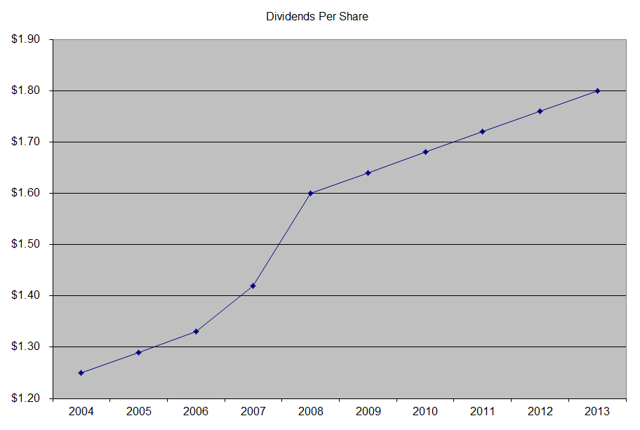

The most recent dividend increase was in September 2013, when the Board of Directors approved a 2.90% increase in the quarterly dividend to 53 cents/share.

The company’s competitors include AT&T (T), Sprint (S) and T-Mobile (TMUS).

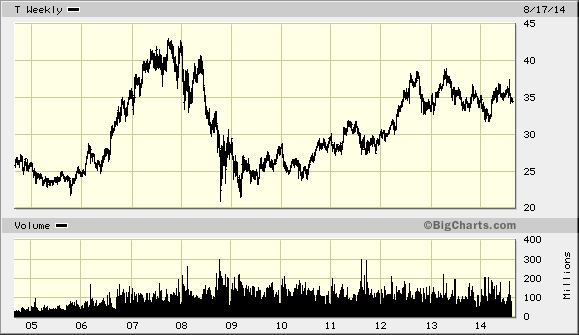

Over the past decade this dividend growth stock has delivered an annualized total return of 9% to its shareholders. Future returns will be dependent on growth in earnings and dividend yields obtained by shareholders.

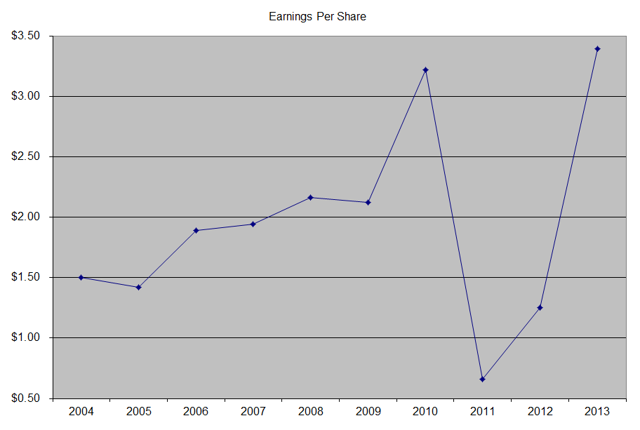

The company has managed to deliver a 12.10% average increase in annual EPS over the past decade. This high earnings growth is deceptive, since the company's annual earnings per share fluctuates wildly due to one-time accounting effects, such as pension adjustments for example. Verizon is expected to earn $3.57 per share in 2014 and $3.87 per share in 2015. In comparison, the company earned $4/share in 2013.

Verizon is one of the two dominant telecom players in the US, the other one being AT&T. Both companies have the scale in number of customers to compete successfully, invest in their business and market their products, while keeping costs of servicing customers low and therefore generating excess cash flows. Those excess cash flows are returned to shareholders through a generous dividend. In addition, the company has the reputation for America's best coverage for wireless, which provides it with a high market share and customer loyalty. This has resulted in low churn rates, which in essence makes it easier to make money, since acquiring new customers is expensive. In addition, Verizon has valuable spectrum, which is of limited quantity in the US. The company has been able to grow through acquisitions over the past years, which is another way that it can bolster its future earnings per share. The risk to Verizon is that the already cutthroat telecom market is shaken by a price war, which could be bad for margins and profitability.

