This is a guest contribution by Bob Ciura of Sure Dividend.

Investors looking for the strongest dividend growth stocks should focus on the Dividend Aristocrats. In order to become a Dividend Aristocrat, a company must be a component of the S&P 500 Index, and have raised its dividend for at least 25 consecutive years, among other criteria. There are currently just 57 Dividend Aristocrats in the S&P 500 Index.

The following three Dividend Aristocrats offer the combination of a market-beating dividend yield, low stock valuation, and strong earnings growth potential. As a result, each stock earns a buy recommendation from Sure Dividend, as they have the lowest level of dividend risk and high expected returns over the next five years.

1. AT&T Inc. (T)

Telecommunications giant AT&T is a unique Dividend Aristocrat, primarily because of its very high yield above 6%. AT&T can afford such a high dividend payout to investors, thanks to its diversified business model and prodigious cash flow. AT&T has over 100 million customers in the U.S. and a significant presence in Latin America. The company provides a wide range of telecom services, including wireless, broadband, and pay-television. AT&T generates more than $170 billion in annual revenue and the stock has a market capitalization of $238 billion.

In late April, AT&T reported first-quarter financial results. Revenue of $44.8 billion missed analyst estimates by $270 million, while adjusted earnings-per-share of $0.86 matched analyst expectations. Revenue increased 18% for the first quarter, primarily driven by the Time Warner acquisition that closed in June 2018. Adjusted earnings-per-share of $0.86 rose 1.2% from the same quarter a year ago. Revenue growth was heavily offset by rising expenses and a higher share count. AT&T’s core mobility segment grew revenue by 2.9% for the quarter, thanks to 179,000 net postpaid smartphone customer additions during the quarter.

AT&T generates a great deal of free cash flow, which will allow the company to accomplish multiple financial objectives. In addition to reinvesting in future growth efforts, AT&T can reward shareholders with dividends, and also pay down debt. The company paid off over $2 billion of debt in the first quarter, ending the period with a net-debt-to-adjusted-EBITDA ratio of 2.8x. AT&T will pursue additional debt reduction in part through asset sales, such as the recent deals to sell its stake in Hulu, as well as the $2.2 billion sale of its Hudson Yards space. AT&T expects to end 2019 with a leverage ratio of 2.5x, which will further enhance the sustainability of the dividend.

AT&T has increased its dividend each year for over 30 consecutive years, and the stock has a high yield of 6.3% today. This makes AT&T the highest-yielding Dividend Aristocrat. Considering the S&P 500 Index, on average, yields just ~2% right now, AT&T is a highly attractive stock for income investors such as retirees, with a bit of dividend growth each year as an added bonus. AT&T stock trades for a price-to-earnings ratio of 9.1, which is below our fair value estimate of 12. Through valuation changes (+5.7%), dividends (+6.3%) and future EPS growth (+3.1%) we expect total returns above 15% per year over the next five years for AT&T stock.

2. Caterpillar Inc. (CAT)

Industrial giant Caterpillar is a recent addition to the S&P Dividend Aristocrats, having joined the list in 2019. It is particularly impressive for Caterpillar to be on the list, considering it operates in a highly cyclical industry. Caterpillar manufactures heavy machinery, meaning it is closely tied to multiple industries such as construction and mining. Caterpillar’s customers tend to report high growth during economic expansion, but struggle during recessions.

Caterpillar reported strong first-quarter earnings results. Quarterly sales increased 5%, while adjusted EPS increased 19%. Resource Industries reported segment sales growth of 18% to lead the way, thanks primarily to higher equipment demand and higher prices for its equipment. Caterpillar expects 2019 to be another strong year. At the midpoint of guidance, the company expects EPS growth of approximately 12% for 2019.

Caterpillar appears to be firing on all cylinders. The U.S. economy continues to grow at a steady pace, while commodity prices remain supportive of growth. This all bodes well for Caterpillar’s future earnings growth. Services are a separate growth catalyst for Caterpillar in the years ahead. Caterpillar expects to double its Machine, Energy & Transportation services sales to $28 billion by 2026, from $14 billion in 2016.

