Tanger Factory Outlet Centers, Inc. (SKT) is an owner and operator of outlet centers in the United States and Canada. This REIT which focuses on developing, acquiring, owning, operating and managing outlet shopping centers. As of December 31, 2016, its portfolio consisted of 36 outlet centers, which contained over 2,600 stores representing approximately 400 store brands. Tanger Factory Outlet Centers is a dividend achiever, which has rewarded shareholders with a raise for 24 years in a row.

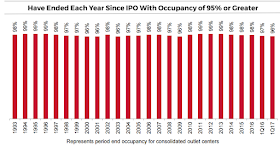

Tanger has maintained a high occupancy rate over the past 20 years. The rate usually dips to 96% during a recession, and then bounces back to 98% - 99%, before going down during the next recession. Currently, Tanger has a low occupancy rate, as if we are in a recession.

You can see Tanger's largest tenants listed below. Most of those are branded companies, which sell merchandise such as apparel (clothes) to the masses. I do believe that these tenants could face more pressure than those for Realty Income and National Retail Properties. This is where I could conclude that perhaps Tanger is slightly riskier than Realty Income and National Retail Properties. That being said, I believe that each of those retailers has a chance of implementing a dual online/brick and mortar strategy for accommodating customers. Having some brand equity associated with specialty merchandise and exceptional quality, can also be a plus. Another plus is having a type of merchandise that is unique to the customer. For example, purchasing shoes or clothes requires the need for some physical trial and error, until you find the one that fits right. Buying certain items like shoes online could be trickier, because it may create extra hassle of mailing things back if they are not as advertised. The other nice thing to consider is that the properties are easy to reconfigure in order to accommodate new tenants.

I spent the most time justifying the type of tenants for Tanger, which probably explains more about their durability risk relative to the tenant base for Realty Income and National Retail Properties above.

Tanger has maintained a high occupancy rate over the past 20 years. The rate usually dips to 96% during a recession, and then bounces back to 98% - 99%, before going down during the next recession. Currently, Tanger has a low occupancy rate, as if we are in a recession.

You can see Tanger's largest tenants listed below. Most of those are branded companies, which sell merchandise such as apparel (clothes) to the masses. I do believe that these tenants could face more pressure than those for Realty Income and National Retail Properties. This is where I could conclude that perhaps Tanger is slightly riskier than Realty Income and National Retail Properties. That being said, I believe that each of those retailers has a chance of implementing a dual online/brick and mortar strategy for accommodating customers. Having some brand equity associated with specialty merchandise and exceptional quality, can also be a plus. Another plus is having a type of merchandise that is unique to the customer. For example, purchasing shoes or clothes requires the need for some physical trial and error, until you find the one that fits right. Buying certain items like shoes online could be trickier, because it may create extra hassle of mailing things back if they are not as advertised. The other nice thing to consider is that the properties are easy to reconfigure in order to accommodate new tenants.

I spent the most time justifying the type of tenants for Tanger, which probably explains more about their durability risk relative to the tenant base for Realty Income and National Retail Properties above.

Below, you can see trends in Funds from Operations (FFO), Dividends Per Share (DPS) and FFO Payouts over the past decade for Tanger Factory Outlets (SKT).

Tanger Factory Outlet (SKT)

| ||||||||||

2016

|

2015

|

2014

|

2013

|

2012

|

2011

|

2010

|

2009

|

2008

|

2007

| |

FFO/Share

|

2.36

|

2.23

|

1.82

|

1.94

|

1.63

|

1.44

|

1.22

|

1.35

|

1.18

|

1.24

|

DPS/Share

|

1.26

|

1.10

|

0.95

|

0.89

|

0.83

|

0.79

|

0.77

|

0.76

|

0.75

|

0.71

|

FFO Payout

|

53%

|

49%

|

52%

|

46%

|

51%

|

55%

|

63%

|

57%

|

64%

|

57%

|

I view Tanger as slightly riskier, but potentially higher reward idea today. It is also available for a bargain price. This REIT also has a low FFO payout ratio, which means that the dividend is safe. The REIT is selling for 11.20 times FFO and yields 5.10%. I initiated a small position in Tanger several months ago. I liked the low valuation, the low FFO payout, and the fact that I am getting a 5% instant rebate on my purchase price. That dividend rebate would likely keep increasing over time too.

I like the fact that I am paid to wait. We have a low valuation, coupled with generous and sustainable dividends, which serve as instant rebates on my purchase price. If this REIT stagnates, and never manages to grow for 20 years into the future, I would have collected enough in dividends to cover the cost of my shares. Best of all, I would still own the shares, which provide ownership claims to real estate throughout the US, as well as the rental income or sale price of said real estate.

That being said, it is quite possible that this REIT could get even cheaper from here. During the financial crisis, even quality REITs sold at yields of 8%. I am stating this in order to make the point that buying shares takes time, and should be done slowly and over time. The investor should not get scared away but should consider buying even if shares fell in price, as long as fundamentals have not deteriorated sharply of course. The investor who buys every month for their diversified portfolio, as long as the fundamentals are in tact, and valuation is still attractive, should do well in the long-run.

Full Disclosure: Long SKT

Relevant Articles:

- Dividend Investors are Getting Paid for Holding Dividend Stocks

- Five Things to Look For in a Real Estate Investment Trust

- Investors Get Paid for Holding Dividend Stocks

- Should Dividend Investors Worry About Rising Interest Rates?

- Are we in a REIT bubble?