Aflac Incorporated (AFL), through its subsidiary, American Family Life Assurance Company of Columbus (Aflac), provides supplemental health and life insurance. The company offers cancer plans, general medical indemnity plans, medical/sickness riders, care plans, living benefit life plans, ordinary life insurance plans, and annuities in Japan. This dividend aristocrat has raised dividends for 46 years in a row. The company most recently announced a 9.70% dividend increase to 34 cents/share.

Over the past decade, this dividend stock has delivered an annual total return of 8.10%.

At the same time the company has managed to increase earnings per share by 10.90% per year. In 2009, earnings per share increased by 21.70% to $3.19. Analysts are estimating FY 2010 and FY 2011 EPS to increase to $5.46 and $5.99 respectively. The company’s Japanese Operations, which contributed 75% of its revenues, are expected to post strong near term revenue increases due to distribution agreements with Japan Post. Introduction of new products should also add to increased revenues. The expectations for US revenues are for a slowdown in the near term due to challenging economic situation. The company’s investment portfolio is riskier than peers, as it includes bank hybrid bonds and sovereign debt issued by European companies and countries. The company’s strong cash position and ability to grow sales and earnings should be a stabilizing factor however, which could fuel future dividend growth.

Return on Equity has increased from 16% in 2000 to 20% in 2009. In addition to that this indicator has remained between 16 and 20 since 2004.

The annual dividend per share has increased by 23.30% annually over the past decade. A 23% increase in dividends translates into the dividend payment doubling every 3 years on average. Sicne 1984 the company has managed to double dividends every four years on average.

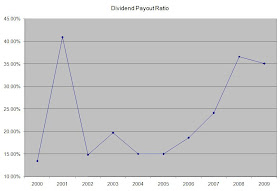

The dividend payout ratio has almost tripled over the past decade, from 13.50% in 2000 to 35% in 2009. This is a direct result of the fact that dividends have been increasing much faster than earnings over the past decade.

Currently Aflac trades at a P/E of 12.60, yields 2.50% and has an adequately covered dividend payment. I would be adding to my position on dips below $48.

Full Disclosure: Long AFL

- Dividend Investing Works in All Markets

- A dividend portfolio for the long-term

- Three Dividend Strategies to pick from

- Financial Stocks for Dividend Investors