We expect Caterpillar to earn $12.25 per share in 2019. Based on this, the stock has a price-to-earnings ratio of 11. Our fair value estimate is a price-to-earnings ratio of 15-16, slightly below the 10-year average valuation multiple of 16.7. Expansion to this level would boost annual returns by 7.1% per year over the next five years. In addition, shareholder returns will be driven by earnings growth (6%) and dividends (3.1%). Overall, we expect total annual returns above 16% per year over the next five years for Caterpillar stock.

3. Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance has increased its dividend each year for 43 consecutive years. It is a large pharmacy retailer with over 18,500 stores in 11 countries around the world. It also operates one of the largest global pharmaceutical wholesale and distribution networks in the world, with more than 390 centers that deliver to nearly 230,000 pharmacies, doctors, health centers and hospitals each year.

Walgreens is in a transition period. In response to the rise of e-commerce, Walgreens has had to invest in new growth initiatives. Brick-and-mortar retailers such as Walgreens are under immense pressure from Internet-based retailers. Fears of Amazon.com (AMZN) entering the health care industry are a constant challenge for Walgreens. Fortunately, Walgreens continue to grow revenue, thanks largely to its strong pharmacy unit.

In the most recent quarter, Walgreens’ revenue of $34.5 billion increased 5% year-over-year, as retail pharmacy sales increased 7.3%. Adjusted earnings-per-share (EPS) declined 5%, as the company dedicates additional resources to investing for the future. Walgreens is also working through reimbursement pressure, and lower generic deflation.

Walgreens is still highly profitable, with more than enough cash flow to invest for the future and pay a compelling dividend to shareholders. The company now expects adjusted EPS to be roughly flat in 2019, but we still forecast 6% annual earnings growth for Walgreens as it retains multiple competitive advantages, including its leading brand and global presence. In the meantime, investors can purchase Walgreens stock at a measurable discount to fair value.

Based on expected EPS of $6.02 in fiscal 2019. The stock has a price-to-earnings ratio of 8.6, well below our fair value estimate of 13.0. We view Walgreens as significantly undervalued. Expansion of the price-to-earnings ratio to 13.0 over five years could add 8.6% to Walgreens’ annual returns. In addition, we expect Walgreens to grow earnings by 6% per year, and the stock has a 3.4% dividend yield. Overall, Walgreens stock has expected returns of 18% per year over the next five years.

Relevant Articles:

- 2019 Dividend Champions List

- Dividend Aristocrats for 2019 Revealed

- Investing is part art, part science

- Twenty-Four Attractively Valued Dividend Champions for Further Research

I am a long term buy and hold investor who focuses on dividend growth stocks

Dividend Growth Investor Newsletter

▼

Pages

▼

Thursday, June 27, 2019

Tuesday, June 25, 2019

Dividend Stock Analysis of Medtronic (MDT)

Medtronic plc (MDT) develops, manufactures, distributes, and sells device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. It operates through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies Group, Restorative Therapies Group, and Diabetes Group.

Last week, the company raised its quarterly dividend by 8% to 54 cents/share. This event marked the 42nd consecutive year of an increase in the dividend payment for Medtronic, which is a dividend champion and a dividend aristocrat.

"Medtronic's strong and growing dividend is an important component of the total return we expect to deliver to our shareholders," said Omar Ishrak, Medtronic chairman and chief executive officer. "Our board and management team have great confidence in Medtronic's ability to generate significant cash flow, and we expect to balance the deployment of this capital through both disciplined investments to drive future growth and returning cash to shareholders."

Medtronic is a very interesting example on the limitations of using earnings per share on a GAAP basis. Understanding its true earnings power requires a little bit of extra work on the hands of the investor. For example, in my analysis of the company I use non-gaap earnings per share of $5.22 for 2019, $4.77 in 2018 and $4.60 in 2017, rather than the $3.41, $2.27 and $2.89 in GAAP EPS. For example, certain items related to the amortization of intangible assets will depress earnings per share by at least $1.10/year for a long time. This is purely an accounting term, meant to satisfy a FASB requirement, which doesn’t impact long-term earnings power of the business. The company raised NON-GAAP earnings per share from $2.60 in 2008 to $5.22 in 2019. Medtronic is estimated to grow earnings to $5.44/share - $5.50/share in 2020. You may review the latest press release for more details.

The growth in earnings per share will be achieved by introductions of new devices, strategic acquisitions, cost containment initiatives as well as increase in foreign sales. The company acquired Covidien in 2015, and is working on realizing synergies. By moving its headquarters from the US to Ireland, the company reduced its corporate tax rate from 35% to 12.50%. Some cost containment initiatives that Medtronic had started a few years ago are starting to bear fruit. Another factor that could help EPS growth is the consistent repurchase of stock by the company. New initiatives as well as expanding into non-traditional markets, could bolster growth. Last but not least, emerging markets such as China and India could present solid opportunities for growth, as emerging markets in general could deliver double digit percentage increases in sales over the next decade.

The medical equipment market is highly competitive and is characterized by short product life cycles. However, the scale of Medtronic’s operations, its continued investments in innovation as well as its diverse nature of procedures offset some of the risks mentioned in the previous sentence.

The company reduced the number of shares outstanding between 2008 and 2014 from 1.142 billion to 1.014 billion. After the acquisition of Covidien, we saw an increase in the number of shares outstanding. Since 2016 however, the company is starting to reduce the number of shares outstanding once again through buybacks.

Medtronic has boosted annual dividends from $0.50/share in 2008 to $1.96/share in 2019. Medtronic’s dividend has grown at a 11.90% compounded annual growth rate over the past decade.

Medtronic's dividend per share has grown by 77 percent over the past 5 years and has grown at a 17 percent compounded annual growth rate over the past 42 years.

One thing I wanted to mention addresses the question on foreign withholding taxes on Medtronic dividends. Residents of the United States are not subject to a 20% withholding tax on Irish dividends.

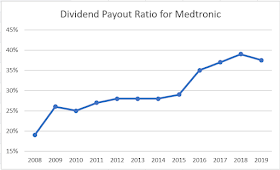

The dividend payout ratio has steadily increased over the past decade, from 19% in 2008 to 38% in 2019. The expansion in the dividend payout ratio is the reason why dividends were able to increase so rapidly over the past decade.

I find the stock to be fairly valued today at 19 times forward earnings. Medtronic yields 2.20% based on the new dividend payment.

Relevant Articles:

- 2019 Dividend Champions List

- Twenty-Four Attractively Valued Dividend Champions for Further Research

- Dividend Aristocrats for 2019 Revealed

- Best Dividend Stocks For The Long Run – 10 years later

- Five Companies Committed to Increasing Returns To Shareholders

Last week, the company raised its quarterly dividend by 8% to 54 cents/share. This event marked the 42nd consecutive year of an increase in the dividend payment for Medtronic, which is a dividend champion and a dividend aristocrat.

"Medtronic's strong and growing dividend is an important component of the total return we expect to deliver to our shareholders," said Omar Ishrak, Medtronic chairman and chief executive officer. "Our board and management team have great confidence in Medtronic's ability to generate significant cash flow, and we expect to balance the deployment of this capital through both disciplined investments to drive future growth and returning cash to shareholders."

Medtronic is a very interesting example on the limitations of using earnings per share on a GAAP basis. Understanding its true earnings power requires a little bit of extra work on the hands of the investor. For example, in my analysis of the company I use non-gaap earnings per share of $5.22 for 2019, $4.77 in 2018 and $4.60 in 2017, rather than the $3.41, $2.27 and $2.89 in GAAP EPS. For example, certain items related to the amortization of intangible assets will depress earnings per share by at least $1.10/year for a long time. This is purely an accounting term, meant to satisfy a FASB requirement, which doesn’t impact long-term earnings power of the business. The company raised NON-GAAP earnings per share from $2.60 in 2008 to $5.22 in 2019. Medtronic is estimated to grow earnings to $5.44/share - $5.50/share in 2020. You may review the latest press release for more details.

