Paychex, Inc. (PAYX) provides payroll, human resource (HR), retirement, and insurance services for small to medium-sized businesses in the United States and Germany. The company is a dividend challenger, which has rewarded shareholders with an annual dividend raise since 2010. Paychex was a dividend achiever until 2009, when it stopped raising dividends during the Global Financial Crisis.

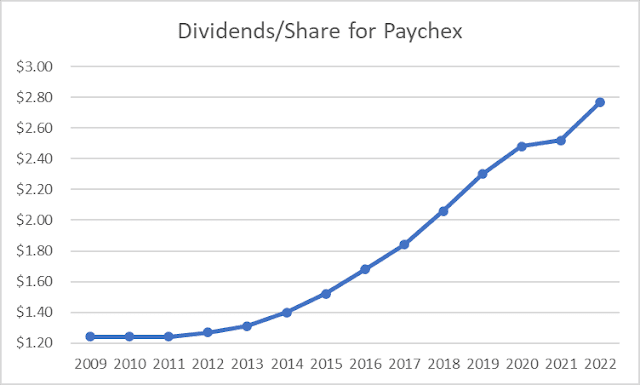

Back in April 2023 the company announced that its board of directors approved 13% increase in the company’s regular quarterly dividend, to 89 cents per share. This was the 13th consecutive annual dividend increase for Paychex.

“Our board’s decision to again increase the quarterly dividend demonstrates our strong financial position and confidence in our ability to continue to return value to our shareholders, while also investing for growth in the business today and in the future,” said Paychex President and CEO, John Gibson.

Over the past decade, Paychex has managed to boost its dividends at an annual rate of 8.90%/year. The company has picked up the pace of dividend growth to 9.60% during the past five years.

The company has managed to grow earnings per share at an annual rate of 9.70%/year. The consensus for 2023 and 2024 earnings per share for Paychex is $4.27 and $4.58. In comparison, Paychex earned $3.84/share in 2022.

Paychex has a three-legged footprint for its cash deployment. Paychex allocates cash to strategic growth initiatives, makes strategic acquisitions and distributes the rest out to shareholders in the form of dividends and some share buybacks.

The company serves the business needs of over 600,000 small to mid-sized clients in the US. The majority of these clients have less than 100 employees. The number of businesses is cyclical, as it rises and falls with the expansion or contraction of the economy. Low unemployment rates and high labor participation rates are good for payroll processors like Paychex. Bankruptcies and mergers typically reduce the number of customers. New business formations help companies like Paychex. Establishing and maintaining solid long-term relationships with the clients is important for business process outsourcing companies like Paychex.

Paychex offers HR, employee benefits, payroll processing, tax returns filling and submission, as well as accounting records to small and mid sized companies that have less than 100 employees. The company has a solid competitive advantage due to scale of operations and the fact that it targets a the small to mid-size employer niche. There are significant barriers to entry in terms of the need for large fixed investments. It makes sense for those small businesses to use the expertise of someone like Paychex, rather than do it on their own. Once a client is signed up, they are unlikely to abandon their provider since most businesses try to avoid switching costs associated with that action.

Due to the high switching costs, the company is able to raise prices to its customers over time. In addition, it is able to further increase its competitive position by introducing and delivering new and additional services to its offering mix. This ensures stickiness in the relationships and helps in retention of customers. The company can offer additional services at a low marginal cost due to its sheer scale of operations.

Increasing reporting requirements for businesses is a long-term tailwind for companies lie Paychex. The introduction of the ACA has been beneficial for Paychex over the past five years, since employers tried to outsource a lot of Human Resource functions.

The combined interest on funds held for clients and corporate investment portfolios benefit from higher interest rates and slightly higher investment balances over time. Basically, Paychex generates money from client funds that are waiting to be distributed. If interest rates increase, Paychex will generate additional profits from this activity.

Additional profits can be generated through strategic acquisitions.

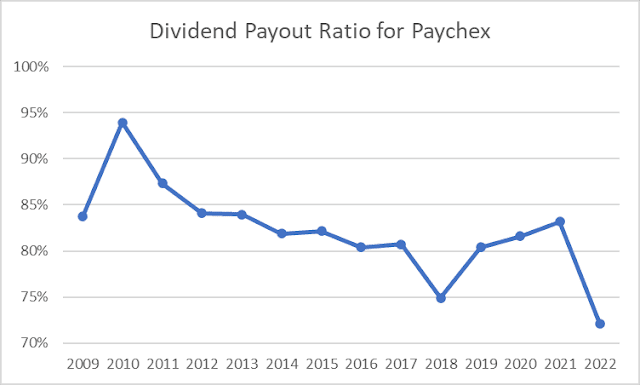

Over the past decade, the dividend payout ratio decreased from 84% in 2012 to 72% in 2022. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings. The company rewards shareholders with dividends, rather than a mix of dividends and share buybacks.

I actually like that arrangement, because Paychex shares have been richly valued for the better part of the past decade. Plus, I prefer when the policy to distribute excess earnings is more straightforward, and is not done as a way to game earnings per share growth through share buybacks.

Right now Paychex is selling at 25.25 times forward earnings and yields 2.93%.