I like the fact that Verizon was able to acquire the remaining 45% of Verizon Wireless it didn't already own from Vodafone (NASDAQ:VOD) by paying $130 billion in cash and stock. Approximately 1.275 billion shares were issued, bringing number of shares outstanding from 2.874 billion at end of 2013 to 4.153 billion by the end of Q2 2014. In addition, the company took on approximately $60 billion in debt, and also offered asset stakes to Vodafone to pay up for Verizon Wireless. This deal is expected to be accretive to Verizon over time, and is helpful to have been done at a time when interest rates are so low. It would be nice if the company takes on the challenge of repurchasing those dilutive shares over the next decade.

Since I owned shares of Vodafone at the time, I also received a few shares of Verizon. For those who own Verizon, they might be optimistic about the company, after Berkshire Hathaway disclosed a stake in the telecom giant. It is unclear at this point however, whether it was Warren Buffett who initiated the purchase, or one of his two trusted money managers - Ted Weschler or Todd Combs.

The annual dividend payment has increased by 3% per year over the past decade, which is lower than the growth in EPS. My expectations for future dividend growth are for them to be close to the rate of inflation over the next two decades.

A 3% growth in distributions translates into the dividend payment doubling every twenty four years on average. If we check the dividend history, going as far back as 1990, we could see that Verizon has last managed to double dividends every 23 years on average.

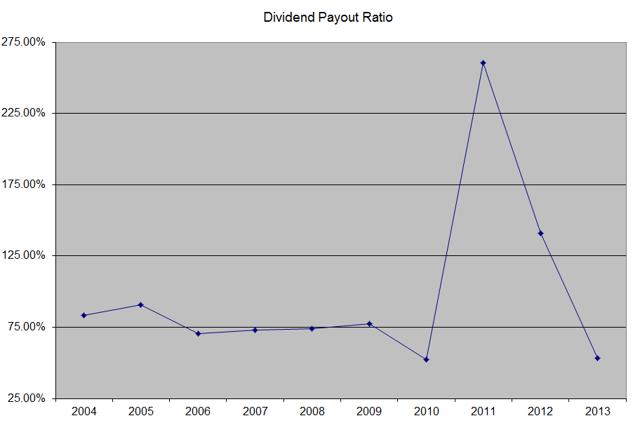

In the past decade, the dividend payout ratio has been all over the place. This was of course caused by the effect of one-time items on earnings per share. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

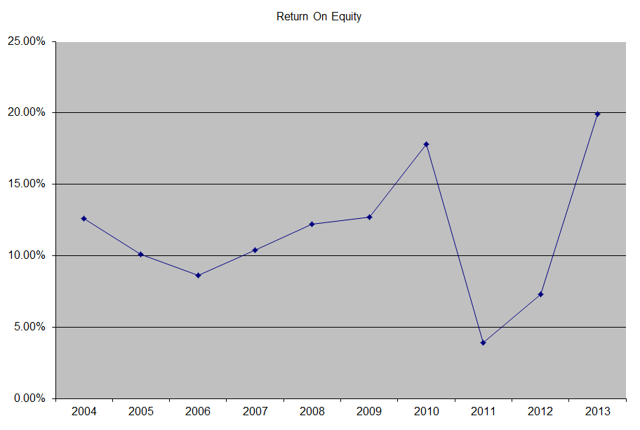

Verizon has been able to generate a decent average return on equity of 13.30% over the past decade. With the exception of a couple years where we had large one-time adjustments to earnings, this indicator has been relatively stable however. I generally like seeing a high return on equity, which is also relatively stable over time.

Relevant Articles:

- Two High Yield Companies Raising Dividends in the past month

- Should I invest in AT&T and Verizon for high dividend income

- Maintaining Moats in times of Technological Changes

- Vodafone Group (VOD) Dividend Stock Analysis

- Types of dividend growth stocks

- Seven dividend companies bringing holiday joy to shareholders