The growth in earnings per share will be achieved by introductions of new devices, strategic acquisitions, cost containment initiatives as well as increase in foreign sales. The company acquired Covidien in 2015, and is working on realizing synergies. By moving its headquarters from the US to Ireland, the company reduced its corporate tax rate from 35% to 12.50%. Some cost containment initiatives that Medtronic had started a few years ago are starting to bear fruit. Another factor that could help EPS growth is the consistent repurchase of stock by the company. New initiatives as well as expanding into non-traditional markets, could bolster growth. Last but not least, emerging markets such as China and India could present solid opportunities for growth, as emerging markets in general could deliver double digit percentage increases in sales over the next decade.

The medical equipment market is highly competitive and is characterized by short product life cycles. However, the scale of Medtronic’s operations, its continued investments in innovation as well as its diverse nature of procedures offset some of the risks mentioned in the previous sentence.

The company reduced the number of shares outstanding between 2008 and 2014 from 1.142 billion to 1.014 billion. After the acquisition of Covidien, we saw an increase in the number of shares outstanding. Since 2016 however, the company is starting to reduce the number of shares outstanding once again through buybacks.

Medtronic has boosted annual dividends from $0.50/share in 2008 to $1.96/share in 2019. Medtronic’s dividend has grown at a 11.90% compounded annual growth rate over the past decade.

Medtronic's dividend per share has grown by 77 percent over the past 5 years and has grown at a 17 percent compounded annual growth rate over the past 42 years.

One thing I wanted to mention addresses the question on foreign withholding taxes on Medtronic dividends. Residents of the United States are not subject to a 20% withholding tax on Irish dividends.

The dividend payout ratio has steadily increased over the past decade, from 19% in 2008 to 38% in 2019. The expansion in the dividend payout ratio is the reason why dividends were able to increase so rapidly over the past decade.

I find the stock to be fairly valued today at 19 times forward earnings. Medtronic yields 2.20% based on the new dividend payment.

Relevant Articles:

- 2019 Dividend Champions List

- Twenty-Four Attractively Valued Dividend Champions for Further Research

- Dividend Aristocrats for 2019 Revealed

- Best Dividend Stocks For The Long Run – 10 years later

- Five Companies Committed to Increasing Returns To Shareholders

Sunday, June 23, 2019

Ten Dividend Stocks for June 2019

Readers of my Dividend Growth Investor newsletter just received a list of ten dividend growth stocks I plan to purchase on Monday. This is for a real money portfolio which I started in July last year in an effort to educate investors on the process of building a portfolio to reach long-term objectives. I invest $1,000 in the ten companies I profile every single month, and let interested readers observe in real time how I build a dividend machine from scratch.

The report includes a detailed analysis of each company, using the methods I use to evaluate dividends for safety, valuation and whether dividend growth is on a solid footing. I used the same methods for building my dividend growth portfolio over the past decade.

The goal of the newsletter is to go beyond just identifying ten companies for investment every month. The real goal is to educate investors how real wealth can be built in the stock market. The process of building an income portfolio is very simple, but not easy. An investor simply needs to save money and put them to work in attractively valued stocks regularly. The next step involves reinvesting dividends either selectively or through a DRIP. The last step is the most exciting one – to patiently hold on to your collection of businesses for the long-term. To build a dividend machine, one has to arm themselves with a lot of patience and a long-term focus. This means avoiding the expensive habit of timing the market because it “looks high” or because “it is crashing”. Having the patience to hold on to your investments through thick or thin is a habit that is within the control of the investor.

I try to select companies that I believe will be around in a decade or so, and will be more profitable and pay higher dividend payments along the way. I also evaluate dividends for safety. I focus on valuation today as well as long-term fundamentals. Without growth in fundamentals, and the ability of the business to grow them over time, the companies I invest in will be unable to achieve future dividend growth. As a long-term investor, I buy companies to hold for years if not decades. This is not a newsletter where I will buy securities with the intent of selling them a few months later.

The price for the monthly subscription is just $6/month to new subscribers who sign up for the service by the end of June. The price for the annual subscription is only $65/year for new subscribers. If you subscribe at the low introductory rate today, the price will never increase for you.

I offer a 7 day free trial for new readers. If you want to give my newsletter a try, you may do so by signing up below:

Once you sign up, I will add you to my premium mailing list, and you will receive all exclusive content related to the portfolio.

Each month, I will be allocating $1,000 to my dividend portfolio by buying stakes in ten attractively valued companies. The newsletter will include information on the companies I am purchasing, along with a brief analysis of each company.

The ultimate goal of the portfolio is to generate $1,000 in monthly dividend income.

I plan to track this portfolio in real time over the next few years, and track our progress towards our goal.

Thank you for reading Dividend Growth Investor.

Thursday, June 20, 2019

Twenty-Four Attractively Valued Dividend Champions for Further Research

I monitor the list of dividend champions regularly, using my screening criteria. This is helpful to identify quality companies available at good prices, which may be good additions to my portfolio at the right time.

My screening process helps me narrow down the list of dividend champions to a more manageable level for further research. This of course is the first phase in company selection process; once the list is narrowed down to a more manageable level,

The screening criteria I used includes the following factors:

1) A dividend streak of annual dividend increases exceeding 25 years

This is understandable, since to be a dividend champion, a company needs to have increased dividends for at least 25 years in a row. I view a long streak of annual dividend increases as an indicator of business quality. After all, only a certain type of company can afford to grow the business, while also showering shareholders with more cash each year for over a quarter of a century. A long streak of dividend increases is a testament to a consistency in a business, strong competitive advantages, and an industry that quietly builds wealth to long-term shareholders over time.

2) A forward P/E ratio below 20

I want to remain disciplined, and focus on companies which are not overvalued. I do not want to overpay for future growth, as I also do not want to buy a cheap company that doesn’t grow either. To me valuation is important, because even the best company in the world may not be worth purchasing at an inflated price .If you overpay for a security, future returns could suffer, because you lock in a lower yield at the start.

3) A forward dividend payout ratio below 60%

I want to have a margin of safety in the dividend payment, which is what a lower dividend payout ratio helps to identify. I am after companies that reinvest a portion of earnings to grow the business and distributes the excess to shareholders. An adequate payout ratio provides a buffer in case there is some short term fluctuations in earnings.

4) Annual dividend growth exceeding 5% over the past five and ten years

Historical dividend growth has been around 5% - 6% on US stocks over the past 90 years. I wanted to find companies which consistently grow dividends, and do not materially decrease them over time. I also screened out companies whose last raise was less than 5%. Again, I value consistency in dividend growth.

5) A history of rising earnings per share over the past decade

Rising earnings per share are the fuel behind future dividend increases. There is a natural limit to dividend growth, if a company does not grow its bottom line. A company that grows earnings per share can afford to increase dividends, and reinvest more into the business. This also provides an additional margin of safety in the dividends, because a company has more tools within its disposal to tackle things such as a temporary high payout ratio. By growing earnings, a company can simply grow itself out of a higher payout ratio, as dividends grow slightly slower until the payout is normalized.

As a result of running this screen, I ended up with a list of the following dividend champions for further research:

I just wanted to caution you that this is not an automatic recommendation to buy or sell securities. I am not a financial advisor, just someone who writes about dividend investing. Any decision you make about investments is solely your responsibility. This means that each company needs to be analyzed in detail, both from a quantitative and qualitative standpoint. In addition, just because a company looks attractively valued today, that doesn’t mean that this company cannot get cheaper from here.

