% by 2013. A lower payout is always a plus, since it leaves room for consistent dividend growth, minimizing the impact of short-term fluctuations in earnings.

The return on equity has increased from 3.90% in 2008 to 18.20% in 2013. I generally like seeing a high return on equity which is also relatively stable over time.

Currently, Visa is slightly overvalued at 20.50 times forward 2015 earnings,

and has a low yield of 0.80%. If the company manages to earn $20 per share by

2020, and even if the P/E ratio compresses to 15 times by, the stock could

provide very good returns to investors. Another plus is that dividend growth

could result in very high yields on cost for Visa investors in 15 - 20 years.

Of course, long-term growth is never certain, which is why I do not plan on

adding to Visa unless I can buy it at 20 times forward earnings or less.

However, I am willing to break my rules slightly, and accept

20 times forward earnings for 2015. If we get a more significant stock

correction, I would be a buyer and will try to increase my position to a top 20

level ( meaning it will be in my top 20 portfolio positions by size).

Full Disclosure: Long V

Relevant Articles: