Early each year, I try to discuss what my goals for the next few years are. However, I really do not like to

set financial goals. Rather, I try to behave in a way that fosters wealth building. This helps me stay on task an accomplish those goals, better than simply setting up goals. This essentially means always spending less than what I earn, always questioning expenses, and continuously monitoring ways to cut expenses and stretch my dollar, without sacrificing quality of life. I also do not like to set goals, because things change, and I learn more about different opportunities along the way. If I adhere strictly to my goals, I will achieve them, but I might be worse off overall. Therefore, it is important to have some flexibility and focus on the best opportunities available, rather than adhering to specific goals for specific goals sake. What I am saying might seem confusing at first. What I am trying to say is that I try to make it a habit to follow a few common sense guidelines all the time, and have found that I have been better overall. If you spend less than what you earn, and invest the different, you will be better off overall financially. That's why you never hear people who enjoy working out 3 - 5 times per week set goals to lose 10 pounds in 2015 - they don't have to because they have the habit to not have to set goals. If those people got into the mindset of consciously trying to be healthy by avoiding overeating and spending some time on a little regular physical activity, they would be successful without really setting specific goals.

For example, between 2007/2008 and 2012, I put most of my money in taxable accounts. My dividend income

was growing exponentially, I was

reinvesting it back into more dividend paying stocks. I was able to achieve that by constantly saving money and also by focusing on growing income. As I made more money from job, dividends and other sources however, I noticed that

I was paying way too much in taxes. Those dollars were lost forever to the tax-person, and were hard earned dollars which would never compound for me. As a result, I made a decision to max out my tax-deferred accounts in early 2013. Those accounts include:

- Pre-tax

401 (k), where each dollar deferred results in immediate savings of 30% (Fed and State)

- Pre-tax SEP IRA, where each dollar deferred also results in immediate savings of 30%

-

Roth IRA, where each dollar earned will compound tax-free and be tax-free upon distribution when I become 59 ½ years old

- Health Savings Account, where each dollar deferred results in immediate savings of over 37.60% ( defers Federal, State and FICA taxes)

I have calculated, that if I wanted to save $100,000 in taxable accounts, I would have to put $10,000/year for 10 years ( I am only looking at contributions, and ignoring compounding in order to make comparison easy and straightforward). If I implemented tax-deferred accounts such as 401 (k) and Roth IRA, I would be able to save something like $3,000/year on taxes. Those savings come from maxing out the 401 (k) at $10,000 at a 30% tax rate ( Federal and State). Those tax savings could be put in a Roth IRA, and compound tax-free. Therefore, by using only taxable accounts, you can contribute up to $100,000 over a ten year period if all else is equal. By using a smart strategy of tax-deferred contributions and immediate tax savings today, the investor will be able to save $130,000, which will compound tax-free until they get to be age 70 ½ years old. Therefore, by utilizing tax-deferred accounts, the second investor is essentially speeding up their accumulation process, and brings their financial independence/retirement date closer by 3 years for every 10 years of saving. Since your lifetime is limited, any shortcut that can shave off spending time at a job you might not enjoy 100% could be worth it.

Most of the funds in the SEP IRA, regular IRA’s and Roth IRA’s are invested in individual dividend paying stocks. The money in the 401 (k) is invested in index funds, since this is the only option available. As I change jobs however, I plan to

rollover that money into IRA’s, and select individual dividend paying stocks available at attractive valuations.

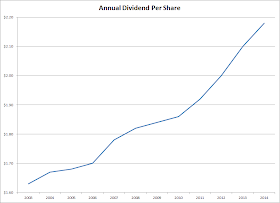

With that being said, I am deferring an awful lot of money in tax-deferred accounts mentioned above. Therefore, I am essentially starving my taxable accounts from fresh capital. To grow that dividend income in taxable accounts, I am essentially relying on

organic dividend growth and

selective dividend reinvestment. My assumptions for historical organic dividend growth are approximately 6% - 7%/year, while the assumptions for dividend yield at reinvestment is somewhere between 3% - 4%. This is why I expect them to generate income growth of approximately 10%/year. In 2014, I was able to cover approximately 66% of my target monthly expenses with dividend income from my portfolio.

My estimate for 2015 is to have my dividend income cover approximately 73% – 75% of expenses.

As I have mentioned earlier, if everything works as planned, I will be able to cover my expenses from taxable dividend income sometime around 2018. This of course assumes that I do not spend much time on the unemployment line. Unfortunately, most employers these days are streamlining operations in an effort to achieve profitability for their investors, which means mass rounds of layoffs for employees, and increased level of stress and responsibility for those lucky souls who are left to man the fort. The dividend income generated by tax-deferred accounts is not counted in the income replacement goal by 2018. That money is essentially a buffer, that will be used just in case something unexpected happens. Since the probability of me using that tax-deferred money ever is moderate to low, it is being stashed in a way that it will compound tax-free for several decades. This is one of my tools in my quest to have

margin of safety in financial independence.

My plan also assumes that there are investment opportunities out there available at good prices. If there aren't any quality dividend growth companies available at decent prices, I might have to end up building up a cash reserve. I do not want to pressure myself to make buy decisions, when the opportunities are simply not there. I would not want to pressure myself to buy companies of poor quality or companies at overvalued prices, merely to achieve a goal. In another example, if I find myself short of my objective, I might feel pressured to

chase high yielding stocks. This could lead to me reaching my dividend income goal on time ( or early), but might expose me to excess risks, which could derail long-term dividend income growth for my dividend portfolio. The point is not only to reach the dividend crossover point around 2018, but to have this income stream grow

above the rate of inflation for the subsequent 30 - 40 - 50 years. I am not interested in reaching a goal for the goal's sake, but rather to achieve an investment objective in a sustainable matter.

The types of companies I might add to in 2015, if their valuations are right and things do not change:

Baxter International Inc. (BAX) develops, manufactures, and markets products for people with hemophilia, immune disorders, infectious diseases, kidney diseases, trauma, and other chronic and acute medical conditions. The company has raised dividends for 8 years in a row. In the past decade, the company has managed to boost dividends by 13.20%/year. Currently, the stock is selling for 14.80 times earnings and yields 2.90%. Check my

analysis of Baxter.

Diageo plc (DEO) manufactures and distributes premium drinks such as Johnnie Walker, Crown Royal, Buchanan’s, J&B, Baileys, Smirnoff, Captain Morgan, Guinness, Shui Jing Fang, and Yenì Raki.. The company has raised dividends for 15 years in a row. In the past decade, the company has managed to boost dividends by 5.80%/year. Currently, the stock is selling for times earnings and yields 2.70%. Check my

analysis of Diageo.

Exxon Mobil Corporation (XOM) explores and produces for crude oil and natural gas. The company has raised dividends for 32 years in a row. In the past decade, the company has managed to boost dividends by 9.80%/year. Currently, this dividend champion is selling for 12.50 times earnings and yields 3%. Check my

analysis of Exxon Mobil.

Unilever PLC (UL) operates as a fast-moving consumer goods company in Asia, Africa, the Middle East, Turkey, Russia, Ukraine, Belarus, Europe, and the Americas. The company operates through Personal Care, Foods, Refreshment, and Home Care segments. The company has raised dividends for 19 years in a row. In the past decade, the company has managed to boost dividends by 7.50%/year. Currently, this international dividend achiever is selling for 21.30 times earnings and yields 3.50%. Check my

analysis of Unilever.

United Technologies Corporation (UTX) provides technology products and services to the building systems and aerospace industries worldwide. The company has raised dividends for 21 years in a row. In the past decade, the company has managed to boost dividends by 12.90%/year. Currently, this dividend achiever is selling for 17.70 times earnings and yields 2%. Check my

analysis of United Technologies.

I do expect to keep earning money in some capacity (1099 or W2) after 2018 however. Therefore, it is very likely that this dividend income will be reinvested, while I live off that salary income. This is why it was important for me to defer any excess income in tax-deferred accounts. Plus, if I ever find myself at the age of 70 and still have money in a 401 (k) plan that

I have not rolled over to a Roth IRA, I might have to find a job in order to avoid required minimum distributions. I would only have to ensure I do not own more than 5% of that employer, and that I roll over my 401 (k) into that employer plan. There are a lot moving parts to my plans, and since tax laws and investment opportunities are subject to change, I would have to keep up-to-date on them. For some this sounds like an insurmountable task - for me it sounds like a stimulating challenge to keep my mind sharp and benefit in the process. I do believe that

continuously acquiring more knowledge is the key to achieving and sustaining financial success.

The goal of this post was not to brag about myself. Rather, it was to provide ideas to readers that dividend investing is just one tool in the wealth building process. I have done well with picking individual dividend paying stocks, as evidenced by the fact that I am on track to cover approximately 73% – 75% of expenses with dividend income alone. However, investors should not dismiss other opportunities available to them, simply because they might not fit in a certain model. I considered myself a solely as a dividend growth investor for a few years, and only put the bare minimum in 401 (k) to get the tiny match, and ignored Roth IRA’s. As a result, I am worse off, because of all the excess taxes I have been paying, which reduced the amount of capital I have at my disposal for compounding.

Just like companies continuously streamline their operations, and cut unnecessary costs, I also want to challenge you to review your largest expense items and look for ways to reduce them. My main expense item was taxes, which I have cut to the bone right now. The other major expense item is housing, which is a major expense item for most households in the US. So while I do not really look at formal goals, I have the mindset to continuously try to improve investment process, eliminate unnecessary expenses, and increase income in a sustainable way.

Housing is another opportunity I have continuously dismissed since starting this site in 2008. I have never owned a house/apartment. The more I think about it, the more I realize that I have been throwing money out the window by renting all those years. Of course, since I have changed jobs every 2 – 3 years, and changed cities and states in the process, it always made sense to rent. However, if I were to settle in one place for say a decade, it might make sense to buy a condo/house that is slightly larger than the places I have been renting ( but not a McMansion). Since I am not handy at all however ( as evidenced by the poor design layout of this website), owning a house sounds like a money and time pit right now. But were I to stay in one place for 10 years, it might be worth it to capitalize my expenses for housing. Everyone needs a place to stay, which is why capitalizing an expense might not fit with initial goals, but would make me better off overall.

So to summarize, the most important thing someone can do is have the mindset that is conducive of achieving the life they want to live. If you consciously live your life in a way that fosters health, wealth and quality relationships on a daily basis, you will achieve a lot more than merely setting goals or New Year's resolutions. Goals can be helpful for many, but it is more important to have the plan to accomplish something by having the mindset of accomplishing it. It is good to have goals, but do not blindly follow them for goals sake, and do not take actions merely to check a goal off the list, while potentially hurting your situation by limiting yourself too narrowly.

Full Disclosure: I own UL, DEO, UTX, XOM, BAX

Relevant Articles:

-

Margin of Safety in Financial Independence

-

Should I buy more high yielding stocks in order to retire early

-

Two Dividend Stocks I Purchased in 2015

-

My Dividend Goals for 2014 and after

-

Check the Complete Article Archive