Furthermore, I am sharing a rudimentary process for screening the list of dividend champions on a regular basis, in order to show investors how I go about identifying companies, and build a diversified portfolio over time. I have found that the ability to stick to a process, invest regularly, and to keep holding through patiently thick or thin is my edge in investing. By sharing my experience, I am hopeful to inspire you into developing your own methodology, and use it to work towards your financial objectives.

Relevant Articles:

- How to determine if your dividends are safe

- 2019 Dividend Champions List

- Stagnant earnings create a risky environment for dividend investors

- Investing is part art, part science

My screening process helps me narrow down the list of dividend champions to a more manageable level for further research. This of course is the first phase in company selection process; once the list is narrowed down to a more manageable level,

The screening criteria I used includes the following factors:

1) A dividend streak of annual dividend increases exceeding 25 years

This is understandable, since to be a dividend champion, a company needs to have increased dividends for at least 25 years in a row. I view a long streak of annual dividend increases as an indicator of business quality. After all, only a certain type of company can afford to grow the business, while also showering shareholders with more cash each year for over a quarter of a century. A long streak of dividend increases is a testament to a consistency in a business, strong competitive advantages, and an industry that quietly builds wealth to long-term shareholders over time.

2) A forward P/E ratio below 20

I want to remain disciplined, and focus on companies which are not overvalued. I do not want to overpay for future growth, as I also do not want to buy a cheap company that doesn’t grow either. To me valuation is important, because even the best company in the world may not be worth purchasing at an inflated price .If you overpay for a security, future returns could suffer, because you lock in a lower yield at the start.

3) A forward dividend payout ratio below 60%

I want to have a margin of safety in the dividend payment, which is what a lower dividend payout ratio helps to identify. I am after companies that reinvest a portion of earnings to grow the business and distributes the excess to shareholders. An adequate payout ratio provides a buffer in case there is some short term fluctuations in earnings.

4) Annual dividend growth exceeding 5% over the past five and ten years

Historical dividend growth has been around 5% - 6% on US stocks over the past 90 years. I wanted to find companies which consistently grow dividends, and do not materially decrease them over time. I also screened out companies whose last raise was less than 5%. Again, I value consistency in dividend growth.

5) A history of rising earnings per share over the past decade

Rising earnings per share are the fuel behind future dividend increases. There is a natural limit to dividend growth, if a company does not grow its bottom line. A company that grows earnings per share can afford to increase dividends, and reinvest more into the business. This also provides an additional margin of safety in the dividends, because a company has more tools within its disposal to tackle things such as a temporary high payout ratio. By growing earnings, a company can simply grow itself out of a higher payout ratio, as dividends grow slightly slower until the payout is normalized.

As a result of running this screen, I ended up with a list of the following dividend champions for further research:

Name

|

Symbol

|

Number

of Annual Dividend Increases

|

Last

Price

|

Annual Div Rate

|

Annual Div Yield

|

Dividend

Payout Ratio

|

Forward

P/E

|

5yr Dividend Growth

|

10yr

Dividend Growth

|

Most

Recent Increase

|

A.O.

Smith Corp.

|

AOS

|

25

|

45.25

|

0.88

|

1.94%

|

32%

|

16.70

|

27.00

|

19.94

|

22.22

|

BancFirst

Corp. OK

|

BANF

|

25

|

57.56

|

1.2

|

2.08%

|

32%

|

15.27

|

9.53

|

8.54

|

42.86

|

Carlisle

Companies

|

CSL

|

42

|

136.68

|

1.6

|

1.17%

|

22%

|

18.42

|

12.89

|

9.88

|

8.11

|

EV

|

38

|

41.93

|

1.4

|

3.34%

|

44%

|

13.31

|

9.31

|

7.78

|

12.90

|

|

Franklin

Electric Co.

|

FELE

|

27

|

45.8

|

0.58

|

1.27%

|

24%

|

19.08

|

8.92

|

6.57

|

20.83

|

General

Dynamics

|

GD

|

28

|

173.59

|

4.08

|

2.35%

|

35%

|

14.82

|

10.63

|

10.48

|

9.68

|

Genuine

Parts Co.

|

GPC

|

63

|

102.92

|

3.05

|

2.96%

|

51%

|

17.30

|

5.69

|

6.33

|

5.90

|

Gorman-Rupp

Company

|

GRC

|

46

|

30.66

|

0.54

|

1.76%

|

32%

|

18.04

|

9.10

|

7.14

|

8.00

|

W.W.

