I wanted to present some general discussion about fixed income securities. I will then present the companies I invested in this week, followed by a detailed review of each at the end of the newsletter. I included this commentary in the March 2023 Dividend Growth Investor Newsletter. I originally used Treasury Bills, but edited to Certificates of Deposit here.

For the past 15 years, we’ve had falling or low interest

rates in the US. The last time I could buy a Certificate of Deposit (CD) yielding

5% was in 2008. Today, after 15 years, I could buy a Certificate of Deposit yielding 5%. I could theoretically lock money for up to 2 years at 5%/year

using a Certificated of Deposit.

Naturally, I see some investors gravitating towards fixed

income.

I see nothing wrong with owning some fixed income

instruments, especially for short-term savings needs such as having your

emergency fund, or saving for a major purchase within the next say 1 - 2 or 3

years. It may make sense for some older investors as well, especially if they

have lower risk tolerance.

With Bonds, you are guaranteed to get your original

principal back and you are guaranteed to earn your interest as well. We are

going to assume you hold through the maturity date. Otherwise, you may end up

losing money under some scenarios (if interest rates increase after you buy the

bond). You may also end up making money if you sell early (if interest rates

decrease after you buy the bond).

However, the downside of fixed income instruments is that

they are fixed in terms of yield and term. This means that at the end of your

term (when the bond expires), you would have to acquire another bond. However,

we do not know today if those yields would be higher or lower. In addition, your return is limited to the

interest rate you settled on at the time of purchasing that bond. It would

never increase, though you are guaranteed to get your principal back at

maturity.

The other risk is that these fixed income instruments offer

high nominal yields, but that doesn’t really tell you much about the real

yields after inflation. A bond yielding 5% sounds nice, but is not as cool if

inflation is more than 5%. In that case, you are losing real purchasing power

for your principal AND income.

A third issue is that interest income on bonds is full

taxable at ordinary tax rates. Treasury Bonds are exempt from state income

taxes, though interest on CD’s is taxable at the State and Federal level. That

could be avoided by buying them through a retirement account.

The fourth issue is reinvestment risk. One can buy a 1 year

or 2-year Certificate of Deposit yielding 5% today. They are guaranteed that rate for

the duration of the bond. At maturity however, they have to reinvest at the

going rate. That rate could be higher or lower. Over the next decade, that’s

several reinvestment risk scenarios out there. There is not a high likelihood

that Short-term Bond would generate 5% annualized returns over the

next decade. Investors could theoretically buy a 10 year Bond yielding 4%.

However, the issue is that their coupon would not increase. In addition, the

purchasing power of their principal and income would slowly lose value over

time.

With dividend growth stocks, you may be getting a lower

yield today, but there is a decent chance that over a longer period of time

that dividend income will grow at or above the rate of inflation. This helps

preserve and even increase purchasing power of that passive income. In

addition, there is the opportunity to generate capital gains as well, as those

businesses earn more money and distribute more to shareholders over time. Of

course, nothing is guaranteed and there is risk, but if history is any guide,

it is possible that a diversified portfolio of dividend growth stocks would be

generating a higher income in 10 or 20 or 30 years from, while also being

valued at higher prices over that same time period. Purchasing A bond that

yields 4% that expires in a decade would yield income that doesn’t grow and a

value that doesn’t change at maturity.

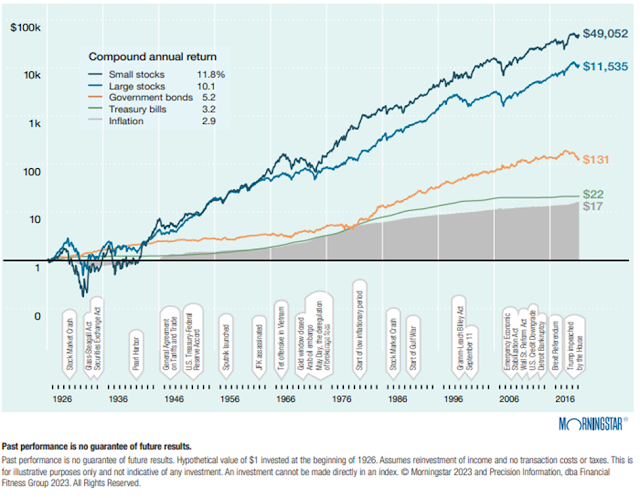

In addition, I wanted to share a longer-term view of total

returns on US Equities, Bonds and Short-term bills between 1926 and 2022:

I believe that a long-term investor in equities over the

next 10 – 20 - 30 years would do better than an investor in fixed income like

T-Bills or Certificates of Deposit. A diversified dividend growth portfolio would likely generate much

higher future yields on cost and total returns over the next 10 - 20 - 30

years. A bond portfolio would not.

I understand the logic to hold fixed income for items such

as an emergency fund, or if someone is saving for a particular large expense

over the next 1 – 3 years for example. In that case, using bonds or a savings

account seem like a good idea. However, I would discourage folks who are buying

Treasury Bills or Certificates of Deposit in an attempt to try and to time the market.

Relevant Articles:

- Does Fixed Income Allocation Make Sense for Dividend Investors Today?