The year 2022 was a good one for dividends.

"Dividend payments continue at record levels. The strength of the increases has declined, as concerns over interest rates, inflation and slowing consumer spending have made companies more measured and cautious in their commitment to dividend increases. At this point, 2023 appears set to increase, setting another record," said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices. "For 2023, the number of increases is expected to grow, with February being the most popular month for increases, even as the average increase is expected to be limited when measured against recent inflationary metrics."

"2023 appears set for another record payment, with the key question being by how much as the answer may depend on the state of the economy and corporate profits. The uncertain forecast for 2023 dividend payments is also driven by several factors including changes in inflation, interest rates, and consumer spending. Overall, it is clear that companies are currently protecting their dividends, even if it means reducing buybacks," Silverblatt concluded. (source)

Despite turbulence in global markets, wars, inflation and fears of recession, US companies paid a record amount in dividends. US dividend strategies delivered very good returns in 2022, when pretty much everyone else was losing money.

While S&P 500 price declined by 19.78% in 2022, S&P 500 dividends went up by 10.82% in 2022. S&P 500 dividends increased from $60.40 in 2021 to $66.92 in 2022. That increase was higher than inflation.

S&P 500 dividend payments have increased for 13 consecutive years, and set a payment record for the last 11 consecutive years. S&P 500 is a dividend achiever.

Historically, US dividends have increased faster than the rate of inflation. They also rarely decrease. Over the past 80 years, US dividends have only decreased in a material way during the 2008 Global Financial Crisis. Prior to that, US dividends had decreased during the Great Depression of 1929 - 1932 and the following 1936 - 1937 mini-depression.

In other words, dividends decrease very very rarely. Only when Capitalism is on its knees, do companies cut dividends en masse.

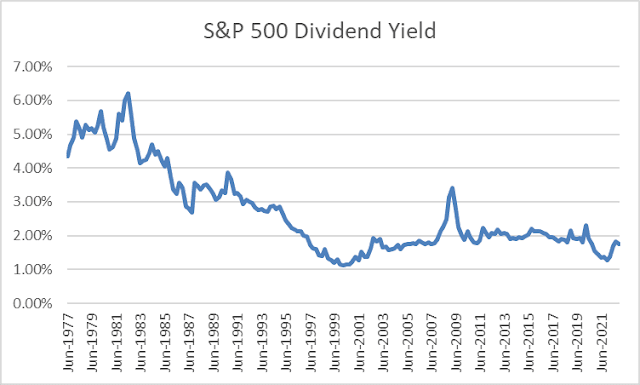

Due to declines in share prices in 2022, dividend yields on S&P 500 increased from the record low levels at the end of 2021. Dividend yields on S&P 500 went up from 1.27% to 1.74%.

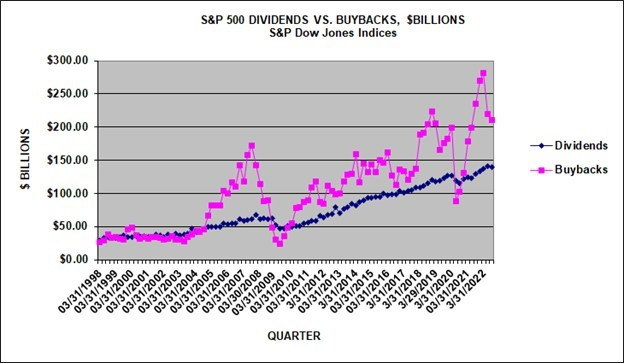

Share buybacks decreased slightly in 2022 as well, though they are still higher than S&P 500 dividends

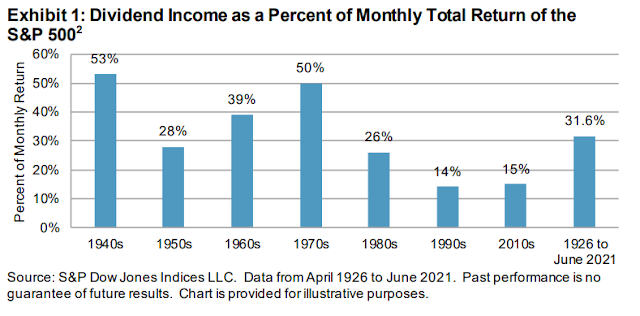

Since 1926 dividends have contributed approximately 32% of total return for the S&P 500, while capital appreciations have contributed 68%. ( through 2021)

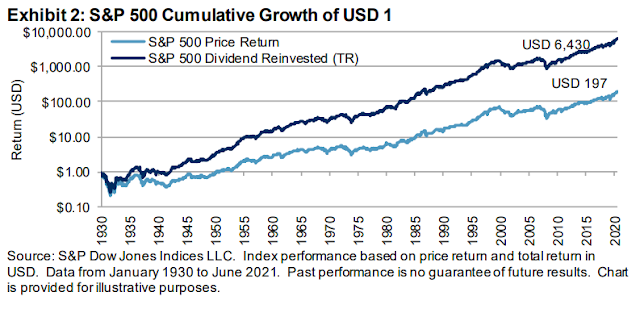

The power of reinvested dividends is even more pronounced over long periods of time.

A $1 investment made using the S&P 500 on Jan. 1, 1930, would have grown to $197 by the end of June 2021 if we focused on price return only

During the same period, a $ 1 investment with dividends reinvested would have yielded $6,430.

Of course, not all dividends are created equal. I prefer to invest in companies that regularly increase dividends. Requiring a consistent track record of regular dividend increases over at least 10 years narrows down my investment universe to a little over 300 companies. This helps me to focus on quality companies, with solid competitive advantages, which grow and distribute excess cashflows to shareholders.

Relevant Articles:

- Dividend Increases for the Dividend Aristocrats in 2022

- There is no alternative (TINA)