Grainger Inc.

|

GWW

|

48

|

271.87

|

5.76

|

2.12%

|

32%

|

15.10

|

8.35

|

13.21

|

5.88

|

ITW

|

44

|

149.21

|

4

|

2.68%

|

50%

|

18.72

|

16.45

|

11.25

|

28.21

|

|

Johnson

& Johnson

|

JNJ

|

57

|

140.23

|

3.8

|

2.71%

|

44%

|

16.34

|

6.45

|

7.03

|

5.56

|

LOW

|

56

|

99.31

|

2.2

|

2.22%

|

36%

|

16.39

|

21.22

|

18.36

|

17.07

|

|

MDT

|

41

|

97.96

|

2

|

2.04%

|

39%

|

19.02

|

12.20

|

11.88

|

8.70

|

|

McGrath

Rentcorp

|

MGRC

|

27

|

60.98

|

1.5

|

2.46%

|

44%

|

18.04

|

6.03

|

5.08

|

10.29

|

MMM

|

61

|

171.86

|

5.76

|

3.35%

|

55%

|

16.32

|

16.45

|

10.52

|

5.88

|

|

Parker-Hannifin

Corp.

|

PH

|

63

|

166.56

|

3.52

|

2.11%

|

30%

|

14.30

|

10.56

|

12.32

|

15.79

|

PPG

|

47

|

114.68

|

1.92

|

1.67%

|

31%

|

18.38

|

8.98

|

5.94

|

6.67

|

|

Stepan

Company

|

SCL

|

51

|

90.84

|

1

|

1.10%

|

20%

|

17.85

|

7.31

|

8.09

|

11.11

|

SEI

Investments Company

|

SEIC

|

28

|

54.34

|

0.66

|

1.21%

|

21%

|

17.53

|

11.38

|

14.87

|

10.00

|

1st

Source Corp.

|

SRCE

|

32

|

45.25

|

1.08

|

2.39%

|

31%

|

12.93

|

9.20

|

6.18

|

8.00

|

Stanley

Black & Decker

|

SWK

|

51

|

144.56

|

2.64

|

1.83%

|

31%

|

16.93

|

5.44

|

7.43

|

4.76

|

TROW

|

33

|

107.4

|

3.04

|

2.83%

|

44%

|

15.48

|

13.00

|

11.30

|

8.57

|

|

United

Technologies

|

UTX

|

25

|

126.62

|

2.94

|

2.32%

|

37%

|

16.01

|

5.25

|

7.74

|

5.00

|

WBA

|

43

|

52.8

|

1.76

|

3.33%

|

29%

|

8.64

|

7.32

|

15.01

|

10.00

|

I just wanted to caution you that this is not an automatic recommendation to buy or sell securities. I am not a financial advisor, just someone who writes about dividend investing. Any decision you make about investments is solely your responsibility. This means that each company needs to be analyzed in detail, both from a quantitative and qualitative standpoint. In addition, just because a company looks attractively valued today, that doesn’t mean that this company cannot get cheaper from here.

Furthermore, I am sharing a rudimentary process for screening the list of dividend champions on a regular basis, in order to show investors how I go about identifying companies, and build a diversified portfolio over time. I have found that the ability to stick to a process, invest regularly, and to keep holding through patiently thick or thin is my edge in investing. By sharing my experience, I am hopeful to inspire you into developing your own methodology, and use it to work towards your financial objectives.

Relevant Articles:

- How to determine if your dividends are safe

- 2019 Dividend Champions List

- Stagnant earnings create a risky environment for dividend investors

- Investing is part art, part science